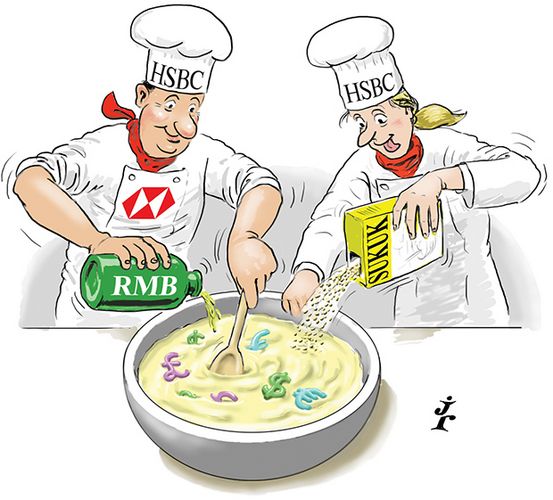

The public sector funding arena is by its nature dominated by large vanilla fundraising exercises in a few core currencies. One bank showed that it was possible to add a little variety to the mix – and that your existing franchise can thrive at the same time. HSBC is IFR’s SSAR Bond House of the Year.

It is difficult for any bank to differentiate itself in SSAR, given that the sector is principally populated by large-scale issuers, each with its own strict funding programme. Volume might be one gauge of success for a bank, but it is a blunt measure in a world where the top flight of underwriters can all boast an impressive roster of deals.

To do something different or extra is what sets you apart as a house, and HSBC was able to do this in a number of important developing sectors.

The firm has long been a leading light in the sukuk arena and 2014 saw it spread its wings ever wider, bringing European sovereigns into the burgeoning asset class for the first time.

June saw it act as sole structuring adviser on the UK’s ground-breaking five-year issue of sterling-denominated sukuk al-ijara, the first from a non-Islamic government. Given that parliament had passed the sukuk law in 2009, it can only be conjectured as to just how much work went on behind the scenes to finally bring the paper to market.

Luxembourg followed at the end of September with a euro sukuk deal, again bagging a couple of firsts, but not before Hong Kong had made its own debut in the asset class with a US dollar offering.

HSBC was also active in the agency sector, with two issues for the Islamic Development Bank, which, while not as surprising in sukuk format, still managed to secure its largest deals with US$1.5bn apiece and is fast approaching pricing parity with its peers.

Add to this transactions from Dubai, Indonesia and Sharjah and it becomes clear that the asset class is flourishing, not to mention now putting down roots in Europe.

Another of the year’s themes that also played to HSBC’s strengths was the rise of the renminbi market.

It teamed up with the UK again to price a Rmb3bn (US$490m at the time) three-year transaction, the first offshore renminbi offering from a non-Chinese sovereign, which planted a flag in the sand of this fast-growing sector, with the bank returning the following week with an equally large deal for British Columbia.

HSBC also neatly combined two of 2014’s trends with a sole led Rmb500m Green bond for the IFC that provided another significant step forward in the currency’s internationalisation.

It also demonstrated its socially responsible investment credentials with deals for the EIB, AFD, NWB Bank, Ile de France and Ontario, spreading the currency mix to include sterling and Canadian dollars as well as euros.

“We’ve been consistent over many years now,” said PJ Bye, global head of public sector syndicate capital finance. “But what really sets us apart from our peers is that we’re doing more interesting things.”

In the core markets, HSBC maintained its top-tier standing. Peripheral countries such as Greece and Cyprus appointed it as bookrunner on their first benchmarks since their bailouts; while Austria, Italy and Spain also relied on its expertise, the latter with a new 10-year issue and a switch out of three shorter-dated bonds to help manage the sovereign’s maturity profile.

Such liability management formed another important foundation of HSBC’s business during 2014, with the bank pioneering the one-day switch format subsequently used by the likes of the EIB and others.

In US dollars, HSBC produced a similar mix of repeat clients including the EBRD, NIB and Finland, as well as more infrequent sovereigns such as Canada and Portugal.

It also showcased its number one sterling SSA franchise, with deals for AfDB, JBIC, CDC and the Council of Europe, while topping the underwriting table for frequent issuers EIB and KfW and putting in its usual strong showing with the UK DMO.

Factor in an ability to price deals in myriad currencies – 21 in all – and it adds up to a imposing proposition.

As one issuer said: “HSBC as a global bank works very well. It has connections with investors across the world and can reach into different pockets of liquidity. At a time when distribution is key, it is an institution that can deliver on that.”

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.