Since the onset of the financial crisis in 2008, there has been considerable flux in the leadership of the investment banking industry. The change has been considerable in terms of personnel. But has it produced a change of culture, to go with a more humble time for the industry?

Are we at the cusp of a generational shift in global investment banking? Is the industry poised to undergo a parallel cultural mutation either in the wake of evolving regulatory change or as a result of remedial work carried out by bankers in the wake of the brutal criticism of the role they played – or were perceived to have played – in the lead-up to, during and since the global financial crisis?

Let’s start with those running the investment banks. By luck or by design, it just so happens that there are a lot of new faces at the helm of the industry behemoths, with other changes set to come into effect during 2012.

There has been a quiet personnel revolution at the top of the industry since the financial crisis. During the past three years, pretty much every major global firm has either appointed a new CEO or a new head to its investment banking division. Alternatively, current heads of investment banking divisions have been given broader group-wide roles.

Goldman resists

The only global firm that has resisted the temptation to change its top management ranks since the crisis is Goldman Sachs. In the circumstances, in which Goldman was unfairly and somewhat absurdly cast as the embodiment of evil in the industry and came under all sorts of pressure to change, the firm’s immutability is extraordinary. It speaks to its unity and binding culture, which is certainly a strength, but by the same token it speaks to its imperviousness to outside influence which, given the charges levelled at it, has been seen as a serious negative.

Under chairman and CEO Lloyd Blankfein, any recent changes have been at best subtle. The inner circle remains intact. In 2011, Richard Gnodde, co-CEO of Goldman Sachs International, was additionally appointed as one of three co-heads of global investment banking (sitting alongside incumbents John S Weinberg and David Solomon). And Michael Evans, one of three vice-chairmen (along with Weinberg and Michael Sherwood, the other co-CEO of GSI) was made global head of growth markets. Gary Cohn, Blankfein’s senior lieutenant, remains president and COO.

The securities business continues to have the same four global co-heads that were appointed in March 2008: Ed Eisler, Pablo Salame, David Heller and Harvey Schwartz, all long-standing Goldman staffers.

There was talk during 2011 that Blankfein might stand down to assuage some of the fury around the firm’s perceived wrongdoing. The names that came up as potential replacements were pretty predictable: Cohn, Sherwood and Evans were front-runners. Solomon was mentioned in dispatches as a potential contender, but because he doesn’t sit on the executive committee, he was seen as the rank outsider. He was, however, the only candidate from the banking side, as opposed to the securities side of the firm.

Bankers versus traders

This latter point is interesting. It’s plausible to imagine the waning importance of trading in investment banks’ revenue mix impacting over time on culture and on management choices, but it’s too early to make a call on this. The dominating pre-eminence of FICC and equity trading in the revenue mix may have declined, but it’s unclear whether this is the result of current market conditions or a function of management endeavour to change the nature of the business on the back of regulatory efforts to reduce systemic risk.

Here’s the thing: running an investment bank just got really complicated

As long as trading had dominated earnings, traders dominated the senior management ranks of the industry while investment bankers who used to be the kingpins were relegated to being bit players. If trading continues in its current abeyant state over the cycle, it might change the direction of executive committee politics within investment banks. And given the (albeit exaggerated) popular and political backlash against the notion of casino banking as practised by traders, the pendulum could swing back in favour of bankers.

Is there any evidence of this? Not yet. Bearing in mind that each and every change at the top of the industry has been accompanied by changes to senior positions across the investment banking and trading universe, what can be gleaned from the C minus 1 and C minus 2 appointments? Have boards and executive committees taken into account the changes about to be wrought by the new regulatory framework and the emerging new world, and sought to impose real change? Not really.

Spot the difference

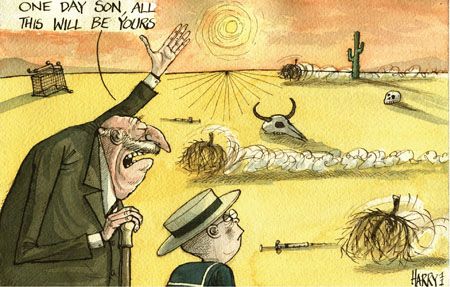

There’s little evidence that the new class of industry leaders is, as a group, materially different from those that went before. The reality is that for every new CEO of an investment bank or CIB division, there remains a veritable army of long-serving industry veterans underneath them representing the former status quo. Clearly, the industry can’t change everything overnight, but there is a sense that with so many entrenched interests, things will change slowly. Effecting cultural change takes years. Only to a point is the industry embracing change.

It’s interesting to look at the discussions around succession for clues here. The two most talked about situations revolve around who will replace Anshu Jain as CEO of Deutsche Bank’s CIB, and who will replace Jamie Dimon as chairman and CEO of JP Morgan Chase. Even though Dimon is expected to remain in situ for another five years, the hunt is on to find his replacement. Might we see a new-style appointment or an external appointee? Frankly, it’s extremely unlikely.

Industry watchers say that Jes Staley, JP Morgan CEO since 2009, is unlikely to succeed him, partly because he is only a year younger. There are good odds on a small group of 40-somethings. Not one comes from the investment banking side. Two front-runners are traders Matthew Zames and Daniel Pinto, global co-heads of fixed income. Pinto probably has the edge because he’s additionally co-head of the EMEA investment bank and group CEO for the region. Other candidates mentioned are Michael Cavanagh, head of Treasury & Securities Services; CFO Doug Braunstein; and head of asset management, Mary Callahan Erdoes.

As for Jain’s replacement, good money is on Michele Faissola, head of rates and commodities trading and a long-standing member of Jain’s fabled derivatives dream team that made a fortune for the bank in the years leading up to the crisis. Other contenders reportedly include Colin Fan, global head of credit trading (previously head of Asian equities); Rich Herman, global head of the institutional client group, and Alan Cloete, head of global finance. Stephan Leithner, co-head of coverage and advisory, is the only contender from the banking side, previously run by Jain’s CIB co-head Michael Cohrs before he left the bank.

Here’s the thing: running an investment bank just got really complicated. The more transparent but more complex operating environment being created combined with higher regulatory and capital costs is likely, over time, to force durable change. Given the fairly long-dated layering-in of the new regulations (out to 2019 in some cases), running an investment bank has, more than at any time in the past 25 years, also become a job for professional managers and technocrats.

Navigating the complex environment is likely to dominate the minds of the new set of industry leaders like never before. But don’t hold your breath for Street-induced change.

| Changes at the top: selected senior management changes at major IBs/CIBs | |||

|---|---|---|---|

| To | From | Notes | |

| Bank of America Merrill Lynch | |||

| Tom Montag | Co-COO | President, Global Banking & Markets | Re-org |

| Purna Saggurti | Chairman of GCIB | Co-Head of Investment Banking | Re-org |

| Paul Donofrio | Co-head of Global Corporate & Investment Banking | Head of Global Corporate Banking | Re-org |

| Christian Meissner | Co-head of Global Corporate & Investment Banking | Head of EMEA Investment Banking | Re-org |

| Michael Rubinoff | Co-head of Global Corporate & Investment Banking | Co-Head of Global Investment Banking | Re-org |

| Lisa Carnoy | Co-Head of Global Capital Markets | Global Head of ECM | Re-org |

| Alastair Borthwick | Co-Head of Global Capital Markets | Global Head of Investment-Grade DCM | Re-org |

| Barclays Capital | |||

| Jerry del Missier/Rich Ricci | Co-CEOs, Barclays Capital & Barclays CIB | Co-president, BarCap/COO | Took over from Bob Diamond |

| Tom King | Co-Head of Global Corporate Finance | Head of EMEA Investment Banking, Citigroup | New hire |

| Sam Dean | Co-Global Head, ECM | Co-Global Head, ECM, Deutsche Bank | New hire |

| Citigroup | |||

| John Havens | President & COO | CEO, Institutional Clients Group | Re-org |

| James Forese | CEO, Securities & Banking | Co-Head of Global Markets | Re-org |

| Ned Kelly | Chairman, ICG | Vice-Chairman | Re-org |

| Paco Ybarra | Head of Global Markets | Co-Head of Global Markets | Re-org |

| Credit Suisse | |||

| Eric Varvel | CEO, Investment Bank | CEO, EMEA | Took over from Paul Calello |

| Jim Amine | Co-head of Global Investment Banking | Co-Head of Leveraged Finance, Head of Global Markets Solutions Group, EMEA | Re-org |

| Luigi de Vacchi | Co-head of Global Invesmtent Banking | CEO, Italy | Replaced Marc Granetz |

| Marc Granetz | Chairman, Global Investment Banking | Head of Global Investment Banking | |

| Tim O'Hara | Co-Head of Global Securities | Head of North America Fixed-Income, Global Head of Credit Products | Replaced Tony Ehinger |

| Phil de Sanctis | Co-Head of Global Credit Products | Head of Public Credit Trading | Replaced Tim O'Hara |

| Eraj Shirvani | Co-Head of Global Credit Products | Head of EMEA Fixed-Income/Credit | Replaced Tim O'Hara |

| Vikram Malhotra | Co-head, Asia Investment Banking | Replaced Paul Raphael | |

| Helman Sitohang | Co-head, Asia Investment Banking | Replaced Paul Raphael | |

| Deutsche Bank | |||

| Anshu Jain | Co-CEO, Deutsche Bank (May 2012) | CEO, Corporate & Investment Bank | Taking over from Josef Ackermann |

| Colin Fan | Head of Global Credit Trading | Co-Head of Global Credit Trading | Became sole credit trading head |

| Noreddine Sebti | Global Head of Equity Trading | Added Head of Asian Equities | |

| Rich Hermann | Global Head of Institutional Clients Group | Head of European Debt Sales | Replaced Jim Turley |

| Goldman Sachs | |||

| Richard Gnodde | Co-Head of Investment Banking | Co-CEO of GSI | Added IB title |

| Yoel Zauoi | Global Co-Head of M&A | Head of European Investment Banking | |

| Gene Sykes | Global Co-Head of M&A | Co-Chairman of Global M&A | |

| Gordon Dyal | Co-Chairman of Global M&A | Global Head of M&A | |

| HSBC | |||

| Samir Assaf | CEO, Global Banking & Markets | Head of Global Markets | Took from over Stuart Gulliver |

| Robin Philips | Co-Head of Global Banking | Head of Global Banking | Re-org |

| Kevin Adeson | Co-Head of Global Banking | Head of Global Capital Financing | Re-org |

| Spencer Lake | Co-Head of Global Markets | Head of DCM and Acquisition Finance | Re-org |

| Jose-Luis Guerrero | Co-Head of Global Markets | Head of EMEA Global Markets | Re-org |

| JP Morgan | |||

| Jes Staley | CEO, Investment Bank | Head of Asset Management | Replaced Bill Winters/Steve Black |

| Jeff Urwin | Global Head of Investment Banking Coverage, Capital Markets and M&A | Co-Head of North American Investment Banking | |

| Andy O'Brien | Co-Head of Global DCM | Co-Head of Syndicated and Leveraged Finance | Replacing Therese Esperdy |

| Jim Casey | Co-Head of Global DCM | Co-Head of Syndicated and Leveraged Finance | Replacing Therese Esperdy |

| Viswas Raghavan | Global Head of ECM | Global Head of International Capital Markets | Re-org |

| Morgan Stanley | |||

| James Gorman | Chairman & CEO (2012) | President & CEO (2009) | Took over from John Mack |

| Walid Chammah | Chairman, Morgan Stanley Intl | Co-President | Re-org |

| Colm Kelleher | Co-president of Institutional Securities | CFO, Head of Capital Markets | Re-org |

| Paul Taubman | Co-president of Institutional Securities | Head of Investment Banking | Re-org |

| UBS | |||

| Sergio Ermotti | Group CEO | CEO, EMEA | Replaced Oswald Gruebel |

| Carsten Kengeter | Chairman and CEO, Investment Bank | Co-CEO, Investment Bank | |

| Mike Stewart | Global Head of Equities | Global Head of Equities, BAML | Replaced Gouws and Bouhara |

| Roberto Hoomweg | Co-Head of FICC and Credit | Global Head of Distribution | Replaced Dimitrios Psyllidis |

| Rajeev Misra | Co-Head of FICC and Credit | Global Head of Credit | Re-org |

| David Soanes | Head of Global Capital Markets | Deputy Head of GCM | Replaced Matthew Koder |

| Rob Joliffe | Deputy Head of GCM | Co-Head of Global DCM | Replaced David Soanes |

| Matthew Grounds | Co-Global Head of Investment Banking | CEO, Australia/New Zealand | Replaced John Wall |

| Simon Warshaw | Co-Global Head of Investment Banking | Head of European Investment Banking | Replaced John Wall |

| Jimmy Neissa | Co-Global Head of Investment Banking | Chairman of M&A | |