Banks have been increasing staff numbers rapidly across Gulf countries in recent years as the region seeks to diversify away from hydrocarbon income and the trend is set to continue, led by Saudi Arabia and the United Arab Emirates and their ambitious plans for capital markets.

Firms bolstering their presence in those two hotspots as well as other locations in the Middle East include HSBC, Goldman Sachs, Citigroup, JP Morgan and Morgan Stanley. Boutiques have been busy too, with Lazard, Moelis and Rothschild all building too.

Rothschild is in the queue to join the investment banking throng in Riyadh. Sources say it has applied for a licence to set up a full office in the kingdom that will be chaired by Mark Sedwill, the former UK cabinet secretary who joined the firm last year. Rothschild declined to comment.

Rival Lazard last month poached Wassim Al-Khatib from Citi as chief executive for Saudi Arabia and head of its financial advisory business in MENA in Riyadh, which Lazard has made its regional investment banking hub. In September it hired Sarah Al-Suhaimi as chair in Saudi Arabia too.

Goldman plans to open a new office in Riyadh later this year, after more than doubling its headcount in the kingdom in recent years, as part of a significant increase in staff across the MENA region.

There have been several other senior appointments in Riyadh in recent months. HSBC appointed Faris AlGhannam as its chief executive in Saudi Arabia and said the appointment was part of “a new phase of growth in the kingdom”.

Standard Chartered appointed Mazen Fahad Al Bunyan as CEO for Saudi Arabia. Goldman hired Mohammed Al Bunyan as a managing director in Saudi, and Deutsche Bank named Alanoud Alqahtani as general manager of its Saudi branch.

In Dubai, HSBC moved senior banker Julian Wentzel from the UK to head global banking for the region, Citigroup appointed Kamal Benkabbou as head of markets for the region and Houlihan Lokey hired Andy Cairns as head of capital markets for the Middle East and Africa. Goldman hired Ibrahim Qasim and relocated Charles der Kinderen and Simon Martyn from London to the emirate in September.

Some banks have also relocated staff to the Gulf from Moscow following Russia's invasion of Ukraine, and they have shifted to covering the Middle East given that's where deals are, industry sources said.

Diversification plan

The hiring and relocations are being driven by optimism that plans by countries to reduce reliance on oil revenues will drive sustainable local capital markets activity. “The need to create depth in domestic capital markets is a way to power the transition agenda,” said a person at one of the leading banks.

Creating deeper local capital markets is central to Saudi Arabia’s Vision 2030 and the UAE's 2031 plans. It means prized assets are being listed, and they are helping to bring new pools of liquidity from local and international investors, as well as increasing the weighting of the region in emerging market indices.

HSBC has said it planned to increase the number of investment bankers in the next year in Saudi Arabia, where it is the biggest investment bank, by up to 15%. HSBC Saudi Arabia has about 250 staff, including about 55 investment bankers, far more than other overseas firms.

Rivals are bulking up too. “Our business has grown over the last three or four years. We are substantially larger today in terms of employees than five years ago,” said Patrick Delivanis, recently appointed co-head of MENA at Morgan Stanley.

“There has been a mindset shift in the region as people appreciate the importance of capital markets. That structural change is here to stay even if volumes might fall and rise over the course of a normal economic cycle,” Delivanis told IFR.

“I expect our business will continue to grow as sovereign wealth funds deploy capital and as the level of service that corporates, issuers, and investors demand from us continues to grow alongside the market.” Delivanis said the diversification trend was accelerating and capital was flowing into the region’s financial system from outside.

Working alongside him as regional co-head is Abdulaziz Alajaji, who is chief executive of Saudi Arabia at the firm, showing the importance of Riyadh in its plans. “It’s an exciting time for the region as it transforms from oil dependency to more diversified economies,” Alajaji said.

Another banker said the rise in oil prices and investors retreating from Russia and other emerging markets had “turbo-charged” what was a clear, long-term commitment to developing local capital markets and investment in the region.

Record fees

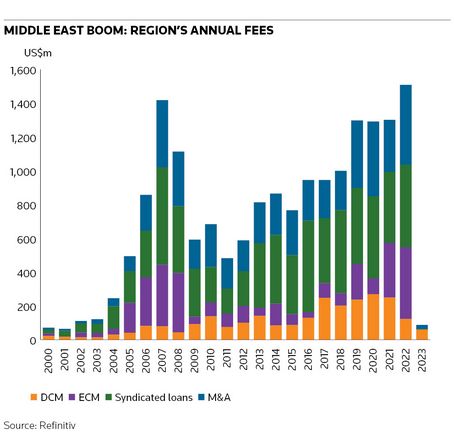

Indeed, last year was a record for investment banking fees in the Middle East. Banks brought in US$1.51bn from debt and equity underwriting, M&A and syndicated loans, up 15% from 2021 and eclipsing the previous record year of 2007, according to Refinitiv data.

It was led by equity capital markets activity, where fees hit US$424m, up 31% from a strong year before. The rise in overall fees and ECM were all the more marked because dealmaking slumped almost everywhere else, with global fees down a third from a record 2021.

“It was a standout year for our Middle East business,” HSBC CEO Noel Quinn told reporters on Tuesday after presenting 2022 results. “We are devoting more resources to the Middle East, it’s a good growth opportunity that is not just for the short term, we see good opportunities over the medium and long term, so we’re increasing our investment.”

Not many banks break out revenues for the region, but HSBC reported a US$1.7bn pretax profit in Middle East and North Africa last year, up 19% from 2021.

HSBC topped the rankings for investment banking in the region last year with US$116m in fees, giving it a market share of 7.7%, Refinitiv estimated.

US banks filled the next four spots – Citi, JP Morgan, Goldman and Bank of America, respectively, to reflect the increasing resources they are putting into the region.

Local banks are also adding bankers too, industry sources said. Saudi National Bank jumped to sixth in the region's fee rankings last year with US$59m, followed by First Abu Dhabi Bank.