The recent collapse in the price of oil has removed the veil of semi-respectability from Venezuela’s finances. President Nicolas Maduro denies that his country cannot meet its obligations but his reluctance to trim expenditure, and his limited options for raising fresh capital, have exposed a void that many believe will inevitably result in bankruptcy.

Venezuela is hopelessly reliant on its oil sector. Little else in its economy can take up the slack when the oil price drops. Even when the oil price is high the country lives beyond its means. But the recent dip in the oil price has left Venezuela hugely exposed, pushing it to the brink of default.

The country itself has been tight-lipped on the state of its economy, feeding speculation that it has something to hide. But late last year an adviser to the country’s main opposition group said the economy had shrank by 4.2% in the first three quarters of 2014.

Credit Suisse estimates that real GDP fell by 3.5% in 2014 and projects a 1% contraction for 2015. It now forecasts a 0.8% of GDP current account deficit this year, mainly driven by lower oil prices.

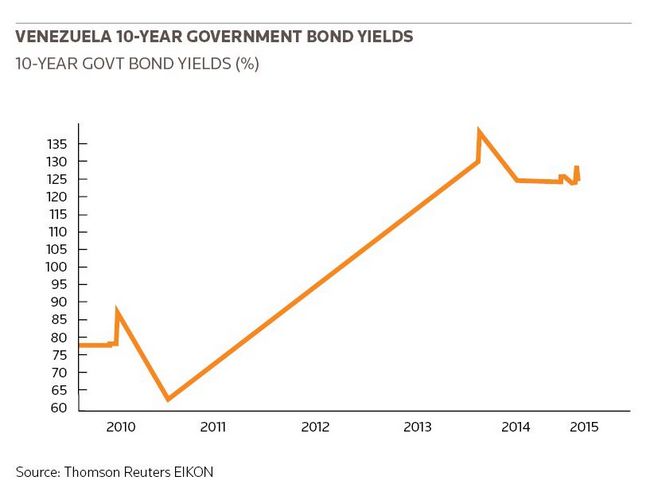

However, bond yields have remained reasonably steady after peaking in early 2014 with a price of nearly Bs140. Since Q3 they have remained reasonably flat at around Bs125.

The oil price is the most obvious source of Venezuela’s woes, but its problems run much deeper.

“The country has around US$25bn in cash revenues [oil exports and non-oil] with current oil prices in 2015,” said Juan Carlos Rodado, head of Latin America research at Natixis.

“They need to pay around US$40bn in imports of goods and service US$12bn in bonds in foreign currency – US$6bn for the sovereign and US$5.8bn for [state-owned oil company] Petroleos de Venezuela [PDVSA]. In other words, they have a US$27bn gap that largely exceeds international reserves.”

Venezuela’s most daunting period of debt repayments will be in the fourth quarter. PDVSA owes more than US$1.75bn in debt repayments in October and a further US$2.85bn in November, with Venezuela on the hook for over US$5bn in total for those two months. If it survives the fourth quarter without defaulting, the more than US$2.5bn owed in the first quarter could push the country over the brink.

“The oil price is not the cause of Venezuela’s problems, it has just unveiled them. But it is making things worse in the short term,” said Armando Armenta, Latin America economist at Deutsche Bank.

It is also likely to determine the timing of any Venezuelan default. Crude oil below US$60 “implies some US$22bn less revenue in 2015 compared with 2014, a year in which it has already proven difficult to close external accounts”, said Ben Ramsey, an analyst at JP Morgan.

Credit Suisse has estimated the 2015 average Brent price will be US$75.3 per barrel, or around US$67.7 per barrel for the Venezuelan oil mix. With oil at that price “Venezuela would face a US$22.8bn foreign exchange financing gap this year”, said Casey Reckman, an analyst at Credit Suisse. If oil does not recover in the second half of the year, and the price averages US$50, the gap would widen to US$33.9bn, she said.

“The oil price is not the cause of Venezuela’s problems, it has just unveiled them. But it is making things worse in the short term”

Deutsche Bank calculates that if the oil price averages US$50–$55 in 2015, Venezuela’s shortfall will be around US$30bn.

In denial

Despite these forecasts, the Venezuelan government has been steadfast in its denial that it will be unable to meet its obligations. In December, President Maduro said: “There is no possibility of default, unless we would decide to not pay any more as part of an economic strategy for development. And that’s not the strategy that has been constructed in these years of economic thought laid out by Hugo Chavez.”

Few attach any credibility to these words. In fact, this speech is not the only thing lacking in credibility: since the death of Chavez in 2013, Venezuela has lacked a credible leader, said Rodado.

“The risk of social unrest and even a coup is therefore higher, especially with fewer dollars,” he said. “President Maduro has only a 21% support, even Chavistas are not happy with his lack of leadership and improvisation.”

Despite his poor ratings, Maduro remains the most popular of the available options, even if he is unable to unite his country behind any plan to address Venezuela’s problems.

“The government and PDVSA can employ numerous strategies to address this shortfall and avoid default this year,” said Reckman. “However, we think that doing so would likely require highly coordinated and decisive action from public sector officials.”

The prospect of such coordinated and decisive action looks remote. The easier path has been to capitalise on the local debt markets, where Venezuela has recently issued paper that was largely taken up by its own central bank. However, this will not be sufficient to pay its foreign currency debts.

A more trusted credit might have enough goodwill in the markets to enable it to refinance those debts. But in Venezuela’s case bondholders are unlikely to agree to such an arrangement without major policy changes – massive reductions in spending – that Maduro looks unwilling or unable to deliver.

For example, Venezuela could save money by cutting gasoline subsidies. Former PDVSA president Rafael Ramirez estimated these cost around US$12.5bn last year, and JP Morgan puts the cost closer to US$16bn annually or 3% of GDP. This idea was briefly floated, but unsurprisingly proved unpopular with Venezuelans. Maduro backed down, shelving the idea with the claim that it would exacerbate inflationary pressures in the current climate.

The problem with this is the lack of a credible plan for tackling inflation, which undermines any expectation that such cuts can be made in the foreseeable future.

So instead, Maduro has been looking for alternative sources of cash. One clever idea has been to securitise and sell PetroCaribe loans – loans made on favourable terms to countries in the region to buy Venezuelan oil. The Dominican Republic reportedly paid around US$1.8bn in one deal, implying an approximate 50% discount on what it originally owed Venezuela from the PetroCaribe arrangement.

The second-largest participant in the PetroCaribe arrangement is Jamaica and if a similar deal were struck it could raise a similar amount again. Although this arrangement certainly has its merits it will not be enough to cover the complete cashflow shortfall for 2015. Indeed, some may ask whether Venezuela can afford the PetroCaribe arrangement, which buys influence in the region at a cost of reduced revenues for its oil, at all.

Other ideas have been less innovative. Rodado said: “President Maduro came back empty-handed from his visits to China, Russia, Qatar. Moreover, he went to Saudi Arabia and other OPEC countries to bolster oil prices, which is especially naive. Saudi Arabia has no interest to bear alone the adjustment, especially with a booming shale industry in the US and one of the lowest oil production cost in the world.”

This has not completely killed talk of a credit line from China or Russia, but analysts are sceptical the money will be made available. If it is, it is more likely to be tied to specific projects, rather than made available for general expenditure.

Asset sales

Another option would be asset sales, such as state-owned companies or refineries, but there are question marks over what the market value of such assets is, or how easy it would be to sell them without offering a massive discount.

The state’s gold reserves, around US$15bn of which is held in Caracas and a further US$2bn in London, could be sold to raise capital but selling such a lot of gold would be time-consuming and it is debatable whether the government would want to sell, given that gold represents the foundation of its monetary system.

Rodado said: “Venezuela has US$14.7bn in gold reserves from US$20.7bn in international reserves. The main caveat is that 82% of the gold is in the most illiquid form in the coffers of the central bank in Caracas. No one will lend you money with that collateral and the liquid resource is just too scarce.”

Venezuela’s endemic corruption represents another formidable obstacle. The economy is riddled with distortions that military officials are well placed to benefit from, exemplified by the three-tier foreign exchange system, which has provided such fertile breeding ground for the black market.

Venezuela’s complex FX management system operates multiple official exchange rates for different purposes. Cencoex sells FX for food, medicine and priority goods at a rate of US$/Bs 6.3, while Sicad-1 attends to the needs of the rest of the economy, selling at a rate of US$/Bs 12. Sicad-2 uses a rate just below US$/Bs 50.

“Multiple FX rates regime will be maintained, with more and more items being shifted up from lower rate to higher rate platforms,” said Ramsey. He predicted the arrangement might be tweaked to allow PDVSA and its partners to sell at least part of the dollars obtained from oil exports at the higher Sicad-2 platform, with the current arrangement requiring export proceeds be sold at the lower Cencoex rate.

“This would be a necessary and positive change, meeting a request from PDVSA and its partners that would improve the viability of JV projects and PDVSA cashflow. Such a change could reduce, at least on the margin, the degree to which PDVSA must rely on monetary financing from the Central Bank,” said Ramsey.

“The government has had many opportunities to reform the exchange rate system but has always been too timid”

Such reforms represent the low-hanging fruit the government has reached for in its pursuit of savings. But mostly these offer no more than one-off windfalls that will make little difference in its fight against bankruptcy.

“Devaluation is not as effective a tool as it used to be,” said Reckman. “The benefits are short-lived unless it is accompanied by appropriate fiscal and monetary measures to sustain the associated competitiveness gains.”

“The government has had many opportunities to reform the exchange rate system but has always been too timid,” added Armenta. “The measures it announced most recently are just more of the same and ultimately the black market will remain the big winner. If there is a silver lining it is that the government has acknowledged something has to be done to tackle the black market. But unless they change this three-tier rate system its efforts to reform will fail.”

Not everyone agrees that a Venezuelan default is inevitable. Richard House, head of EM debt at Standard Life, said: “Despite Venezuela having the largest proven oil reserves globally, investors price in a high probability of a sovereign default in the next few years. We believe this would do more harm than good and that policy will be adjusted to avoid default.”

This would require Maduro to rise above his lack of popularity and force through unpopular reforms to ensure Venezuela lives within its means. Few believe he has it in him.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

| Venezuela’s monthly debt service payments (US$m) | |||

|---|---|---|---|

| Months | PDVSA | Venezuela | Total monthly payment |

| Jan–15 | – | 70.31 | 70.31 |

| Feb–15 | 191.25 | 557.05 | 748.3 |

| Mar–15 | – | 1,567.53 | 1,567.53 |

| Apr–15 | 351.58 | 437.12 | 788.7 |

| May–15 | 800.37 | 182.5 | 982.87 |

| Jun–15 | – | 80 | 80 |

| Jul–15 | – | 70.31 | 70.31 |

| Aug–15 | 191.25 | 557.05 | 748.3 |

| Sep–15 | – | 228.75 | 228.75 |

| Oct–15 | 1,764.81 | 437.12 | 2,201.93 |

| Nov–15 | 2,850.37 | 182.5 | 3,032.87 |

| Dec–15 | – | 80 | 80 |

| Jan–16 | – | 70.31 | 70.31 |

| Feb–16 | 191.25 | 2,057.11 | 2,248.36 |

| Mar–16 | – | 228.75 | 228.75 |

| Apr–16 | 316.25 | 437.12 | 753.37 |

| May–16 | 713.24 | 182.5 | 895.74 |

| Jun–16 | – | 80 | 80 |

| Source: Credit Suisse | |||

| Venezuela macro forecasts | |||

|---|---|---|---|

| 2014 | 2015 | 2016 | |

| Growth (%oya) | –3.0 | –0.5 | 1.4 |

| Inflation (%eop) | 60 | 60 | 40 |

| US$/VEF* (eop) | 50 | 75 | 75 |

| Current account (%GDP) | 2.6 | 0 | 1.2 |

| Primary fiscal balance (%GDP) | –2.0 | –2.0 | –2.0 |

| Public debt/GDP | 65 | 75 | 75 |

| * Sicad 2 | |||

| Source: JP Morgan | |||