Japanese retail investors have tended to leap on the opportunity to buy foreign equity in public offerings without listing, yet relatively few IPOs end up including such a tranche. As investors from the country gear up to invest more abroad, Tokyo could become a more frequent stop for IPO roadshows.

In September, Chinese e-commerce company Alibaba toured major investment centres across the globe as it sought to drum up investor enthusiasm for its IPO on the New York Stock Exchange. In Asia, the company took in Hong Kong and Singapore. The only major Asian investor base it failed to try and woo was Japan’s.

It was a notable absence, particularly given that 32.4% of Alibaba is owned by a Japanese citizen – Masayoshi Son, chief executive of SoftBank and Japan’s most dynamic entrepreneur. For Japan, the absence appears to confirm a slow but steady drop in the importance of the country’s retail investor base to foreign equity issuers.

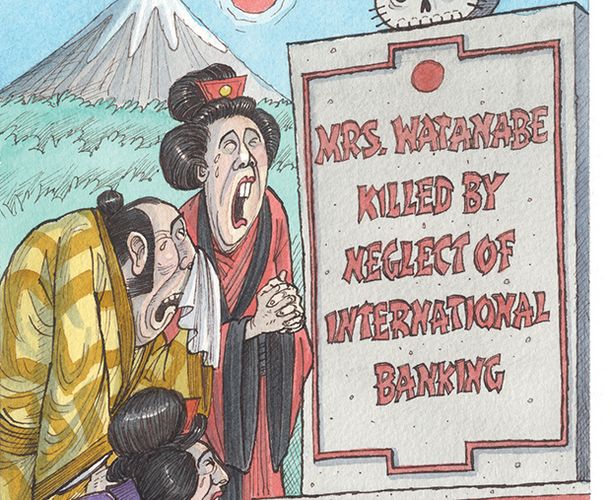

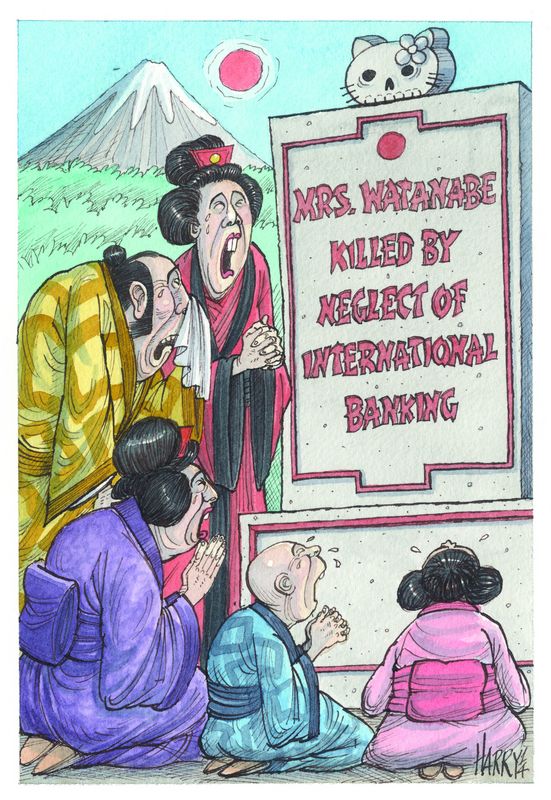

International companies are able to access the country’s retail investors (known colloquially as Mrs Watanabe) by using a unique format called public offering without listing. This lets a corporate or shareholder sell a predetermined portion of shares in an IPO to interested Japanese investors without having to list in the country, provided it offers the shares for a minimum of two weeks.

Until a few years ago, 10 or more international equity issuers a year would include POWLs in their deals. China’s big privatisation wave of the mid-2000s included POWLs on several IPOs, including those of Bank of China and Agricultural Bank of China.

However, the number of POWLs has declined of late to barely a trickle. There was just one between January and November 2014 and that barely counts. Accordia Golf Trust completed its Singapore IPO in July and placed most of the stock in Japan through a POWL, but the golf courses it runs are in Japan and it only floated in Singapore because business trusts cannot list on the Tokyo Stock Exchange.

Bankers say a combination of retail investor choosiness and issuer reluctance amid sunnier equity conditions has served to stymie the number of deals that include the structure. Certainly, POWLs are seen as a defensive option, but IPOs have been extremely challenging for the past five years and only became easier in Europe in the past 18 months – a period that still includes moments when the market was closed – plus POWLs have not failed to deliver when used.

So what else has happened since the financial crisis – an event that neatly coincides with the drop in POWLs?

Well there are two banks with the reach into high-net worth individuals to make promises about what Japan can offer – Nomura and Daiwa.

Nomura’s branch network and client base arguably puts it well ahead of its rival. But in the immediate aftermath of the crisis Nomura was reinventing itself – on the back of the acquisition of Lehman Brothers in Europe – into a global investment bank.

The last thing the bank wanted was to undermine its ambitions by pitching a Japanese product that would typically account for somewhere between 3% and 25% of a transaction. Most banks pitch for the top global co-ordinator slot in any IPO syndicate and accept lower bookrunner positions if they are offered. A POWL-led pitch would be akin to aiming to be a lowly lead manager and if the issuer decided against the tranche, the bank could easily be excluded entirely.

The situation has changed. Nomura has cut its cloth and, while it maintains global ambitions and is growing, most notably in the Americas, it is more willing to play the Japan card. Its investor base has seen the country slip back into recession and it may have to look overseas once again for returns.

And it is not just Mrs Watanabe checking her purse. The country’s largest state pension fund, the Government Pension Investment Fund, is about to start spending tens of billions of US dollars accumulating equities both at home and abroad, as part of a massive re-weighting of its ¥127trn (US$1.08trn) portfolio.

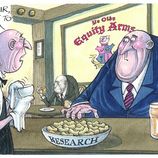

It is this asset shift that has brokers and banks rubbing their hands in anticipation. Could it also help to rekindle Japan’s love affair with offshore IPOs?

Investor preferences

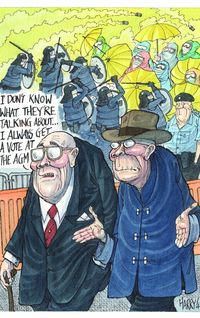

While Japan’s investors have been active buyers of some foreign IPOs, analysts say local interest in stocks in general, and foreign ones in particular, has been limited for years.

“Back in 1949, 69% of Japanese individuals were equity owners; today it’s 19%, after falling to 18% in 2012,” said Nicholas Smith, a Japan equity strategist with CLSA. “There just isn’t a huge [household] equity culture here, and the government has a job on its hands to create one. Of course, you must remember that for the past 20 years this was absolutely the right call by these investors.”

The rise of the yen’s valuation for almost three decades – from ¥125 per US dollar in the mid-1980s to ¥80 in 2012 – meant that foreign equity investments not hedged for currency movements struggled to make decent returns once converted back to yen.

Yet despite this, POWLs have consistently found a home among Japan’s retail investors. Bankers say the key has been to identify and market the right names.

“Retail investors in Japan like POWLs, but they tend to be very specific in terms of the stories they favour,” said Jerome Renard, head of EMEA equity capital markets at Nomura in London. “To ensure a successful IPO, we identify several categories of stocks we think will appeal.”

Retail investors in Japan have similar preferences to their counterparts elsewhere in the world.

First, investors tend to like financially robust companies that provide a good dividend. Belgium’s postal service bpost was one such company. It included a POWL in its IPO in June 2013 via Nomura. It offered absolutely no excitement, having fully modernised in the preceding years, but there was a chunky 7% dividend yield.

The €92.8m POWL on bpost represented 11.4% of the base deal and was so successful that several banks – not just Japanese ones – pitched a POWL for the privatisation of Royal Mail later that year.

Second, they like companies that have products or brands they recognise. One example of this was the €784m IPO of Italian clothes manufacturer Moncler in December 2013, which included a POWL arranged by Nomura. The maker of posh puffa jackets promised high-growth rather than an income but it made sense to go to Japan as it is Moncler’s second-largest market, after Italy.

Last, it helps if the company possesses a meaningful or promising business in Asia. “Most companies that add a POWL tranche tend to have some level of presence in Asia already,” said Renard. “It’s rare to see a completely foreign company to the region attempt a POWL.”

The US may be home to exotic, high-growth names, but IPOs elsewhere in 2014, particularly in Europe, have ticked many of investors’ boxes. So why have there been so few POWLs? Partly because bankers advise POWLs only be used to sell 3%–25% of a deal totalling US$1bn or more.

The small portion to be offered means the commitment it requires from the company can seem excessive.

Initially there is minimal effort required. A bank with strong retail investor distribution prepares the documentation and paperwork together with an accountancy firm and local lawyers. It takes six to eight weeks to arrange, and there is a cooling-off period of a little over two weeks between when the POWL registration is filed and when it is effective, which “easily fits into the period between launch to pricing of a global offering”, according to Jeff Matsumoto, the Hong Kong-based head of equity capital markets for ex-Japan Asia at Daiwa Capital Markets.

But a company that conducts a POWL does have responsibilities. It must consider its accounting standards versus Japan GAAP, while it must also prepare and publish a Japanese version of all financial reports and updates from the IPO onwards.

And so market conditions can be the deciding factor.

“In some case issuers may ask: ‘Do I need to do a POWL?’,” said Renard. “They should be seen as more useful when an issuer needs a set of investor support that is likely to be fairly faithful and steady, providing visible and early demand into the IPO bookbuilding and offering enhanced visibility in Japan for the issuer.”

Matsumoto echoes these views, although he thinks there is the potential for POWL candidates from China. “China’s remaining three asset management companies and China Reinsurance could all do listings and would all be good candidates for potential POWLs,” he said. “Hopefully, some will end up including a tranche.”

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.