Divyang Shah

IFR Senior Strategist

The PBOC’s notable absence of repo injections this week has markets focused, once again, on the prospect of the central bank repeating June’s squeeze that sent interbank rates shooting higher.

While the market is nervous, the money market impact in Shanghai is contained, so far. The 7-day repo rate jumped nearly 50bp to finish at 4.05%, even quoted as high as 4.55%, but that benchmark rate has been higher since August and we are way off levels seen in June.

Thus far the PBOC has abstained from open market operations for two consecutive sessions, and this could continue into Thursday. But liquidity remains ample.

The PBOC has been highlighting that liquidity has risen sharply on the back of a wider trade surplus and delayed Fed tapering, which creates a lesser need for the PBOC to add to domestic liquidity surplus. Chinese banks have also seen a return of inflows, especially in September.

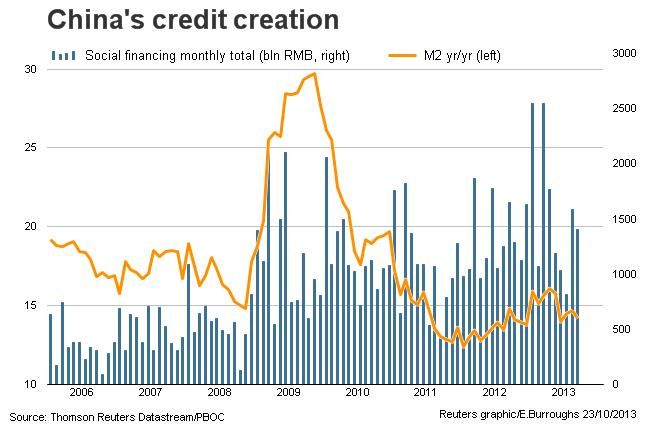

The markets concerns largely reflect an understanding that the PBOC has yet to put a lid on domestic M2/credit growth at a time when inflation has surprised to the upside. The fact that the market is willing to entertain the prospect of the PBOC taking action highlights the extent to which concerns over a hard landing have ebbed.

The PBOC has learnt from the June shenanigans that a heavy-handed approach to money markets is not the solution, and the current market concerns are likely to prove temporary.