Divyang Shah

IFR Senior Strategist

Central banks that have flirted with negative interest rates during the crisis have seen little in the way of positive effects. With the benefits unclear and the risk of unintended consequences, it is likely that any further easing from the ECB will take the form of a 25bp reduction in the refi rate from 0.50%, rather than a cut in the depo rate below zero.

Negative rates only beneficial if you target FX

Sweden and Denmark are two countries that flirted with negative rates during the crisis the former in July 2009, the latter three years later in July 2012. While the Riksbank was quick to reverse the experiment as the benefits were far from observable, the Nationalbank had more success, largely due to the impact that negative rates had on demand for DKK.

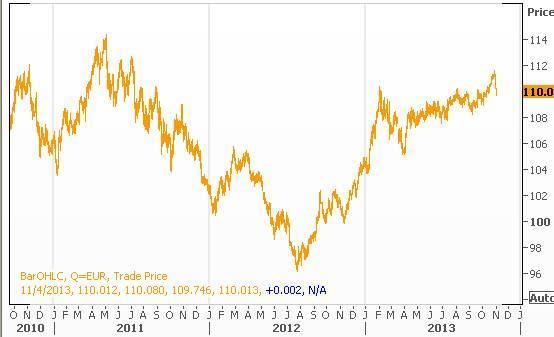

In fact, the benefits of going negative on the deposit rate are only really visible for a country looking to make its currency less attractive. For the ECB, the impact of the strong EUR on the inflation outlook is of concern, but the EUR itself is not really a target. In a world where the Fed, BoJ and BoE have all adopted aggressive balance sheet expansion policies, the EUR would have been a lot stronger had it not been for the eurozone crisis. With the crisis now off the boil and foreign investors making a comeback, the current pullback on the EUR could prove to be short lived.

The costs and unintended consequences

The added disadvantage of negative deposit rates is the unintended consequences it could have on:

1) money market funds, especially those looking to exit/shrink their presence, and

2) money market liquidity, due not only to MM funds but also from reduced incentives to repo.

Deposits parked at the ECB have come down to around €55bn, so this should be manageable for banks, but might increase the incentive to participate in the weekly fixed term deposit tender. Ahead of the stress tests/AQR it is best not to take risks with the interbank funding market, especially as there are early signs of healing/reduced fragmentation.

EONIA curve priced for cut, time to deliver

The deposit rate has acted as a floor for money market rates and has become much more important than the refi rate. With the deposit rate likely to stay at zero, a cut in the refi rate has the advantage of:

1) supporting the ECB’s forward guidance, and

2) cementing the flattening seen on the EONIA forward curve.

A failure of the ECB to confirm market expectations risks reversing the favourable market movements on both EONIA and the EUR. Unless the ECB is willing to deliver a further LTRO, we don’t think it likely that the EUR weakness will gain momentum on the back of lower interest rates.