The last 12 months have certainly been interesting. But at times like these it is easiest to differentiate between the highest quality issuers and everyone else. During the extended bull market that ended in the summer of 2007 there was a gradual erosion of the kind of hard-headed investor scrutiny that has since returned in force. Companies wishing to raise capital had found it easy surfing the waves of investor exuberance, without having to worry unduly about pricing their debt. No more though.

The winners in this market are those that put the needs of their investors before their own and adopt a flexible approach. Those that feel a sense of responsibility towards the market – not only using the market for their own needs, but offering their services in the market’s time of need – will emerge from this period stronger.

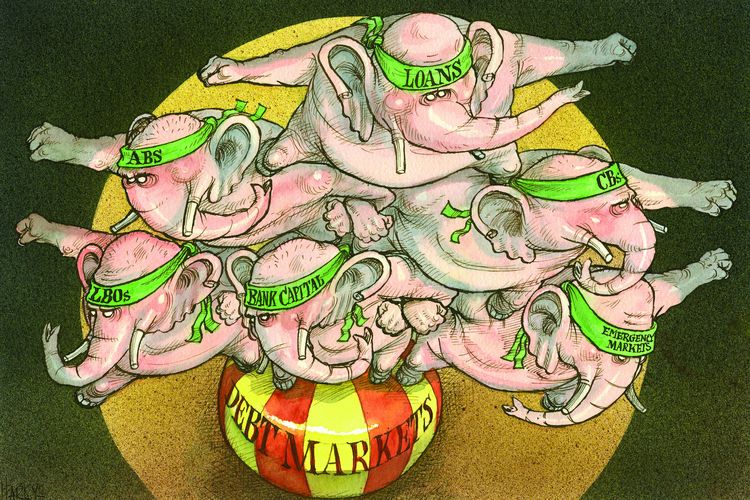

Today, price is everything. Some names can raise all the money they need while others struggle with the larger financing requirements, but everyone has found it necessary to price more aggressively. The phenomenon is true in all the asset classes, from bonds and loans to securitisations.

But that is not to say the effect has been spread evenly, by asset class or by geography. In terms of pricing, financials have been hit harder than corporates, for example.

Securitisations have, of course, been among the most extreme casualties of the credit crunch, in terms of issuance numbers, pricing and performance. But in the European bond markets, the long end of the curve and the high-yield markets have also been decimated, with nothing priced since July 2007. Senior unsecured volume is not much over 50% of last year, and capital issuance is well under half its 2007 levels.

There has been happier hunting in Japan. As our feature on the Samurai market makes clear, issuance has spiked to levels that suggest that if there is a credit crunch happening, nobody told the Japanese. The market has attracted issuers from all over the world, but the real champions of the phenomenon have been the Australian banks.

Where the market will go from here is anyone’s guess. Few feel brave enough to call the bottom and predict a bounce-back in the second half of the year, but some believe we may be past the worst. What is clear is that the borrowers that learn the lessons from the last 12 months and spend time listening to their investors will emerge better for it.