Deutsche Bank’s top bosses owned shares in the bank currently worth just €3.5m, far less than peers at rival institutions, which has prompted criticism they have little invested in the bank’s fortunes – or a lack of confidence in its prospects.

Deutsche’s 12-person management board owned 444,444 Deutsche shares as of February 2018, according to its most recent annual report. That amounted to just 0.02% of the shares in issue. Its annual report for 2018, due out on March 22, will update the shareholdings.

One former senior Deutsche banker was scathing about the lack of “skin in the game” management had – at a time the bank is in talks to merge with Commerzbank, Germany’s second biggest bank.

“They don’t have an equity mentality – they have a remuneration mentality,” he said. “Everyone [at that level of seniority] should own 5–10 million euros of stock. That is typical at other organisations.”

Indeed, there are likely to be many bankers at Deutsche who own more stock in the bank than those in the leadership team.

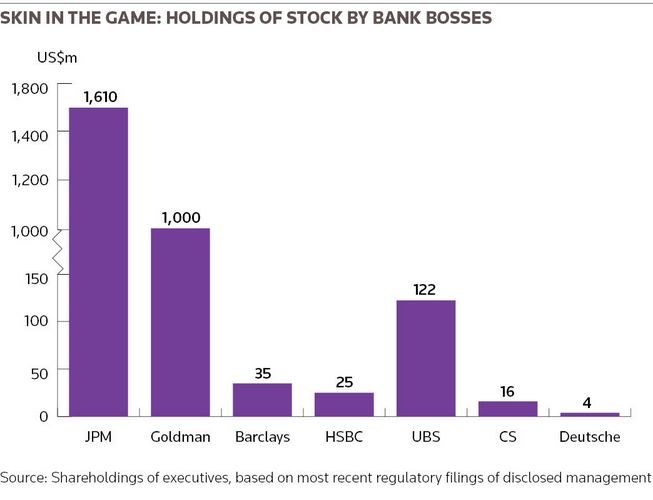

US banks stand in stark contrast. The 11 executive officers of JP Morgan owned 15.5m JP Morgan shares (worth US$1.61bn last week) at the end of February and the 11 executive officers of Goldman Sachs had 5.1m shares in their own institution (worth US$1bn) as of March 5 2018, according to IFR calculations using the most recent data. That equates to 0.5% and 1.4% of the shares in issue, respectively.

The latest data show that the top executives at Bank of America Merrill Lynch owned stock in BAML worth US$334m at last week’s prices, at Citigroup the equivalent is US$145m and at Morgan Stanley US$124m. The US data include some share options and unvested share awards.

US executives typically own more stock in their companies, reflecting the culture and higher pay levels, including payment in stock. But Deutsche also fares badly compared with European rivals.

Barclays only has two executive directors, but the latest information shows they owned Barclays stock worth £26.2m (US$34.8m) at last week’s prices. HSBC’s three executives on its board owned £19.1m (US$25.4m) of their bank’s stock and Societe Generale’s five top executives owned €7.6m of SG shares.

UBS’s 12-person management board owned stock in UBS at the end of 2017 valued now at SFr122m (US$122m), or 35 times the amount that their Deutsche counterparts owned in the German bank. Credit Suisse’s executive board at the end of 2017 owned stock now worth SFr16.2m.

Several factors have contributed to the low value of shares owned by Deutsche’s bosses, including a 70% crash in its share price in the past five years; leadership turnover; and because Deutsche has not paid bonuses to executives in 2015, 2016 or 2017, which typically include shares.

Deutsche’s managers held far more in the past. For example, its seven-person management board owned 1.43m shares, worth €55.8m at the time, as of February 2011.

Most banks require management to hold stock as it is seen as good corporate culture to align management’s interests with investors. Many require management to own minimum amounts of stock as an absolute amount or a multiple of salary.

Deutsche requires its chief executive to own stock worth €6.8m and other management board members to hold at least €2.4m. But it only applies when the managers have received 133% of the requirement in share-based variable pay.

“This requirement fosters the identification of the management board members with Deutsche Bank and its shareholders and aims to ensure a sustainable link to the performance of the bank,” its last annual report said.

NEDS TOO

Deutsche’s supervisory board of non-executives barely holds stock in the bank either.

As of February last year, the 25 members of Deutsche’s supervisory board owned 233,918 shares – now worth a combined €1.85m. That works out at €74,000 per person. The supervisory board is paid about €5m a year in aggregate.

In stark contrast again, the 11 non-executive directors who sit on JP Morgan’s board held stock now worth US$1.4bn as of the latest data, while Goldman’s non-executives owned US$270m of stock, according to IFR calculations.

At European banks, the non-executives held smaller amounts of stock – but still more per person than at Deutsche.

According to the latest data, Barclays’ 13 non-executives owned stock now valued at £1.8m, at HSBC £3.2m, at UBS SFr21.9m and at Credit Suisse SFr15.2m.

Commerzbank, Deutsche’s partner in waiting, does not disclose how much stock its management team owns.