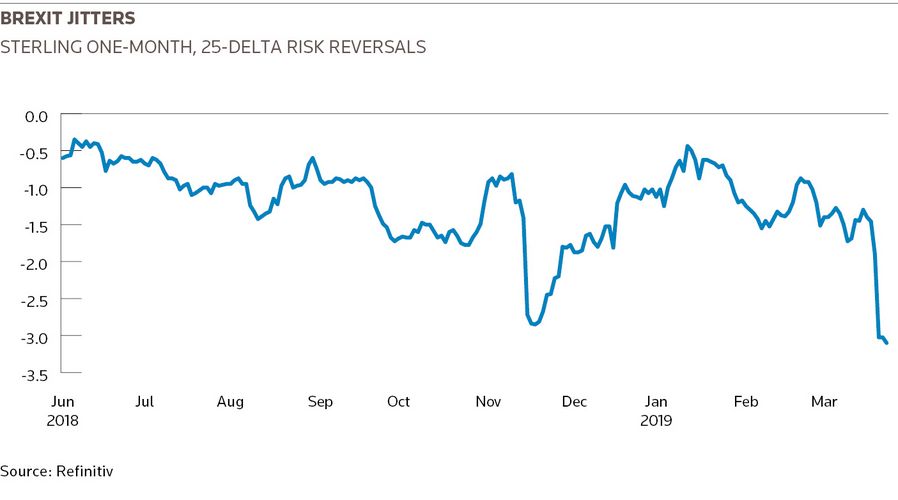

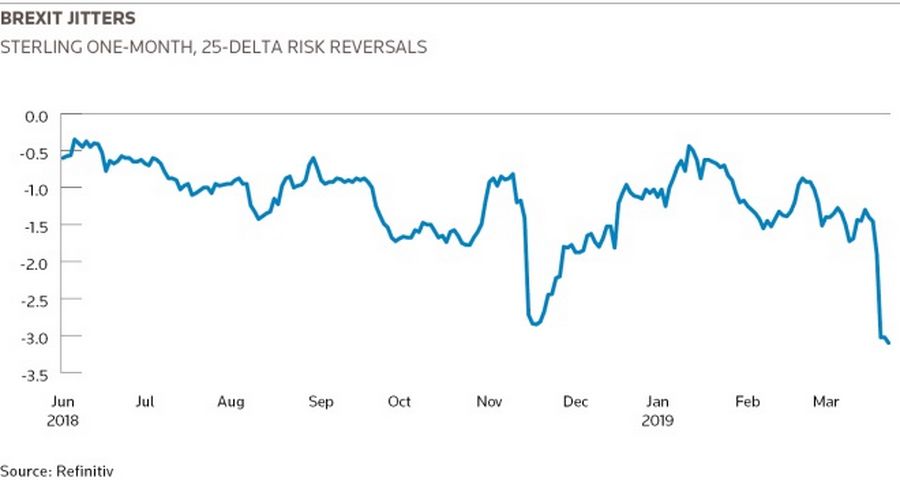

Demand for protection against a steep slide in sterling has reached its most extreme level since the aftermath of the Brexit vote nearly three years ago, as concerns grow among the financial and business community over the outcome of the UK’s efforts to leave the European Union.

Foreign exchange options markets - where companies and investors can hedge future currency moves - show a surge in interest in hedging against a large decline in the pound against the US dollar, with one-month, 25-delta risk reversals sinking to -3.2 on Monday.

That is the most negative level since the weeks following the Brexit vote in June 2016 and indicates traders and end-users are willing to pay far more for put options that protect against a sharp move lower in the pound over call options that would benefit from a bounce in the currency. A week ago, one-month risk reversals traded at -1.4, according to Refinitiv data.

The move in sterling options “reflects demand for tail risk hedging”, said Gene Frieda, head of FX strategy at Pimco.

Frieda highlighted the far greater risk of being positioned for the pound to rise rather than fall following recent gains.

“In the event of a surprise hard Brexit, there is 10%-15% potential downside” in the pound against the euro, said Frieda, compared with 3%-4% of upside if UK prime minister Theresa May gets her deal through parliament.

The pound has been volatile as May has struggled to get members of parliament to sign off on her deal to leave the EU. Earlier this month, the pound rose above US$1.33 to its highest level since last June after trading as low as US$1.24 in early January. Last week, it sank to just above US$1.30 in choppy trade as May sought an extension from the EU on Brexit. It is currently around US$1.32.

Last week’s volatility came “as consensus long positions were forced to reassess the assumption that the risk of a no-deal Brexit is negligible”, strategists at JP Morgan wrote in a note to clients.

May has secured a short extension from the EU to get her deal through parliament, though it is unclear whether she has the support from lawmakers to do so. In the meantime, she remains under pressure from members of her own Conservative party to step aside.

Investor uncertainty is readily apparent in FX options markets. In one telling sign, the gap between where traders will offer to buy and sell overnight, at-the-money options contracts on sterling is around 13 points. That compares with 2.6 points on equivalent euro-US dollar options contract and around 0.5 point on longer-dated sterling contracts. That suggests traders have very little conviction over the pound’s near-term trajectory.

Strategists at Citigroup wrote in a note to clients on Monday that there is a high likelihood that there will be a snap election.

“However, that does not resolve Brexit uncertainty per se but may increase it,” they said, pointing to the possibility that the Conservatives win with an anti-EU manifesto.