“The greatest manager of any sales and trading organisation in the world … like Bono joining your rock band.”

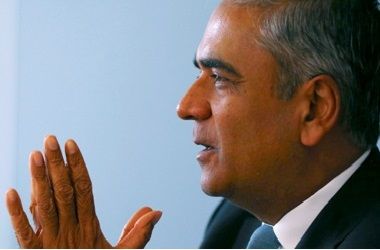

That was how Cantor Fitzgerald chairman and CEO Howard Lutnick gushingly described his close friend Anshu Jain joining his racy broker-cum-investment bank as president. I’m sure Jain never imagined that sort of comparison but I’m equally sure he loved it.

It’s an intriguing appointment by any stretch and one that no-one could ever easily have predicted. On a personal level, as much as Jain and Lutnick might be friends, putting two testosterone-fuelled larger-than-life control-oriented alpha males together in one room, even if nominally as partners, is likely to be a fascinating spectacle.

It has a touch of the gladiatorial combat about it to the extent that if you were to read one day in the tabloids that one had done away with the other in a bid for ultimate supremacy there’d be a touch of ‘I told you so’ about it. Then again, Lutnick talks of the two of them having fun developing a new way of doing business. This, he also says, is no succession-driven appointment.

It’s still a bit ‘Back to the Future’, though. It’s almost as if in hiring Jain, Lutnick is seeking to rebuild the aggressive sales and trading-driven investment banks of yesteryear. He speaks not of competing with the investment banks but of banks being overloaded by capital and regulatory burdens that undermine their ability to extend risk to clients. That almost sounds dangerous but the opportunity to take up the baton that the banks have been forced to drop sounds like a challenge he relishes.

Having said Jain’s move was hard to predict, what was less hard to predict was that he would end up in the shadow banking arena. You just couldn’t see him sticking it in the banking industry; not just because of the lack of CEO vacancies but because the way the industry is regulated and supervised just isn’t for people with the backgrounds and inclinations of people like Jain; those with maverick reputations.

Cantor and its various offshoots have an aggressive business orientation that will appeal to Jain’s animal instincts. By the same token, this is no minnow: the group employs over 10,000 people across financial services (rates, FX, credit, energy/commodities, equities, capital markets and investment banking) and real estate. That’s bigger than Deutsche Bank’s corporate banking and securities division.

In Q3 2016, subsidiary BGC posted revenues of US$643.5m and made pre-tax profits of US$107m. Beyond the numbers, Cantor has been serially acquisitive, buying London insurance broker Besso Insurance this week, following 2016 takeovers of London equity derivatives broker Sunrise Brokers, Continental Realty in the US, Micromega Securities in South Africa and Perimeter Markets in Canada.

“Anshu has a proven track record as a pioneer and builder of leading global businesses. We expect to leverage Anshu’s global outlook, unrivalled experience, and deep network to further grow our firm”, the press release announcing the hire said.

Jain spoke of setting course for the next era of the firm’s growth. Sounds like the two have hatched a plan. I wonder if it involves putting the legendary Deutsche Bank band back together. This is one worth watching.