Goldman is back but with Jane Street snapping at its heels

It’s been almost 25 years to the day since Wall Street’s most storied private partnership – Goldman Sachs – went public. Goldman arguably reached the peak of its powers 10 years later in 2009, when its trading division raked in a record US$23bn in fixed-income, currencies and commodities revenues. Now, after a decade of underwhelming performance, the investment bank looks to have returned to its former glory.

Goldman began to splutter after its 2009 heyday as the bank faced headwinds including US Dodd-Frank regulations, the Volcker rule banning proprietary trading, the 1MDB scandal and a failed diversification strategy into consumer lending. The negative press coverage reached fever pitch last year, with more gossip than the Kardashians leaking into the news pages.

The irony was that, behind the scenes, Goldman’s investment banking and trading businesses were motoring once again. Fast forward to today and the bank’s share price is now back hovering around its record high and market share trends are skyrocketing.

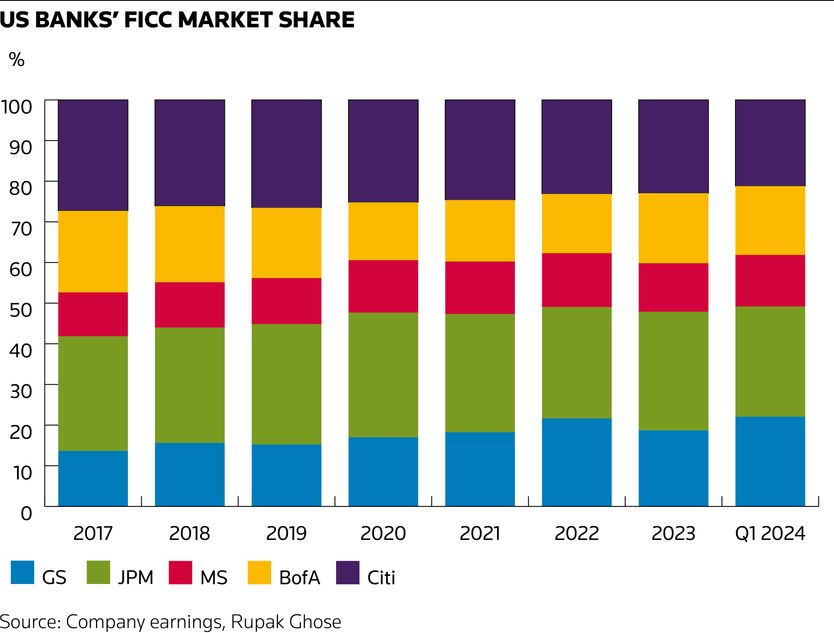

In the first quarter Goldman’s FICC revenues increased 10% on the year to US$4.32bn, a stark contrast to the average 7% decline among its four main US banking peers. Goldman was second only to JP Morgan in FICC revenues, with its market share as a proportion of this peer group rising 300bp to 22%.

Market share can ebb and flow from one year to the next. But Goldman’s FICC expansion from trough levels of just under 14% in 2017 is broad based. The commodities business has its swagger back and has proved its improved performance wasn’t purely a one-year, Covid-19-related pick-up. Traditionally stronger fixed-income franchises, like credit and US rates, have benefited from increased macro volatility too.

Closing the gap

Goldman’s FICC financing revenues grew 31% in the first quarter, underpinned by mortgages and structured lending. Five years ago, senior management told investors that it was underweight in FICC financing relative to its US peers and this was a major gap that it was planning to close. And it’s certainly done so. Goldman is now annualising at three times its 2017 and seven times its 2012 FICC financing revenues.

As for client mix, Goldman had suffered for many years because it doesn't have the regular corporate flow of commercial banks. But it has benefited lately as market activity has skewed back towards its favoured hedge fund client base. Executives say it is also increasing its presence with its largest investment management clients. Materially outperforming Morgan Stanley in FICC supports this, especially in the first quarter when Goldman’s commodities revenues did not grow, unlike those of its longtime rival.

Following a lengthy period of underperformance versus the three giant Wall Street commercial banks, Goldman has been outperforming even the mighty JP Morgan in recent years. A lot has been written about the recent turnaround at Bank of America, but this is small compared to the momentum at Goldman. The biggest laggard in the pack has been Citigroup’s FICC business, which has declined from a market share of between 26% and 27% in 2017–19 period to 21% today. In 2017, Citi’s FICC revenues were twice Goldman’s. Today, Goldman is bigger.

Goldman has also been outperforming in the equities business, growing revenues by 10% in the first quarter – double the average increase of its four US peers. And this was not just a story of continued expansion in prime brokerage; Goldman’s equities intermediation revenues increased 14%.

Medium-term market share trends in equities are strong albeit less stark than for FICC. Already being the market leader makes further gains more difficult. Nevertheless, equities market share as a proportion of the big five US banks has increased by 200bp since 2021.

A business mix tilted towards hedge funds clients and prime brokerage has also been a tailwind. But Goldman has still outperformed Morgan Stanley, which has a similar mix. The latter had been a big market share winner for many years, and in 2021 and 2022 was neck and neck with Goldman in terms of equities revenues. Contrast that with the first quarter, when Goldman’s equities revenues were 17% higher. This outperformance has been in both equities intermediation and financing, but more pronounced in the latter. Goldman’s equity financing revenues have increased by more than 30% in the last three years, while Morgan Stanley’s have been relatively static.

New competitors

Despite these successes Goldman can’t afford to be complacent as regulation and the growth of markets like ETFs are creating new competitors. Goldman traders must have looked on in envy at the news that Jane Street allegedly generated US$1bn from trading Indian options last year using a trading strategy that Jane Street and hedge fund Millennium Management are now fighting over in US courts. In a time long gone, Goldman traders were the masters of the universe when it came to generating outsized profits from these sorts of niche markets.

Jane Street’s reported US$4.4bn of first-quarter revenues represent year-on-year growth of more than 100% and make Goldman’s market share gains look pedestrian. The same could be said of the US$12bn of investment gains that hedge fund Citadel’s expanded commodities team is reported to have delivered in the past two years.

Goldman may have its mojo back in trading. But it’s increasingly looking like the real opportunities for growth in these markets are now coming from outside the banking system.

Rupak Ghose is a former financials research analyst