Investors are casting a sceptical but fresh eye over Brazilian oil company Petrobras amid hopes a new CEO can finally steer the debt-laden credit towards a more sustainable business model.

A recovery in oil prices, some success in shedding non-core assets and proven access to market funding have all helped improve risk perceptions surrounding beleaguered state-owned entity Petrobras.

The company still has a long row to hoe as it struggles to deleverage amid softer crude oil prices and contends with a corruption scandal that has tainted its reputation worldwide and limited its funding options.

But investors are seeing some light at the end of the tunnel after a market-friendly administration replaced unpopular President Dilma Rousseff in May.

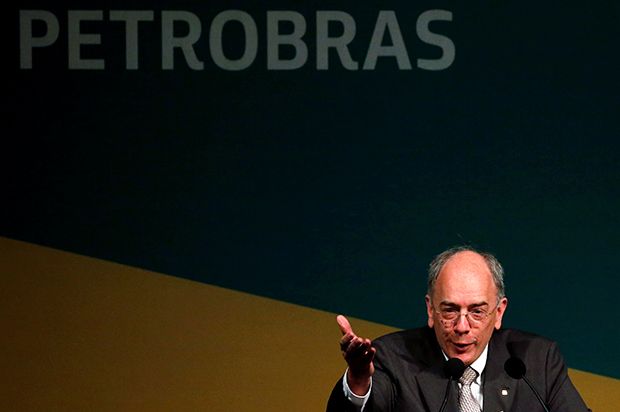

And while acting president Michel Temer has problems of his own as he attends to corruption allegations within his own party, he is expected to give Petrobras freer rein after appointing Pedro Parente as the new CEO.

As a former executive at agribusiness giant Bunge’s Brazil unit and chief of staff during the presidency of Fernando Henrique Cardoso, Parente has a wealth of experience in both government and the private sector. And investors hope he is the man to finally mend the company’s finances.

“We are seeing the first of multi-step process that is putting the company back on the path to being run like a private entity rather than an extension of the Brazilian government,” Darin Batchman, a portfolio manager at Stone Harbor Investments, told IFR.

Part of that process is regaining access to capital market funding, which the company did for the first time in close to a year in May 2016, when it raised a US$6.75bn through dual-tranche offer to fund a tender for short-term debt.

The deal marked the first corporate bond sale of the year out of Brazil as Petrobras sought to take advantage of market optimism that a new business-friendly government could pull Latin America’s largest economy out of its worst slump in decades.

The company timed the issuance of five and 10-year bonds well, coming just days after Congress agreed to start impeachment proceedings against now-suspended Rousseff.

Important step

Yet while some US$21bn in demand underscored the changing sentiment toward Brazilian risk and allowed leads to upsize the deal to US$6.75bn from US$3bn, poor secondary performance tainted the trade amid complaints of full allocations on the tightly priced longer dated tranche.

The new US$1.75bn 8.75% 2026 sank several points on the break after pricing at 98.374, only to recover by early June to trade at 98.375–98.875. The larger US$5bn 8.375% 2021 has proven to be the clear outperformer after pricing at 99.002. It first slumped to the mid-97s but had jumped up to 102.75–103.25 by June.

While some questioned the logic of retiring short-term debt using five-year money that cost over 8%, the deal marked an important step for Petrobras.

It assuaged concerns about the fate of Petrobras, now considered the world’s most indebted company, and how it would tackle a wall of short-term maturities as funding sources narrowed in the wake of a widening corruption investigation.

“Their choice to take a market-friendly approach in dealing with their near-term maturities is a significant positive, as they could have chosen to be much more aggressive with their creditors,” said Jason Trujillo, a senior analyst at Invesco.

With this transaction, the company cut 2017 refinancing needs to US$6.1bn from US$10.8bn in one fell swoop, according to JP Morgan .

“We expect continued normalisation of the Petrobras bond curve following the recent debt issuance and tender,” Trujillo said. “From a fundamental basis, while the company still faces many challenges, we think they are moving incrementally in the right direction.”

Yet while the liability trade makes a substantial dent in upcoming amortisations, more such exercises are likely. Aside from the remaining US$6.1bn for 2017, the company also faces some US$14bn of maturities in 2018 and another US$20bn or so in 2019.

“They are kicking the can down the road,” said Sarah Leshner Carvalho, a director of research at Barclays. “I don’t think any sort of transaction such as this one is enough to completely alter its credit profile.”

Talk of possible equity issuance has also been making the rounds, but some analysts think management will focus its efforts on raising funding through asset sales rather than through what would have to be a massively dilutive stock issue.

“The market has done its part by supporting the liability management exercise and the ball is in the company’s court to deliver on the asset sales,” said Batchman.

Asset sales have been gaining momentum, though analysts think Petrobras is likely to fall short of its approximately US$14bn target for the year.

The company announced it June that it would begin selling its LNG terminals in Rio de Janeiro and Ceara, along with thermoelectric power plants. This follows successful sales of assets in Chile and Argentina, and reports that Brookfield might buy its gas pipeline assets for US$5bn.

Reports that the energy ministry will support plans to allow Petrobras to set domestic fuel prices were also good news. Price controls under the Rousseff administration damaged Petrobras’ bottom line as the government tried to keep a lid on inflation.

And with Brent breaching US$50 a barrel in June, the future looks a tad rosier for a company that ultimately depends on the price of crude oil. Against that backdrop, investors see value in Petrobras’ bond spreads, which still look cheap against peers.

“We are not going to wake up tomorrow and see the company going to two times levered,” said Leshner. “But at 300bp over the sovereign, it is among the most attractive quasi sovereign globally.”

To see the digital version of this special report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com