It has been a long road back for RBS’s investment banking unit from the day that the British government stepped in to prop up the bank with a £20bn cash injection. The story of its partial recovery involves two separate restructurings, the slashing of £700bn from its assets, a surprising (and temporary) surge in profits and a series of ruthless decisions.

Alistair Darling had little idea of exactly what he was buying when he signed off on a £20bn state rescue of the Royal Bank of Scotland just after 6am on October 13 2008. The collapse of Lehman Brothers four weeks before – the biggest bankruptcy in history – had sent markets into a tailspin, halting interbank lending. Days earlier, RBS chairman Tom McKillop had called Darling to warn that the bank was hours from collapse, precipitating the decision to take the world’s largest bank into public ownership.

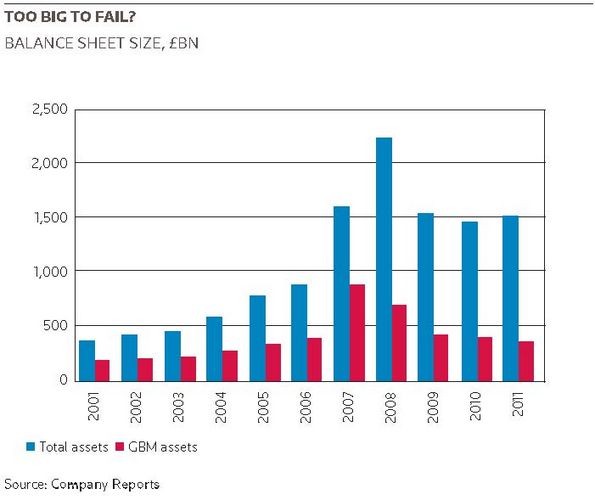

Events had progressed so quickly that neither Darling nor anyone within the UK government had had a chance to look at the bank’s books. RBS was sitting on £2.2trn of assets, then equal to the annual GDP of the UK and Spain combined, but nobody knew how bad those books were. The bank’s chief executive Fred Goodwin, then a knight of the realm, had grown so suspicious of RBS’s own accounts that he had asked one of his lieutenants to fly in for a second opinion just a few weeks before.

“What we were bothered about was the general condition of British banks, many of which had the look of death about them,” said Darling, then Chancellor of the Exchequer. “They just didn’t have enough capital. We were drawing up plans, but we couldn’t share details with banks. We couldn’t do due diligence because of the lack of time.”

It was months before the dire state of RBS’s finances would become clear. The bank was in a far worse position than had been imagined; it was stuffed with worthless junk. Darling later learned the bank owned a golf course in Florida that was 70 miles from the nearest road and a cemetery in the US Deep South. What began was a long process that is still ongoing to clean up the books, return to profit and pave the way for the government selling its stake.

Goodwin had agreed to go as a price for the rescue. But McKillop and Johnny Cameron, who was head of the global banking and markets division, insisted on holding on to their jobs for a few more months. Eventually, the two backed down. Stephen Hester, an investment banker by trade and former boss of British Land, took the CEO role, while Philip Hampton became chairman. John Hourican, the man asked by Goodwin to re-examine the books, took the helm at GBM.

The bank was still haemorrhaging money, not least in GBM. Emergency liquidity from central banks had helped stabilise things, but many of RBS’s assets were plunging in value by the day. “The turnaround strategy was to salvage whatever it could from the ruins – to save whatever could be saved initially,” said Darling, who said he never considered closing down GBM. “It was all about crisis management. It was never a case of splitting out the retail bank and running down the investment bank.”

“We all had an on-the-beaches attitude at the time,” said Hourican, who until Goodwin called him back had been working in Amsterdam unpicking RBS’s joint acquisition of ABN AMRO in what then was the biggest bank takeover in history. “The problems we were discovering were large and continuous. Every day, we would see the value of the assets we were sitting on move significantly – and usually down. A lot of the stuff on the balance sheet was becoming rapidly illiquid and very difficult to value.”

What started were many months of shrinking the books, a task which soon fell on Peter Nielsen, the former head of rates who was quickly placed in charge of the markets business, which generated the lion’s share of GBM revenues. “In those early days, every single day was spent trying to get the books down, making sure the books were smaller at the close of business than they had been at the beginning of the day,” he said. “It was a very difficult period. A lot of the systems we relied on had helped bring down the bank. It was like flying in the dark with no instruments.”

GBM domination

Under the stewardship of Cameron, GBM had grown to dominate the bank. In the last two full years before the bailout it had contributed about a third of RBS’s total revenues. It also commanded about half of the balance sheet, mostly funded by short-term debt. Hourican was tasked with shrinking the business massively, and brought in McKinsey to help him figure out what to do.

“We needed to determine what we should be, what risk appetite we should have, and spent two to three hours every day taking apart and analysing the strategy, thinking about whether the same markets would even exist a few months down the line,” said Hourican, who took the difficult decision of closing down the leveraged finance team he had formerly run because he saw little future for the asset class – at least at RBS. “When in doubt, we would close down the business,” he said.

By February, when RBS unveiled a £24bn loss for 2008 – the biggest in UK corporate history – the new strategy was ready. GBM saw the biggest overhaul, with many of its pre-crisis businesses such as proprietary trading, real estate lending, asset management and project finance shut down. The business would cut its risk-weighted assets by 45% to £150bn and concentrate on what it was good at. The idea was that the slimmed-back unit would generate “steady and significant profits”, Hester told investors.

A major piece in the strategy was the decision to park assets with a face value of £385bn – about one in six of all the assets the bank owned – into a non-core division, to be run off or sold over time. The assets came from businesses in which the bank no longer saw a future, and many of them were worth significantly less than what they had been bought for. Of the £385bn, some £350bn came from GBM alone, indicative of the mess Cameron had made. The idea was that Hourican and others could concentrate on turning around what they had left, without distractions.

The non-core unit was born of compromise. Some at the firm had been pushing for a so-called bad bank, which would have definitively split off the ropey assets in a separately-run, separately-capitalised entity. They were concerned that by keeping the old assets on RBS’s balance sheet, the ongoing operations would continue to be tainted. They had a point – over the next three full years, the non-core assets would generate almost £25bn in losses for the group. But Darling vetoed the plan. “We did look at the possibility of creating a bad bank completely separate from RBS, but we concluded that the costs would just be too large for the taxpayer, who would be left with any losses,” said Darling.

Insurance package

What the government did agree to, however, was an insurance package for RBS that would essentially put a cap on its losses and boost its capital ratios to meet minimum standards. RBS’s participation in the Asset Protection Scheme was agreed in February 2009, initially slated to provide protection for £325bn of assets – both core and non-core. Darling was happy: the assets would remain with RBS, and there was a good chance the scheme would not have to pay out if the economy turned around.

But it was a big gamble. And details needed to be hammered out, a process that took much of the year. RBS was not happy about the £6.5bn fee the government wanted to charge, or the Treasury’s insistence that it gives up some tax relief. Lloyds initially signed up too, but backed out of the deal in November, putting pressure on the government to ensure the APS was not a flop. A deal was struck: RBS agreed to insure £282bn of assets, take the first £60bn in losses and pay £700m a year in fees. As a condition for the aid, the European Commission ordered RBS to sell its stake in commodities venture Sempra.

“The scheme was very much unchartered territory,” said Bill Dickinson, who joined the Asset Protection Agency in early 2010 and later became its chief executive. “But it was immediately successful, in that the market saw that the government was willing to support banks and stand behind their assets to ensure financial stability.” RBS exited the scheme this October, by which time the APS had taken £2.5bn in fees – while never paying out a penny to the bank in claims.

Part of the reason the APS was watered down slightly was because the wider economy was showing signs of improvement – the “green shoots”. With cheap funding readily available from central banks and trillions of dollars of fiscal stimulus packages from the US, China and elsewhere, GBM revenues soared. It immediately went back into the black. Indeed, business was so buoyant throughout 2009 that it became GBM’s most profitable year ever – it made £5.7bn.

It was quite a turnround for the business that months earlier brought the bank close to collapse. During that first full year after the bailout, GBM made more than five times the profits of any other part of the bank. Since the end of 2008, it has contributed more than £13bn in profits to the group – twice that of RBS’s corporate franchise, in second place. According to Hourican, the rebound was important for morale – although the feeling about GBM’s success within the group was somewhat mixed.

“The first quarter of 2009 helped show we were still alive, and people around could see that clearly,” he said. “All of a sudden, the world could see that we had a business that could still survive. But it was quite clear that many of the guys in the rest of the group still blamed the investment bank for everything that had happened, and we had to respect that opinion – the management of the investment bank, after all, had contributed to destroying their wealth and their brand.”

Markets agreed: from a low of 10p in January, RBS shares surged as high as 58p by August. Significantly for Darling, that was above the threshold at which the UK government would break even.

Half truth

The success of GBM was only a half truth, however. While the businesses it had chosen to keep were doing very well, the investment bank benefited massively from being able to chuck most of its junk into non-core, which made a loss of £14.6bn in 2009. Most of that was old GBM junk. Still, things were on the up. Amid the surge in market confidence, the bank even managed to sell off more than £2bn of its holdings, including a 4.3% stake in Bank of China and 50% of Spanish insurer Linea Directa.

The good times were not to last, however. Greece saw to that. Concerns had been growing through the back end of 2009 that Athens might not be able to pay back bonds maturing the following year, but it was the downgrade of those bonds to junk the following April that sent markets reeling. Eurozone governments helped bail out the sovereign to the tune of €110bn that May, but the damage had already been done. Investors were nervous. The European sovereign crisis had arrived.

Attention quickly turned to Ireland, which in June 2010 had posted its 10th consecutive quarter of year-on-year economic contraction. Mortgage, personal loan and business defaults were on the up, and RBS was massively exposed – it had £44bn of outstanding loans in Ireland and Northern Ireland through its Ulster Bank unit. Worse still, GBM profits, which had cushioned the impact of impairments through the previous 18 months, were falling off. They dropped almost 40% in 2010 to £3.5bn.

According to Darling, the UK government at one stage considered forcing the Irish government to take RBS’s problematic Ulster assets into the country’s bad bank, the National Asset Management Agency. “Legally, we could have insisted that the Irish assets of RBS and HBOS be included in the Irish bad bank, but we were quite conscious that if we insisted on Dublin taking on the additional debt then we may have torpedoed that scheme entirely,” he said. “We decided to be good neighbours and let them proceed.”

At this time, the Bank of England was also becoming concerned about general bank funding. RBS and others had been big users of its emergency liquidity facilities, not least the so-called special liquidity scheme, which was open between April 2008 and January 2009 and allowed banks to swap assets for UK government debt for a period of three years. By the time the drawdown period closed, banks had borrowed £185bn worth of UK debt under the scheme.

The SLS had been created at a time of emergency, just weeks after Bear Stearns collapsed, as tensions were rising about who might be next. But by early 2010, the Bank of England and Paul Fisher, the central bank’s executive director for markets, were becoming concerned that banks were not making proper preparations to pay the money back as scheduled. In January 2010, about £170bn remained outstanding. RBS owed an estimated £30bn.

“The SLS, on top of providing much-needed liquidity immediately, was also meant to provide banks with sufficient time to build up extra capital and repair their balance sheets,” Fisher said. “By mid-2010, we started to have conversations with the largest banks about how they would exit the scheme and it became clear that this could not be done smoothly without some guidance from the Bank.”

Fisher told the banks to start raising money again in private markets, which had reopened. But that implied higher funding costs – and a further drag on profits. Low borrowing costs had helped artificially boost profits through 2009, and now banks were being asked to return to paying the market rate.

The boost to RBS had been clear. In 2008, it paid £9.2bn in interest on debt it had issued. By 2009, the bill had fallen to £4.5bn – and £3.3bn in 2010. Some of that reduction had been because its debt pile had shrunk, but the bank also replaced a huge amount of funding with cheaper central bank money. As 2010 came to a close, with business dropping off because of the eurozone crisis and the cost of funding about to increase, senior management had to look again at just what was sustainable.

Second overhaul

About this time, Hourican brought in John Owen from Credit Suisse to take a wide-ranging role dealing with the bank’s main corporate clients – and to look for further areas where the bank could save money and trim its precious balance sheet. In his first weeks in the job, Owen asked colleagues to bring him a spreadsheet of the bank’s biggest clients and details of the return the bank was making from each of them. He was told that information was not tracked. He was flabbergasted.

“We decided very early on: if we were not adding enough value to a client to be able to earn a proper return, then we probably shouldn’t have been banking that client,” he said. “It became clear that RBS had the luxury of a substantial amount of flow and annuity business. That was a wonderful asset, but it created a challenge. There was a real danger of bankers becoming complacent and not working hard enough to deepen those relationships.”

“Also, without the proper understanding of the cost of capital to the business, deals were done for the sake of it, rather than because they made a fair return to the bank,” he said. “We had to ensure that we selected our clients and transactions based on where we could add value and, as a consequence, provide a return to our own shareholders for the deployment of the capital and other resources; we could no longer have any free rides.”

As 2011 wore on, the bank extended the exercise and it quickly became apparent that huge areas that GBM had chosen to keep hold of after the bailout were making very little money. Some, like equities, were losing huge amounts of money every month. Hourican and Nielsen had debated long and hard about keeping the equity business in early 2009, but the business hadn’t been cut.

According to Nielsen, getting out earlier would also have proved difficult. “The decision right in the beginning to keep hold of the equities business was a fiercely wrought one,” he said. “Still, it was a reasonable wager to keep the business. The markets did come back but the volumes just didn’t. Other banks will testify to that. Back then, we were struggling to just keep the lights on. Getting out of equities would have been difficult for management to have accomplished in that environment.”

Other parts of the business were performing poorly too. “It was obvious we weren’t making much progress in areas such as mergers and acquisitions and equity capital markets; we weren’t going to be making substantial progress there any time soon,” said Owen. “It was about calling a spade a spade. We took our bets right off the table when it came to these product areas as well as in certain geographies, such as Latin America. We were too far behind the pack and so we were never going to make any money in places like Brazil where the boom had already reached its peak.”

“We reviewed the strategy and did a deep dive into everything, constantly asking whether the returns we needed could be met,” said Hourican. “By 2011, we were having to work harder because of increased funding costs, new regulations and an economic downturn. We executed our strategy doggedly, and tried to be even tighter than what we had promised the board. But some things were just outside our control.”

Over Christmas 2011, Owen and his team started to draw up plans to dispose of some more businesses. All the pieces were in place by February, when the bank announced that it would pull out of equities and advisory. Upstart investment bank Jefferies had agreed to buy corporate broker Hoare Govett from RBS. In all, 3,500 people were earmarked to go.

Split

The bank would also scrap the old GBM, splitting the business in two. The markets division would be a shrunken version of its former self, focusing on providing mainly credit, currencies and interest rates market access for the bank’s primary customers. It would be headed by Nielsen. Owen would take charge of a new international division, which would deal with globally active corporate clients, providing hedging, financing and payment management facilities. They would both report to Hourican.

More than three years after the bailout, a huge amount of work had been done. The balance sheet has shrunk massively – and with it, the bank’s reliance on wholesale funding markets. From the £2.2trn at the end of 2008, the bank approaches the end of this year with about £1.5trn in assets. In the GBM division, assets have more than halved and will be cut further. Capital ratios have also improved massively – from 4% prior to the bailout to 10% now.

But the intervening few years have been tough, and the bank is still some distance from meeting some of the top-down tests that Hester created in early 2009. One of those was to regain the banks standalone AA rating. Standard & Poor’s and Moody’s still regard it as a couple of notches below that, with few prospects for an upgrade. Also, Hester’s 15% return on tangible equity target was cut back in February to just 12% – and only for the core bank. The third measure – of having a more stable mix – is a work still in progress. Markets and international now contribute about a fifth of group revenues.

The years since the bailout have been costly too, with the bank cumulatively losing almost £31bn in 2008, 2009, 2010 and 2011, more than what the government injected back in the dark days of the bailout. This year, the bank hopes to make its first full-year profit at group level since it was part-nationalised, but the share price still languishes well below what the government paid for its stake. Some have suggested 2014 might be the year the government sells its stake, but that may be hopeful.

In some ways, however, RBS is well ahead of the pack. Most investment banks have resisted scaling back their businesses and concentrating on what they are good at, possibly for fear that a sudden global economic rebound might be just around the corner. RBS was forced to concentrate on what it was good at and should come out of its current (second) restructuring as one of the more efficient banks in the industry.

Analysts at UBS think the bank is well ahead of its peers in addressing current regulatory and industry change. “There is no European bank that has done as much and been rewarded as little as RBS for the efforts of its restructuring,” said John-Paul Crutchley and Alastair Ryan. “However, with 2013 expected to be the last year of significant restructuring for RBS, it is likely to be one of the first European banks to have dealt with legacy issues and to have defined itself around a business model that is capable of delivering acceptable returns to shareholders in a Basel III compliant post crisis environment.”

For the moment, the decision around the government selling its stake is out of the hands of RBS’s senior management. Hourican, Nielsen and Owen have now committed to a business model, which although massively shrunken from the pre-bailout days of GBM, they believe is the best way ahead. They consider restructuring to be largely over and done with, and in numerous interviews restated that their main goal now is to concentrate on increasing returns. They believe others will have to follow their deep cuts.

“Going bust isn’t the best way to go about these things, but what happened to us allowed us to be more aggressive in cutting back quickly, and that put us at an advantage compared to many of our peers,” said Hourican. “Other banks still have to take the difficult decisions that we made. They chose not to back then, but will have to make similar choices. We need to stay relevant, add value and stay well risk-managed. We aren’t planning growth, just on adding value. We need to be really good in what we are doing.”