Divyang Shah, IFR Senior Strategist

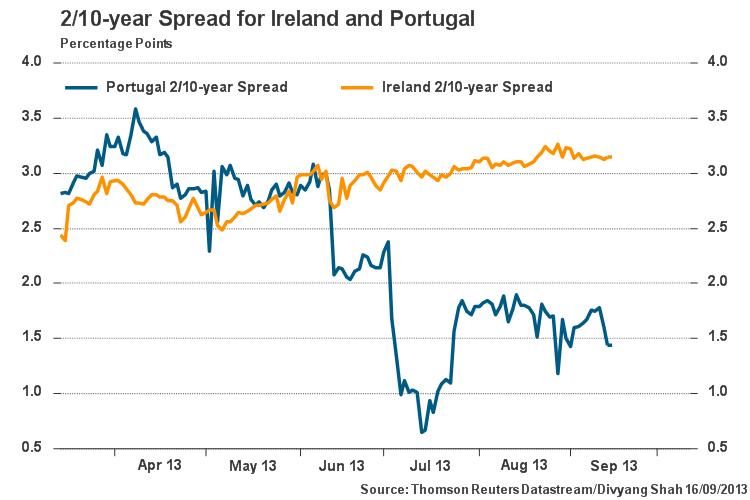

The shape of the curve as measured by the 2s/10s slope on Portugal provides a barometer of market concerns. The slope flattened by 30bps on Friday but at just under 150bps currently (using mids) it is not as flat as the levels seen in July of this year when political concerns were more acute.

The 8th and 9th review from the Troika is set to start today and negotiations could be difficult as once again there are requests for easier budget goals for 2014. Given that these are targets that have been constructed under certain assumptions the question we have to ask is whether relaxation of the budget goals will mean giving Portugal more time or money (remember how we asked these questions on Greece?.

While politically there is a desire for Portugal to stick to its 4% deficit target for 2014 it has not gone unnoticed how previous relaxations have been well received by financial markets.

Too strict adherence to fiscal targets has created more political and economic pressure as adjustments are forced to happen faster than is digestible. The market concerns over Portugal were visible on Friday when we saw the 2s/10s curve flatten as 2-year yields went up by 46bps while 10-year yields were up 16bps (using Tradeweb closes).

It is looking like Portugal will need further assistance beyond just relaxed targets. However, while a 2nd bailout or even ECCL credit line appears likely at some point, it does not seem to be on the agenda just yet.

A more detailed discussion has been postponed by the eurozone FinMins until November according to Reuters but markets clearly do not like it that, instead of dealing with Portugal in a pre-emptive manner, the easier option of sweeping the issue under the carpet has been chosen.

We would keep an eye on the 2s/10s slope on Portugal.