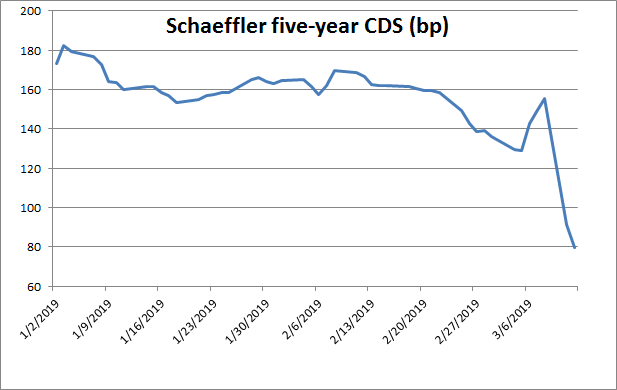

The value of credit derivatives used to insure against a default on Schaeffler collapsed this week after the German car-part supplier announced changes to its debt structure that traders worried could make credit default swaps on the firm all but worthless.

The annual cost of insuring against a default on €10m of Schaeffler debt for five years nearly halved to €80,000 on Tuesday, according to Refinitiv Eikon data. On Friday, it cost €155,000.

The move came after Schaeffler announced a bond on Monday, to be issued under its new €5bn investment-grade debt issuance programme. Bonds will be issued from a new holding company, Schaeffler AG, as opposed to Schaeffler Finance BV, the vehicle referenced by CDS contracts.

The dwindling stock of debt belonging to Schaeffler Finance BV raises questions about the value of the CDS.

“This means that as Schaeffler starts to remove the bonds at Schaeffler Finance BV … there will be no deliverables left” to be used in a CDS auction, credit strategists at BNP Paribas wrote in a note to clients today.

When a company defaults and CDS are triggered, an auction is held to determine the payout to protection holders. That typically involves banks bidding on the value of the bonds belonging to the company in default. If there are no bonds to deliver into the auction, there can be no CDS payouts.

Schaeffler Finance BV still has four bonds, the BNP Paribas strategists noted. Three of those are callable and the other - maturing in 2025 - will be callable from next year.

Writing in September, Moody’s analysts said they expect Schaeffler’s existing senior notes, due 2020, 2022, 2023 and 2025, will be gradually refinanced with senior unsecured notes under the new debt issuance programme.

CDS have been in the headlines of late following a string of unrelated controversies. Last week, the International Swaps and Derivatives Association proposed updates to CDS documentation following regulatory pressure to prevent so-called manufactured defaults.

That is when a company strikes a deal with an investor that holds CDS protection on the company’s debt to engineer a default, triggering a CDS payout. In return, the investor will typically give the company a cheap loan.

While investors and bankers largely applauded the move from ISDA, some pointed out the trade body has not sought to address other perceived issues with the contract. Those include the process of a company shifting its debt to another entity to render its CDS worthless - known in the industry as “strategic orphaning”.

There is no indication that Schaeffler’s move to issue debt out of a different vehicle was planned with CDS in mind. Schaeffler did not immediately reply to a request for comment.

“Strategic orphaning” remains a problem, credit strategists at Citigroup wrote in a note to clients last week. “The [latest ISDA] proposals do little to address [these] cases … which keep cropping up both in Europe and the US,” they said.

Schaeffler will kick off meetings with European investors for its new bond programme on Thursday. BNP Paribas, Bank of America Merrill Lynch, Commerzbank and Deutsche Bank are bookrunners.

The company is eyeing a two to three tranche benchmark euro including fixed rate tranches with maturities of three to eight years.

Last week BNP analysts wrote that the announcement of the new bond programme looked strange as it came after the ECB wrapped up its corporate bond purchase programme in December.

Schaeffler acquired an investment-grade rating from all three major rating agencies after S&P upgraded the company to BBB- from BB+ at the end of August. The company is rated Baa3 by Moody’s and BBB- by Fitch.

“Very strange timing to be now considering issuance of bonds after having missed the opportunity to do so under the CSPP and at much tighter levels,” analysts wrote.