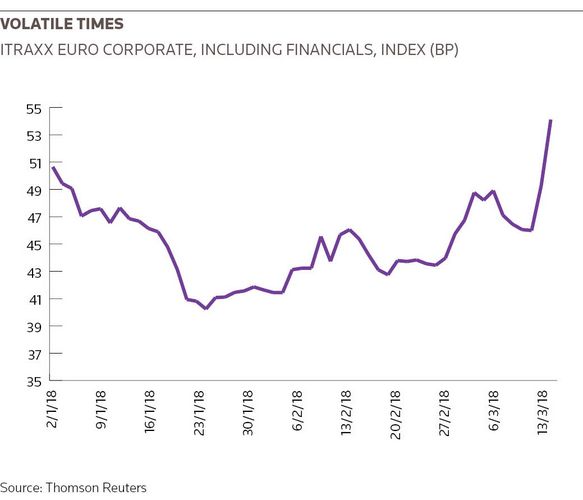

Credit markets on both sides of the Atlantic remain on shaky ground, even though issuance volumes over the past couple of weeks have picked up following the big spike in volatility in February.

Last week was not only the biggest of the year for corporates in Europe in terms of volume, it was also the second busiest week ever in the euro investment-grade corporate market, according to IFR data, while in the US deals continued to be churned out in the wake of CVS’s US$40bn offering on March 6.

But while the data suggests syndicate desks are busy and credit spreads are still relatively tight, the feeling in the trenches is less bullish.

“The market is at a cliff edge,” said one capital markets banker in London.

A syndicate banker said the past week was particularly tough but he had no answer as to why given that the main barometers, such as equity markets, rates and bond indices were all relatively stable.

“On screen things are fine but underneath there is zero investor conviction about what’s going on,” he said. “Therefore, trades are very unpredictable.”

More uncertainty for issuers and investors comes from the knowledge that the exceptional support that credit markets have received from central banks over the past few years is coming to an end.

“Last month’s widening may only be a ripple, but to us it marks the beginning of a transition to a new market paradigm,” wrote Hans Lorenzen, head of European IG credit strategy at Citigroup, in a recent research note.

In the primary markets, a dig deeper into some of last week’s deals reveals many failed to generate much momentum and underperformed once they were free to trade.

In the US high-grade market, most borrowers barely moved the needle on pricing during the bookbuilding process, while Campbell Soup, which issued a US$5.3bn seven-tranche trade, did not manage to do so at all.

The unusually high number of deals that went straight to the number at guidance included an offering from Fifth Third Bancorp (a banker involved added that Fifth Third had hoped to raise around US$1bn, but ended up with just US$650m). Even utility credits that are typically an easy sell - such as WGL Holdings and Idaho Power - could not get the traction needed to tighten pricing.

And with new issue concessions rising from virtually nothing to 9bp-10bp, syndicate officials came in for something of a rude awakening.

“People got spoiled over the past couple of years with how bullish the market was,” said one US syndicate banker. “This is not something we’re used to seeing.”

SLOW GOING

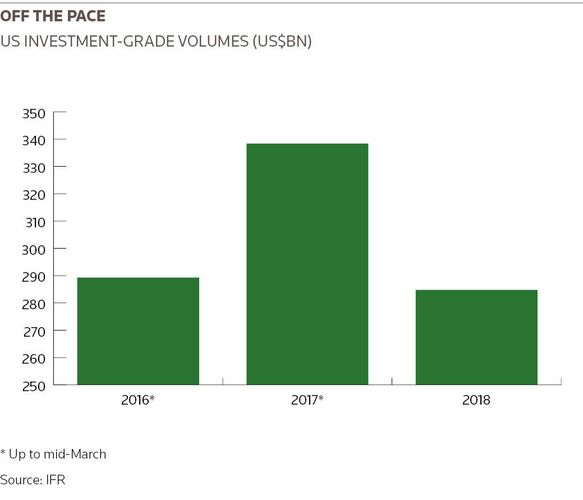

Issuance volumes in the US are running US$48.4bn behind last year’s pace of US$341.3bn as a result of factors such as cash repatriation and rate hikes.

But instead of spreads tightening, as might be expected as volumes fall, they have widened as investors push back, partly because of valuations and partly because of technical reasons, such as less foreign demand due to higher hedging costs.

Many had thought that investors were keeping their powder dry for the much-anticipated multi-tranche M&A bond from pharmacy chain CVS to finance its acquisition of healthcare insurer Aetna.

But while that trade attracted an eye-watering US$114.6bn of demand - the largest order book ever in the US investment-grade market - it has not translated into success for others.

“Many of us thought that the performance of CVS meant we might have had a little more leverage when trying to bring these other deals,” one banker close to the trade said.

INVESTORS EMBOLDENED

CVS paid as much as 18bp in concessions and its curve was already trading cheap in anticipation of the deal. But rather than clearing the way for other borrowers, CVS may instead have emboldened investors.

So while Campbell Soup did offer hefty concessions over fair value of between 12bp and 19bp for its trade, it had started its pricing strategy at aggressive levels compared with CVS and investors proved willing to fight back as a result.

Campbell, which issued the bonds to finance its acquisition of salty snacks company Snyder’s-Lance, was unable to tighten pricing from initial price thoughts on any of its seven tranches, and the 30-year actually came at the wide end of the initial range. The bonds then widened when freed to trade.

“As volatility has ticked up, there is more focus on how tight spreads are and the prospects for returns,” said Kathleen Gaffney, director of diversified fixed income at fund manager Eaton Vance.

INVESTOR DIFFERENTIATION

In Europe, conditions are not as tough as in the US but some bankers think it’s just a matter of time as investors become more selective.

“We’ve seen some differentiation being done by accounts wanting to participate, especially when it feels like there’s a reasonable amount of supply on offer,” said one banker covering the corporate market.

The biggest beneficiary last week was Sanofi, which raised €8bn - €3bn more than it originally indicated - with the book peaking at €21bn. Sanofi will use proceeds to fund its purchases of Bioverativ and Ablynx and investors liked the rarity value of an M&A bond financing, as such deals have been scarce this year.

But there were also plenty of deals that were unexceptional. On Thursday, UK information company Relx Finance announced a €600m no-grow long nine-year bond at 60bp area over midswaps but only managed to raise €500m with pricing flat to initial levels. The deal came on a busy day in the corporate market, with other deals also struggling to generate big books, and in a busy week overall that saw nearly €21bn of issuance, only a €1bn short of the weekly record set in March 2016 (see Bonds section for more).

There were signs of indigestion in the financials sector too. In senior, Intesa Sanpaolo’s €1.25bn 10-year was bid more than 5bp wider than its 77bp reoffer level on Tuesday, a day after pricing, according to Tradeweb, while bonds from BNP Paribas and BPCE were around 1bp wider.

“A lot of deals came on Monday morning, which was unusual but shows that dealers are nervous about supply,” said a senior syndicate official. “I think the market will struggle to absorb much as we get to quarter-end. Even higher NIPs are failing to get deals cleared easily.”

Even the staid covered bond market is seeing the odd dud. A €500m 10-year issue from Germany’s WL Bank failed to move from IPTs of mid-swaps less 13bp area.

“The fact that we haven’t published a book speaks for itself. If we had something more encouraging to say, we would have done, but we haven’t,” said a lead banker of the WL Bank deal.

One banker said the primary market in Europe will continue to bumble along simply because investors have few alternatives, even though many markets are in negative territory this year.

“If you don’t continue to buy you’re going to get cash balances building, which there’s no point sitting on. There’s an element of Dead Man’s investing,” he said.

(Additional reporting by Helene Durand)