FX traders aren’t buying a second Trump presidency

Political polls and betting markets predict Donald Trump will later this year win a second term as US president. Currency traders aren’t buying it just yet.

The starting pistol officially sounded for November’s US presidential elections last week after Trump and president Joe Biden secured their parties’ nominations, setting up a rematch of the 2020 vote. The prospect of Trump returning to the White House is already dominating investor conversations, with polls giving him a handy lead over Biden.

Betting on a strong US dollar looks like an obvious Trump trade and the likely return to protectionist policies that characterised his first term is widely expected to boost the greenback. But despite options markets anticipating a pick-up in volatility around the elections, traders aren’t yet placing large-scale wagers given the risk that central bank policies, or other events, could derail bullish US dollar positions between now and then.

“While the US election comes up in almost every conversation we have with market participants, there’s not been material trading off the back of [that],” said David Leigh, head of European FX trading at Deutsche Bank. “The US election [is] too far away for the FX market to want to do much with it currently."

Recent research from Barclays estimates a direct boost to the US dollar of up to 3% from Trump-imposed tariffs, while every 1% of GDP in additional fiscal spending under Trump is anticipated to create another 1%–1.5% of upside.

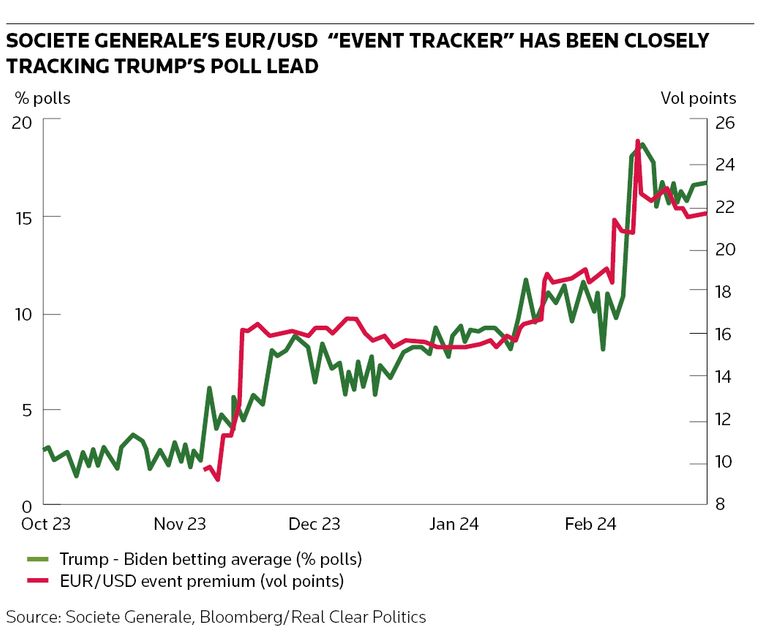

There are already some signs of FX options markets starting to factor in choppy markets around the election. Researchers at Societe Generale say that options prices anticipate euro-dollar daily volatility will be four times higher than usual on November 6 when the elections results come in. There are also signs in options markets that countries with strong trade links to the US – such as Mexico, Japan, Canada and China – could see big moves in their currencies around that time.

Even so, banks say that precious few clients are positioning themselves for the elections because of other macroeconomic and geopolitical events that could influence FX markets in the meantime.

“It’s a bit early to look at the US election in isolation as there are so many events and uncertainties that are heavily impacting the overall macro environment,” said the head of FX at a major dealer.

Top of the list of unknowns is when the Federal Reserve will lower interest rates from multi-year highs. A closely watched gauge of US inflation came in slightly hotter than expected in February, further supporting the view of many economists that the Fed is unlikely to start cutting rates before June.

Uncertainty over when central banks would start to loosen monetary policy has already resulted in depressed FX activity this year, with trading volumes down about 10% in early 2023.

“There’s still a question as to when the US election is going to matter for markets [given] we still have this central bank debate ahead of us, which will have a more dominant impact on the US dollar,” said Paul Mackel, global head of FX research at HSBC. “When we get into the late third quarter with presidential debates taking place then that will really be prime time for FX market activity.”

There is also debate around what a second Trump term would look like in practice – and how it would affect financial markets. While Trump’s fondness for tariffs on foreign goods is well known, many other aspects of his agenda remain unclear, complicating investors’ ability to position their portfolios.

“Consensus is still lacking as to what Trump will do given how erratic and volatile his behaviour was last time,” said Yakeen Mirchandani, head of emerging market FX trading at Nomura. “People don’t want to put a lot of thought into predicting what he will do, and be wrong.”