The eurozone malaise is holding back deal-making in Germany as corporates look to preserve balance sheet flexibility. But there are positive signs that sponsor-led deals will provide some relief for deal-hungry loans bankers. Buyers and investors are being highly selective when it comes to the deals they will back. Non-cyclical industries are popular but the valuation has to be right.

To view the digital version of this report, please click here.

CVC Capital Partners’ knock-out €3bn bid for German metering business Ista in April has delivered some much-needed cheer to the German loan market.

The European private equity firm’s surprise entry into the bidding, backed by a single loan from Deutsche Bank, shows that lending appetite is strong and that for the right deal in the right sector, buyers are keen to execute deals. The question is whether this will translate into a broader recovery at a time when corporate confidence remains febrile across Europe.

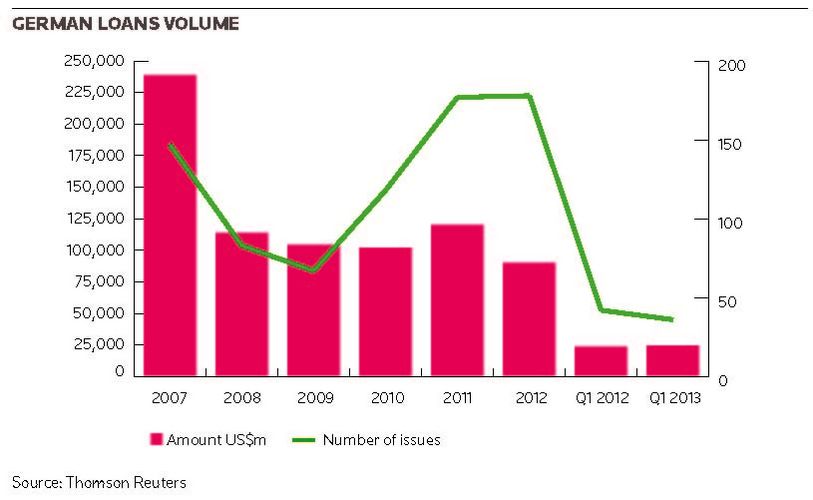

The CVC deal will ensure that the second quarter will start on a positive note. During the first three months of the year, M&A financings accounted for just 4% of the US$27bn worth of syndicated loans in the German market.

Meanwhile, announced deals involving a German company fell by 12% in the first quarter, compared with the equivalent period a year ago. CVC trumped rival BC Partners to buy a 76% stake from co-owner Charterhouse in a €3.1bn deal – Germany’s largest private equity transaction since 2008.

“The M&A market is soft across Europe and Germany is no exception. If anything, the M&A market is more depressed because [many German] companies have strong balance sheets and do not need to buy and sell assets to reposition their businesses,” said Wolfgang Fink, head of German investment banking at Goldman Sachs.

Sporadic activity

There are pockets of activity. Bankers are reporting a rise in dual-track processes, where private equity-backed companies are looking to either sell their businesses or float them on the equity markets. Sources said that German bathroom equipment maker Grohe, which is owned by TPG and Credit Suisse, has taken soundings for a sale that could be worth as much as €2.2bn. The sponsor-backed deals are heavily weighted towards refinancings, rather than providing much-needed fresh loans.

“There are a lot of ingredients in place for an improvement in Germany’s M&A market,” said Armin von Falkenhayn, head of corporate finance Germany at Deutsche Bank. “Financial sponsors are starting to look at dual-track processes and with the loan markets at competitive levels, covenants are becoming more comfortable, and that is supporting M&A trade when competing with an equity market exit.”

Another source of deals is coming from Asian investors – notably from China – which are looking to snap up high quality assets in the eurozone at low valuations and are targeting Germany as the currency bloc’s safe haven.

In January 2012, Sany Heavy Industry agreed to buy Putzmeister Holding, Germany’s largest cement-pump maker, for US$653m, including debt in the biggest takeover by a Chinese firm. The deal was significant because it was one of the first successful sizeable Chinese acquisitions of a company in Germany’s Mittelstand.

Sitting on dry powder

While there is evidence of a recovery in the transaction range of €1bn to €5bn, there is no sign yet of a return of the sort of big-ticket dealmaking that the loan markets crave. Fink said: “The message from equity investors to the boards of large German companies is that they want to see a very disciplined approach to spending on M&A deals.”

The frustration for loans bankers is that company executives are sitting on their hands at a time when there is a glut of firepower, both from private equity firms sitting on dry powder, and from banks willing to extend balance sheet to corporate Germany. “There is a liquidity overhang for financing German corporates,” said Von Falkenhayn.

“Although our industry is shrinking the combined balance sheet and selected competitors are participating less in the loan market, we have seen a resurgence in appetite from international banks.”

But lenders and potential acquirers alike are being selective as they focus only on high-quality companies with good earnings visibility. Chinese companies are focused on the industrial sector, Von Falkenhayn said, while Deutsche’s willingness to act as sole underwriter on the Ista deal was down to its confidence in the business model and the sector in which it operates.

“There is no big cyclicality in the metering sector and Ista has one of the most stable business models I have ever seen,” said one banker involved in the bidding process. The debt financing on Ista will consist of a mixture of loans and bonds with total leverage of about 7.25 times and senior leverage of about 5.5 times.

Valuation gap

Bankers said sell-side valuations were being skewed by the stream of available credit. “The strength of the financing markets is increasing the discrepancy between buyers and sellers. Sellers are looking at the availability of financing and inferring a higher price for an asset than buyers, who are more focused on the operating environment,” said Fink.

Ista is a case in point. CVC has held a stake in the company since 2003 and the most recent deal extends its stake to majority ownership. One banker close to another bidder in the process said: “The valuation gap is such that sellers do not see this as an ideal time to come to market. The valuation spread here was such that CVC went from being a seller to a buyer.”

In some cases, the valuation mis-match is scuppering deals altogether. In March, the planned sale of German insulation company Armacell collapsed after bidders pulled out, citing too high a valuation. Armacell hoped to fetch up to €500m, a size that is problematic as it sits on the cusp of where big banks can do profitable business. However, the dearth of suitable targets for private equity deals eventually led to the sale of Armacell. Bahrain-based private equity firm Investcorp agreed a sale at the end of April for more than €500m.

Homeward bound

“At the smaller end of the deal spectrum, we are witnessing a renationalisation of the funding markets,” said one leveraged loans banker based in Frankfurt. “Overseas players are returning to their home markets and many of the Landesbanken have pulled back from the market. That is where there is most need for financing.”

But the pressure for sponsors to close out positions and re-invest in new deals will continue to be a driver, but uncertainty over earnings is leading to protracted execution as buyers struggle to retain motivation for all but the highest quality assets.

In October, private equity firm Advent International agreed a €1.5bn bid for Douglas Holding, which brought the takeover of the German retailer closer after almost a year of talks. While some banks were not prepared to commit financing to a transaction in the troubled retail sector, JP Morgan, Credit Suisse and Goldman all stepped up.

“We are starting to see the signs of a recovery in the German consumer and that could lead to some M&A opportunities in that sector,” said Von Falkenhayn.

Shift to bonds for small deals

Germany is Europe’s second-biggest fee pool for investment banks behind the UK; an improvement in deal flow is as essential for revenues as it is for sentiment. And while banks are keen to provide finance for the best names, the same cannot be said for smaller deals in the bracket of €50m to €250m. It is here that bankers are witnessing a gradual, secular shift from the loan to the bond markets and that is providing opportunities for bankers to offer creative solutions. What is needed is a return of good old-fashioned confidence on the part of buyers.