Despite a lack of fine details, new CMBS risk retention rules that come into play in the US at the end of the year are likely to increase issuance.

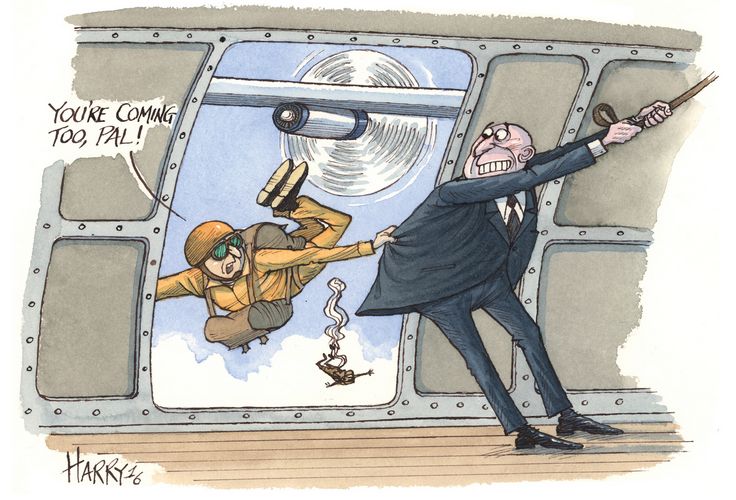

At the end of the year, new risk retention rules come into play for the commercial mortgage-backed securities market in the US. From Christmas Eve, banks must retain at least 5% of every issue – or find someone else to do so on their behalf - in what has been dubbed the new “skin in the game” rules. The aim is to stop the kind of seat-of-your-pants origination that was characterised in last year’s hit securitisation movie “The Big Short”. Banks that have to retain a tranche of their own deals are less likely to play fast and loose with structuring – or at least that is the theory.

Making clear its need to remain neutral and without showing favour, the Commercial Real Estate Finance Council, the trade association for the US$3.5trn commercial real estate finance industry, is backing the move. “In the case of risk retention, the goal remains minimising uncertainties and volatility in the marketplace by helping to create effective avenues to compliance with the new rules,” said Lisa Pendergast, the organisation’s executive director.

Not that the new legislation hasn’t caused some concerns. “Risk retention is one of the most talked about and fretted issues of the year,” said Lauren Cerda, senior director at Fitch Ratings in New York. She makes the point that many legal nuances remain untested and unanswered, particularly those surrounding regulatory niceties. “But the coming requirement to hold on to a risk retention piece seems to be less catastrophic than originally anticipated.”

Under the new rules, which come in as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, originators must keep a horizontal portion of a CMBS’ subordinated paper, a vertical portion or an L-shaped portion.

“The sponsor has the option of holding the required retention interest as an eligible vertical interest in an amount equal to 5% of the face value of each tranche of securities issued in connection with the securitisation, as an eligible horizontal residual interest in amount equal to 5% of the fair value of all securities issued in connection with the securitisation, or in any combination of the two – in other words an L-shaped interest,” said Stewart McQueen, partner for law firm Dechert in North Carolina.

Although only three deals that conform to the new legislation have printed to date, initial fears that the new deals could end up costing as much as 15bp–30bp extra appear to have been overblown.

Landmark

At the start of August, Wells Fargo, Bank of America Merrill Lynch and Morgan Stanley priced WFCM 2016-BNK1, a 10-year US$870.6m securitisation of 39 commercial mortgage loans secured by 46 properties.

It was a “landmark securitisation”, according to Paul Fitzsimmons, managing director of Kroll Bond Rating Agency. Enthusiastic investor support saw pricing tighten significantly on all tranches, but the attraction was not just a modest loan leverage rate of 91.7%, or even the high quality of the paper. Rather it was the vertical 5% slice of the deal that was retained by the banks that piqued investor attention.

It certainly passed the plausibility test with the ratings agencies. “Based on our review of the WFCM 2016-BNK1 transaction documents, we believe the creation of the vertical interest won’t have any credit impact on the securities we rated in this transaction,” said Moody’s analyst Chaim Gottesman.

This was followed in mid-October by the Hartz Group, a private investment company with interests in the real estate, oil and gas, and financial management industries, which refinanced a loan taken from Goldman Sachs in 2007, with a US$214m securitisation arranged by Deutsche Bank.

It was a clever deal that showed that investors could warm to the idea of new CMBS issuance. Based on a single property – the group’s flagship property of 667 Madison Avenue, better known as the Country Club – three of the tranches of COMM 2016-667M came in from guidance. While the AAA rated 10-year tranche came in 2bp to swaps plus 118bp, the AA–/AA and A–/A notes tightened 10bp to 135bp and 165bp, respectively. The BBB–/BBB tranche printed at swaps plus 235bp.

Rather than retain the crucial 5% themselves, before the transaction printed Deutsche managed to sell US$16m of the BB/BBB rated Class E notes to a single – unnamed – investor who agreed to retain the paper for the life of the transaction. The new rules allow the originator to sell its retained 5% stake to a third party but this is not simply a case of shifting the risk. The third party must retain the paper for at least five years and the investor must report quarterly on its holdings to the bank. But inevitably details are missing. “There are no express limitations or constraints on the capital structure of a retaining party, other that it remain a retaining party,” said one lawyer.

Most recently, Morgan Stanley, Wells Fargo and Bank of America priced the oversubscribed US$725.6m BANK 2 deal for Morgan Stanley in early November. Based on 40 loans originated by the three banks, the AAA tranche tightened 4bp from guidance to swaps plus 106bp.

As in their summer issue, the banks decided to take a vertical, rather than horizontal slice of the paper, and retained around US$36m.

Questions remain

All good news, but while these so-called test transactions have all passed muster, questions remain. The elephant in the room is to what extent the new rules will affect issuance. At its peak in 2007, there was US$230bn of CMBS issuance in the US, according to IFR data; this year is expected to see US$70bn, according to Morgan Stanley. Although Credit Suisse estimates that the fourth quarter of 2016 will see a US$21bn burst of issuance as issuers sprint to refinance ahead of the deadline, some doom-mongers suggest that next year could see only token issuance.

Of course, certain details still require clarification. A significant issue that needs to be resolved is what the repercussions might be for the risk retention sponsor if a deal is determined to be non-compliant in some way. “This could initially make it more difficult for some of the smaller non-bank issuers to find a partner to take on the sponsorship role as there could be concerns about their ability to cover any material costs associated with non-compliance,” said Cerda at Fitch.

Constructive guidance has been slim to say the least. “It would be prudent for the non-retaining sponsors to perform due diligence to reach a level of comfort that the retaining sponsor has, as of the date of the closing of the transaction, the proper capacity, intent and structure to retain the required risk,” advised Michael Gambro and Jeffrey Rotblat, partners at Cadwalader, Wickersham & Taft writing in ”The National Law Review” at the end of October.

Another issue is how bank regulators intend to view the originators’ 5% slice, whether it will be seen as a security or a loan. Given the almost permanent regulatory attention on banks’ balance sheets, an answer is needed. It will have a material impact on the amount of capital that issuers need to retain.

Answers are unlikely any time soon and the lack of clarity means that the market will see increased volatility in the first quarter of next year as pricing begins to find its level, say the sceptics.

Irritations

The objections are valid, but few believe that they are likely to be anything more than short-term irritations. Indeed most believe that the new rules will do exactly what it is hoped and help stabilise the market.

CMBS defaults have been declining since their peak of around 9% in 2009 as the economy stalled. This September’s delinquency report from New York-based research and analytics firm Trepp shows that the figure is now around 4.78%, 50bp down on the year. And the new compliance rules are likely to lower that figure even further.

With around US$105bn in CMBS maturing in 2017, according to Trepp, there is certainly going to be issuance next year. And there is confidence that any issues that make it to market will find buyers. “The pricing dynamic of the three compliant CMBS issues so far show that there is definite buyside interest,” said one New York-based securitisation banker.

Perhaps most significant of all for issuers is that the three test transactions over the past couple of months prove not only that appetite is still there, but that the new CMBS structure might not necessarily mean a massive premium.

To see the digital version of this review, please click here .

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com