There remains persistent uncertainty on the SNB’s FX policy stance since it abandoned the euro/franc floor on Jan 15.

Swiss press reports over the weekend suggest that the SNB is operating with an unofficial minimum FX rate with talk of a euro/franc corridor of €1.05-€1.10. We still think that it is likely the SNB has adopted and is testing a Singapore style FX policy of a basket, band and crawl (BBC) mechanism for the franc.

It does not make sense for the SNB to have dropped the €1.20 floor and now adopt a corridor of €1.05-€1.10 as this is akin to adopting a new floor at €1.05. Given safe haven flows, the upper end of any corridor is irrelevant and when coupled with the SNB thinking that the costs of a floor outweigh the benefits it does not make sense that it now effectively adopts a new lower floor.

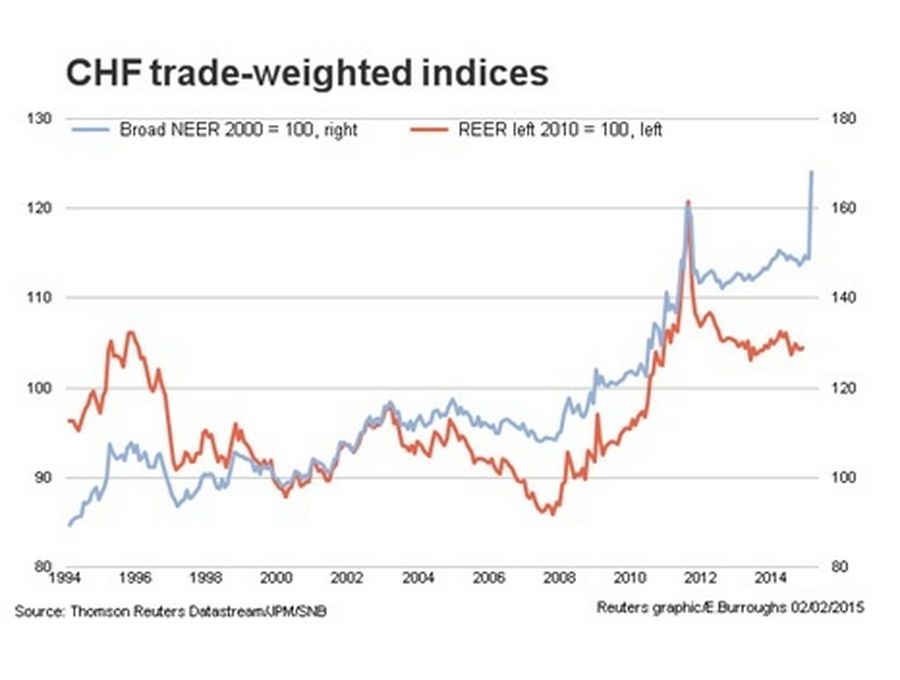

If there is a desired range on euro/franc then this should be looked at in the context of how this, as well as a range on dollar/franc, will allow the SNB to manage the franc’s NEER (nominal effective exchange rate) within an undisclosed target band.

We believe FX intervention has not only happened on euro/franc but also on dollar/franc so as to align both to its new NEER target. The focus beyond euro/franc helps to explain why the SNB described movements of the franc versus the euro and the dollar in its statement on Jan 15 when the floor was abandoned.

We repeat that the advantage of a BBC mechanism for the SNB is that:

1) unlike a euro/franc floor the band would minimise the need for constant FX intervention

2) the band could be set to give maximum flexibility and allow short term fluctuations and

3) the crawl feature would allow the exchange rate to adjust to changing fundamentals.