A surging labour market has helped to overturn the bleak outlook for Germany’s economy that is now fuelling hopes of a new era of eurozone growth.

Spirit of the age, or Zeitgeist, a German word that has entered the universal lexicon – is first recorded as being published in a bizarre novel of 1840, Sartor Resartus. This parody by the Scottish social commentator Thomas Carlyle takes the form of a lengthy book review by a cantankerous editor flummoxed by a German title he is required to read.

It forces the reader to confront the problem of where “truth” is to be found – a question that could equally apply to a sudden change in Germany’s economic fortunes and whether this is likely to form a sustainable basis for a new, post-crisis European Zeitgeist.

Stalling euro area growth had bleakened the outlook for Germany as 2014 drew to a close. Deflation in Europe was on everyone’s lips and confidence indicators were heading south. In December, the Bundesbank duly halved its forecast for 2015, saying the German economy would deliver growth of just 1% this year after losing “considerable momentum”.

In January, however, the economics ministry increased its forecast to 1.5% and then in April the bar was lifted even higher when German research centres, led by the Ifo Institute, predicted Europe’s top economy would expand by 2.1% – nearly double previous estimates.

The change in prospects is as dramatic as it has been swift – and has had analysts rushing to ascertain the “truth” behind the sharp shift in sentiment.

“Cyclically, all the dials right now are on full power in Germany. It’s a wonderful story and it’s a story that has materialised in the asset markets with absolutely crazy pricing. It’s almost as if the German asset markets, the German economy, are in this sort of a bubble, where if things are bad, asset prices go up, and if things are good, asset prices go up, and I don’t see why that will change any time soon,” said Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics.

Perfect storm

The key to this recovery lies in Germany’s domestic economy, which is benefiting from a perfect storm of positive factors. The slide in oil prices has undoubtedly stimulated Europe’s largest economy, leading to lower than forecast inflation – this edged up marginally in April to 0.4% – thereby boosting real wages and consumer sentiment. Strong euro depreciation against the dollar is a second tailwind, as is the ECB’s quantitative easing.

Most analysts characterise what is happening as a long-awaited cyclical upturn propelled by a fortuitous convergence of positives. The clear expectation is that Germany’s rebound will, in turn, fuel a eurozone recovery stabilising with growth most analysts put at 1.2%–1.3%.

Anatoli Annenkov, senior euro economist at Societe Generale Corporate & Investment Banking, said: “We’ve been a little bit below consensus for many years on Europe and that also included Germany, but even in our forecasts, until 2019, we now are seeing a very strong push, which is cyclical. There are a lot of factors: there’s the oil price, primarily, the exchange rates, QE, there’s no fiscal austerity this year basically for Europe as a whole – so somehow the stars have all lined up for a very strong cyclical push.”

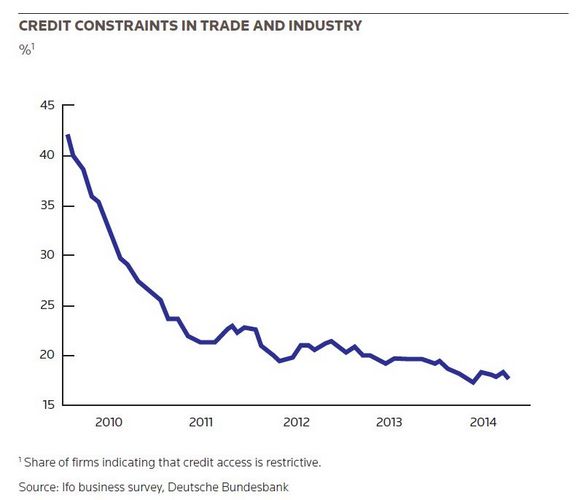

Financing conditions seem to be peripheral to Germany’s turnaround and there has been no credit crunch, although low interest rates are discouraging investment as corporations take a wait-and-see approach to decisions.

German bond yields have registered big declines, reflecting their status as a potential safe haven and fuelling expectations of shortages of German debt for the ECB to buy under its QE programme, although there has been considerable volatility. A big selloff of 10-year German debt in early May again pushed yields up before the market again calmed.

The deeper explanation for the rebound seems to lie in Germany’s booming labour market: employment is at a record high, unemployment is falling, and wage growth is strong.

Annenkov believes the labour market was already vigorous well before oil prices fell, and there is clear evidence of a structural shift in favour of falling unemployment, now at its lowest level since reunification.

Reuters end of Q1 data from Germany’s Labour Office showed the number of people out of work had fallen to 2.798m (6.4%), and in April, German research institutes predicted this would decline further next year to 5.9%.

Stefan Schneider, chief German economist at Deutsche Bank, said: “The German economy is slowly moving towards full capacity, so companies are still looking to hire. Without the strong immigration we have seen in the last two years there probably would have already been severe bottlenecks but in the last two years we had net immigration of around 400,000 people; 300,000 of those moved directly to the labour market.”

Annenkov points to wage growth at a time of falling inflation, and hence the rise in real incomes, as a key factor in Germany’s rebound. Trade unions are in a good position to reverse a long-term decline in the wage share – in February the giant IG Metall union won a pay settlement of 3.4%.

Concerns have been voiced, nonetheless, about the potential distortions caused by the introduction of a minimum wage at the start of this year as well as new pension rules.

The positive labour market factors are bucking wider European trends and explain why consumer confidence in Germany has remained robust. According to market research group GfK, consumer sentiment reached a 13-year high in February. In January the economics ministry forecast household spending would grow by 1.6% compared with 1.1% last year.

Conditions for a pick-up

Vistesen at Pantheon said: “It’s very interesting to note that even though the eurozone economy as a whole has seen significant volatility since 2012 and has been stuck in more or less permanent low growth, the unemployment rate in Germany has continued to go down and vacancies have risen.

“The labour market is very strong, which has obviously fed into consumer confidence. If you add wage growth, low oil prices and on top of that record low interest rates and the fact that financial conditions have eased significantly – you just get the perfect conditions for a consumption pick-up.”

Confidence underlines why – unlike past recoveries – Germany’s rebound is a domestic affair representing something of a departure for a country that usually exports itself out of trouble.

“We basically see this kind of a shift where Germany traditionally has been very much dependent on net exports contributing to growth, and over our forecasts we have basically no contribution from net exports and all, with growth instead coming from domestic demand and especially consumption. We are used to a German recovery led by exports, investment coming on the back of that and then, lastly, consumption; now we are seeing completely the opposite,” said Annenkov at Societe Generale.

Schneider at Deutsche Bank said, more importantly, that Germany is experiencing the right kind of domestic consumption that poses no risk of overheating.

“Consumption is the mainstay of growth this year, no doubt about it – but it’s not a classical consumption boom. German consumers are not on a kind of credit finance shopping binge. If you look at consumer confidence, remember that interest rates are low, consumer credit is still shrinking and even mortgage loans are just growing by around 3% – that just shows you that consumers are being very careful, and similarly the corporate sector is being very cautious in terms of investing,” said Schneider.

Export conditions remain strained due to continuing weakness in the eurozone and sluggish global trade, but are improving thanks to the weak euro.

“We have additional windfall profits through the fall in the euro exchange rate and we have seen already in business surveys that export expectations among German corporates have improved somewhat. This is really mainly a reflection of the exchange rate and not so much driven by a much better external environment with regards to global trade; so our expectation for global trade is still very much subdued,” said Stefan Schilbe, chief economist at HSBC Germany.

The gloomier trade picture – symbolically illustrated by the impact of the Ukraine crisis on German exporters – therefore makes the consumption boom particularly timely.

But even if the consensus is that the locus of growth is the domestic sector, Vistesen at Pantheon said the export story was worth watching.

“It’s spectacular what’s going on in Germany at the moment because normally we don’t see cyclical upturns in Germany without it being driven by exports and manufacturing; what we have seen this time around is that the consumer has driven the cyclical upturn and now we are starting to see signs of manufacturing and exports picking up,” he said.

Judgment reserved

A key question now is whether Germany’s good fortune will last – and hence engineer a wider European resurgence – with most analysts reserving judgment. Vistesen said he did not expect the consumer to continue fuelling recovery indefinitely, not least because of the country’s ageing demographic.

Annenkov at Societe Generale points to a longer-term spanner in the works – the divergence between real wages and productivity that erodes competitiveness and, in turn, highlights the need for more investment.

Schilbe at HSBC agrees, saying: “The German recovery has really been mainly driven by private consumption and not by exports, so this means for a really sustainable upswing we need more investment. We are optimistic that the circumstances for private consumption will remain solid. What’s still missing in this puzzle is business fixed investment. There is also the potential for a government-led infrastructure programme, which could be easily financed at these historically low interest rate levels.”

Lack of investment could hold back productivity growth in the longer term, with demographic trends reinforcing the need to invest more in capital goods.

Annenkov said: “We take a very positive view on Germany this year and probably into next year, but beyond that we still are concerned that potential growth is not that high and should come down to below 1.5%. In the medium term, the key factor really is the demographic story, where there will be people leaving the labour market – the OECD estimates around 200,000 a year from 2016 and onwards – which is going to be a significant headwind for the German economy.”

At the same time, broader problems in the eurozone are not going away – not least the considerable divergence under way between Germany and other economies – which suggest that it is probably premature to be talking of a new European Zeitgeist.

Vistesen at Pantheon said: “It is too soon to say Germany is back to a permanent growth trajectory after last year. The underlying story is that the economy is doing very well, it’s benefiting hugely from QE, it still has a big current account surplus, and so far the cyclical story has been the consumer – we are seeing record-breaking consumption data that is not something we usually see in Germany, which is also why I am a little bit sceptical that it is going to continue.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com