Reclaiming its crown in a challenging year of ongoing negative rates and ever-more draconian regulations, one bank held its head high, providing innovative solutions and maintaining its lead in the face of stiff competition. Credit Suisse is IFR’s Swiss Franc Bond House of the Year.

Credit Suisse truly dominated the Swiss franc bond market in 2014, with more than half of all deals led or joint-led by the firm. Out of 323 deals and taps during the year, Credit Suisse was present in 176, a 54.5% hit rate.

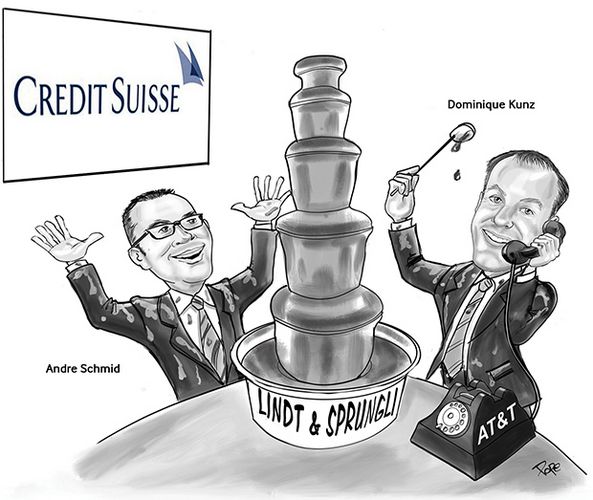

It was a year when the low rate environment, coupled with the return of a modicum of optimism, led to some M&A in the Swiss market – most notably from insurer Helvetia and confectioner Lindt & Spruengli – giving issuance a boost.

Helvetia bought rival insurer Swiss National, while Lindt purchased US Russell Stover Candies. Both refinanced large bridge loans through the bond markets, raising SFr1bn each via multi-tranche deals.

Those two deals, along with a SFr500m (US$519m) 1.25% six-year deal for Glencore, were important not just for Credit Suisse, but also for the Swiss bond market itself.

“Lindt, Helvetia, AT&T and Glencore were all huge for the Swiss market and cemented its position as a real world player, with sizes nearing what can be achieved in the much larger dollar or euro markets,” said Dominique Kunz, managing director of capital markets at Credit Suisse in Zurich.

One truly original feature pioneered by Credit Suisse – originally for BP’s SFr300m seven-year in late September, and then almost immediately copied by others – was a short settlement date. The four-day settlement, down from the usual two to four weeks, was wanted by the oil giant to avoid event risk between pricing and settlement.

There were also larger trades from BP, Deutsche Bahn and Philip Morris, with Credit Suisse in lead or joint lead positions.

Despite the headwind of an unsympathetic basis swap, which would put many high-grade international issuers in negative yield territory throughout the year, Credit Suisse managed to take advantage of brief windows of opportunity to bring well-rated names into the Swiss market.

Of special note was Dutch energy agency EBN, whose small funding needs mean it can only issue in Swiss francs. Other SSA deals present on the Credit Suisse roster were reappearances from Land NRW and Niederoesterreich after more than three and four years respectively.

Perhaps the most innovative deal of the year came in early January with the EIB’s Climate bond, the first Green bond to be marketed in Swiss francs. It was led by Credit Suisse, along with Barclays and Deutsche Bank.

Pricing of the trade was in line with other EIB paper, but the size of SFr350m was almost double what would have been achieved with a conventional bond, as SRI investors piled in.

Some of those investors were again seen in a SFr250m four-year deal from Peruvian social housing provider Fondo Mivivienda, which was sole-led by Credit Suisse. The bonds were not specifically targeted at SRI buyers, but were seen as socially responsible enough to fit many of the portfolios. It was also the first Peruvian name in the Swiss market.

Credit Suisse brought many other new EM names to the currency, including Brazilian and African banks, a debut Kazakhstan trade from KTZ, and a debut Chinese name with ICBC. Despite adverse global conditions for the country, there were also Tier 2 deals from Russia’s Gazprombank and VTB.

As ever, Credit Suisse remained strong in the domestic sphere, with many corporates and public sector entities under its belt. The bank nudged just ahead of the competition in this area, taking the number one slot with 60 deals, totalling just shy of SFr9bn, a 28.4% market share.

Larger domestic corporate highlights included OC Oerlikon, Nant de Drance, Syngenta and SPS.

With SFr19.7bn in total over 135 issues, out of a total of 225 issues (with taps and increases rolled into the original deal, and discounting self-led deals), Credit Suisse was involved in 60% of all countable deals done in the year and can boast a 33% market share.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.