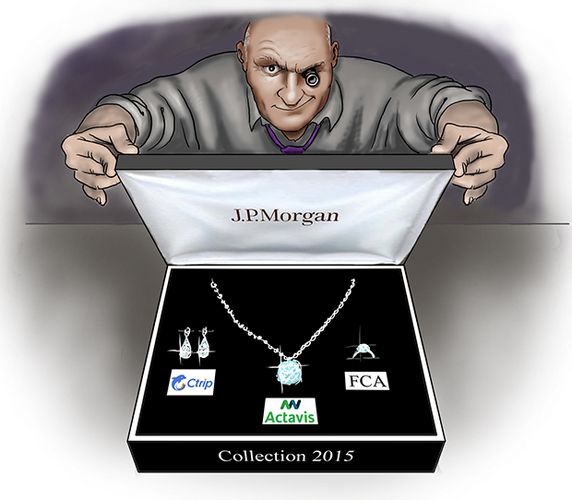

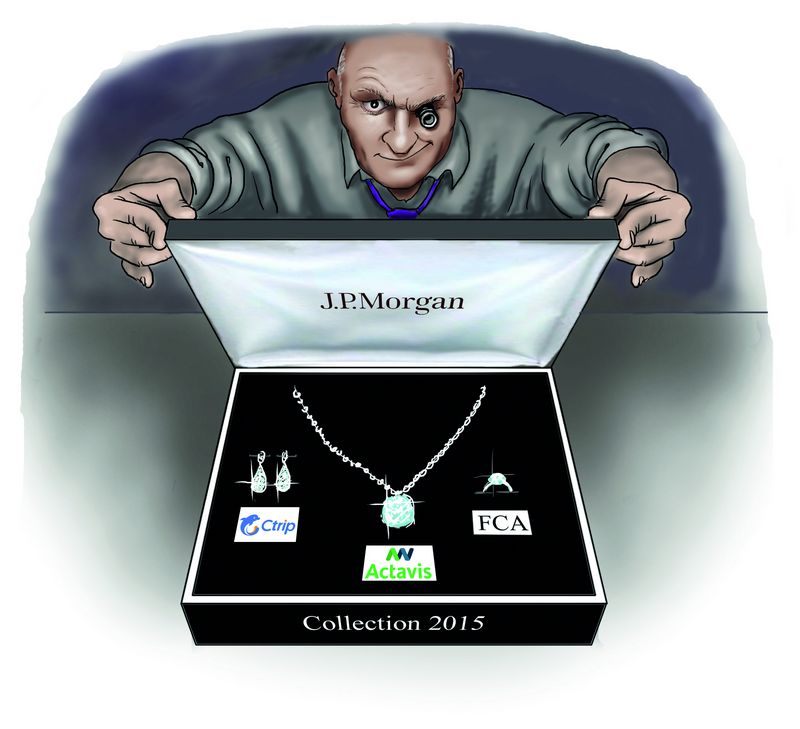

Each one a gem

Market conditions were ripe for a big year in structured equity, but issuance disappointed. Yet JP Morgan managed a leadership position in every region and led trophy deals with skill and panache. It is IFR’s Structured Equity House of the Year

The structured equity market flattered to deceive in 2015 with a clutch of genuinely interesting deals and remarkable valuations – but far too little fruit to be a quality vintage.

It wasn’t a disastrous year: dollar issuance of US$88.1bn was down 20% on the previous year, but still up versus 2012. However, the 276 deals priced is the lowest annual total since 2008 (when the preponderance of jumbos ensured volume was a lofty US$132.5bn).

While many equity-linked bankers have been left deflated by overall issuance, there have been some stand-out deals establishing new structures and pushing terms achievable for issuers to new levels. Nonetheless, the fall in the number of deals means most banks have failed to establish a strong presence across markets.

JP Morgan is the exception.

The US bank is a long-established leader in the asset class, having been a stalwart of the top three globally for the past decade. In the past three years, it has moved up from third, through second, to first in 2015. More importantly, however, JP Morgan is the only bank that is strong in every region, ranking first in the US, second in EMEA and third in the barely active Asia-Pacific market.

Key to success in the year was blending the easy trades, such as vanilla bonds to finance buybacks or mandatory bonds, with the more challenging – such as the remarkable 70% premium achieved on Telecom Italia’s convertible.

In its home market JP Morgan was miles ahead of its peers. The bank priced 44 issues, when only two other banks broke into the thirties. Its market share of 11.3% trounced the competition, with the second-placed bank claiming a share of 8.8%.

It was in the US that the bank led the centrepiece of its 2015 collection – the US$5.06bn mandatory convertible from Actavis that was part of a near-US$30bn fundraising through bonds and equity for the purchase of Botox-maker Allergan.

Notably the US$9.24bn equity and mandatory components came first, with the US$21bn debt deal being priced the following week. JP Morgan was lead-left for what is the largest dual-tranche follow-on offering and acquisition-related equity raise outside the financials sector.

Quality

Size was no hindrance to quality and having launched with equally sized tranches the equity portion was scaled back in order to pump up proceeds from the mandatory. The upsize was to capitalise on appetite that allowed for pricing at a coupon of 5.5%, better than the 5.75%–6.25% guidance, while still having a book three times covered.

Another gem among JP Morgan’s roster is Fiat Chrysler, a transaction that required the expertise of both its US and European operations. Again it was a combo trade with the mandatory portion larger than the stock sale. The carmaker raised US$2.875bn through the issue of unusually short dated two-year convertibles. Fiat Chrysler wanted to expand US representation on its shareholder register and so the bond was SEC registered.

Yet it is the convertible bond for Telecom Italia, done in conjunction with BNP Paribas, that stands out most among the deals won by the European team.

The €2bn CB was immediately significant as it was launched in late March with a fixed 70% premium. Adding to the challenge, issuance for the year to-date had only just topped €1bn, there had been no pre-sounding of the deal and it was launched on a Thursday evening in the midst of the Greek crisis. Plus, there had been no issuance for nearly a month.

The lack of pre-sounding was very deliberate. “It gives investors a chance to say ‘no’,” said one banker involved.

The premium was less scary upon closer inspection as the bonds included full adjustment for dividends over the seven-year life. Some bonds that followed achieved even more extraordinary terms, such as the 62.5% premium on Airbus CBs with adjustment only on an increase in dividends, but bankers agreed that what followed could only have happened thanks to Telecom Italia.

The 70% figure was enough to get treasurers and CFOs across Europe reconsidering converts.

Asia was something of a flop in 2015, with only Japanese banks able to register more than a handful of trades. So the sole bookrunner role on a US$1.1bn dual-tranche CB for Ctrip.com in June was all the more precious. The terms were punchy, with premiums of 45% on the five-years and 42.5% on the 10-years, versus a stock price up 65% since January 1. A call spread took the premium to a far loftier, though undisclosed, level.

Pickings were slim, but JP Morgan produced a deal roster of first-growth quality.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .

<object id="__symantecPKIClientMessenger" style="display: none;" data-install-updates-user-configuration="true" data-extension-version="0.4.0.129"></object>