IFR: What would investors look for? One of the issues presumably is liquidity. I guess there are transparency issues as well in the bond market that borrowers are not necessarily used to, if they have been used to tapping a small bank club for funds. For the bond market to really pick up steam, what kind of companies, what kind of size would pass muster?

Myles Clarke: That’s the problem, right. You’re looking for liquidity with a minimum deal size of, say, £300m. The structure of the UK corporate market is such that there’s probably not a lot of people in a position, whether they need it or not, to raise that type of liquidity, or would need that much. The irony is the guys who could accept that scale of a transaction don’t need the money. They’ve done deals already, they can go to the bank market, they can go to euros. It’s quite fragmented. You get down to the tail end of a lot of small corporates. There are a number of initiatives, and a number of brokerages setting up to try and intermediate £20-£25m bond deals, but there’s not a developed retail market in the UK to support that.

Frazer Ross: I think that’s the case. If we do a €300m bond for an unrated or mid-Triple B rated German company, who are we selling it to? Pimco, DWS etc? Absolutely not. We’re selling it to the guy off the street via the German and Swiss retail banks. That’s only possible because of the very strong bond culture in Europe vis-à-vis here. I’m not sure anyone would go into a Lloyds or an RBS and say “Can I buy a bond please?” I know at Deutsche Bank, people walk in in the middle of Germany and say “I want the VW bond that’s on the screen”. In five minutes it’s flown through to the London trading floor.

So the culture is different, and as such, I don’t totally agree with Myles that you don’t have the willingness from the investor community to support those sorts of small deals.

Georg Grodzki: I was involved in the discussions instigated by the Treasury to develop an alternative to bank funding for UK SMEs. That was always a long shot. For a start, typical SMEs would struggle with the disclosure requirements, which we would naturally have to impose. And they would baulk at the spreads we would demand. Some of them have no idea how cheap their funding is, even though they complain about how expensive it is! Many other structural reasons stand in the way of bringing more SMEs to the institutional market.

The London Stock Exchange is trying to promote retail corporate bonds. We’ll see if it’s a really good idea or whether there will be some bruised wallets a few years down the road. I can see some finger pointing around whose idea it was to stuff unsuspecting retail investors with corporate credit risk.

The Treasury is very conscious of the fact that there is a US private placement market, which UK corporates actively access. And there’s a Schuldscheine market in Germany, which UK corporates access as well. And these markets were open almost all the way through the crisis, not for SMEs but for UK corporates with a decent investment-grade standing.

I just heard how strong the bond culture is in Europe. Well I would maintain that the corporate bond culture in the sterling market is at least as strong, and probably a bit more sophisticated. In Europe, certain institutions have got away – and still get away – with selling corporate bonds on the grounds of the name of the issuer.

We’ve seen the re emergence of unrated corporate bond issues in Europe, which I understand given my disapproval of the rating agencies performance (and I say that having worked once for one of them). But I still feel slightly wary about this on the grounds that some of that risk is not properly priced, partly because there is no rating, which could give some idea where the risk is. (On the industrial corporate side, the rating agencies broadly speaking have done a reasonable job; they screwed up elsewhere.)

Therefore, I feel a little bit mixed when the strong corporate bond culture in Europe is mentioned, having lived and worked there. I think retail investors don’t always do the market a good service by their name-focused buying of anything which offers a little bit of yield pick-up over Pfandbriefe. There is a bond culture, but no credit culture on the retail investor side.

So to sum it all up, as a UK Sterling institutional investor, we would love to see more UK and non-UK corporates coming to the market. But as was said before, UK corporates that can issue either already have the cash and invariably have international operations. And that means, they can go to the US dollar market, which has been dead easy this year. This makes sense given the openness of the market but also given their own funding needs.

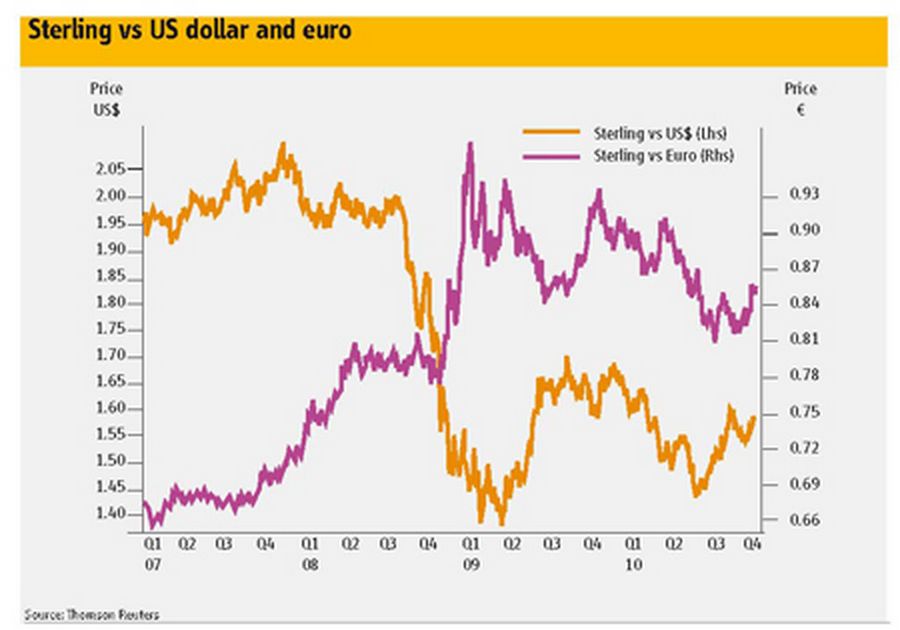

Sterling is just one of many currencies they can issue, and unless they really need long-dated funds, they probably wonder if sterling makes sense for them. So we’re hoping is that non-sterling issuers will come. I’m very encouraged to see Temasek from Singapore dipping their toes in the water, hopefully attracting more investors but also attracting more issuers from that region of the world into the sterling market. That would be quite helpful. I don’t think we can count on many UK corporates. The universe of UK corporates which have a genuine focus on meeting their funding needs in the sterling market has shrunk.

Frazer Ross: I think you’ve hit the nail on the head. The likes of Shell, BG, BT and Vodafone don’t care where they issue. They’ll issue much like EIB, at the lowest rate. The basis swap issue is a major impediment. For those issuers I’ve mentioned, sterling spreads are way back of dollar Libor basis levels. So what you’ve got is small companies that for reasons that have been mentioned can’t or don’t need to access the market and the major players who can access any market. So you’ve got basis swap problems, swap spread problems, and frankly even if the basis swap and swap spreads went back to normal, the credit spread at which they trade is just not competitive.

Samantha Pitt: We have exactly the same issue when we look at what market to issue in. Leaving long-dated inflation-linked debt to one side, for nominal issuance, we look at what market can offer us the best value. And at this point in time, except for very, very short-dated nominal sterling, US dollar is the most attractive market for us to issue in.

Sam Hill: I think this question is very interesting in the context of the Bank of England and their evaluation of quantitative easing, because one aspect of the transmission mechanism is the sensitivity of corporates to much lower long-dated funding costs. And if it turns out that the corporate structure of the UK is at odds with responding to those low yields, then I think we have to consider, from this point onwards, if we ever were to get to a point where people did start talking seriously about QE2 what would the Bank of England be hoping to achieve from that?

Because it looks as though thus far, we haven’t had the response, in terms of new investment, to form capital, to promote the recovery that’s intended from engaging in quantitative easing, so I think this conversation is something which is crucial to the debate about any future QE.

IFR: We keep coming back to this basis swap issue. What drives basis swap spreads and why have sterling swap spreads been so stubbornly uneconomic for non UK borrowers for so long?

Steven Major: Well, there are a number of factors. It’s very difficult to measure, actually. I’d like to be able to say whether we could price it to see whether it’s right or wrong. But obviously the weight of issuance in certain regions compared to others matters, as does the amount of that that’s swapped, how much of it goes from fixed to floating. They start to be the key parameters, but it’s not something you can model very well.

Frazer Ross: This is also a problem for euro issuers. So that’s why all the euro issuers are going into dollars as well. So this is not sterling, this is dollars just being much more attractive versus Europe.

Steven Major: It comes down to more the fundamental issues of disintermediation, the fact that US companies aren’t shy of issuing bonds. They’re quite happy to pay fixed. When they think there’s a chance, they’re happy to issue opportunistically. Maybe here, the point you raised already about the syndicated loan market dominating is a factor.

Robin Stoole: My understanding is most of this is driven by the creation of synthetic dollar liabilities in Europe. And that’s not necessarily to do with the bond market, it’s more to do with FX flows and things like that. So when risk aversion is high, we’re seeing a lot of synthetic creation of dollars effectively, and that’s keeping the basis swap where it is.

Obviously you’d expect over time, that to be arbitraged out because all European issuers are getting great funding in the US on a local Libor basis, and if they swap it back, they get an extra kicker because the basis is in their favour. So the more US issuance we see, which is swapped back in either euro or sterling, that should have an effect to bring the currency basis back to a more normal level. But I think it’s dwarfed by the synthetic creation of dollars.

IFR: I’m conscious of our time here. Before we close, I wanted to get a fix on the outlook for sterling issuance into Q4, 2011 and beyond. What’s going to drive issuance, be it corporate, financial, SSA etc? Myles, when you look forward three or four or five quarters, what’s your general outlook on the sterling bond market?

Myles Clarke: I think M&A will be important because some of the bigger transactions will require more than just one visit to the US dollar market, and that will impact euros as well. But I’d certainly like to see the sterling market benefit from more supply driven by some of those bigger transactions. But they’re quite binary. They either happen or they don’t. In the case of more day-to-day SSA transactions, I think as Fraser mentioned at the very beginning, you have to see continued interest from the international community. That’s concentrated at the short end because as a swap spread proxy product, a supra/sov is not the most exciting product for a lot of domestic investors, and it is driven actually a lot more by international demand.

So you want to see a continuation of international demand. I’d rather see wider swap spreads here, wider swap spreads automatically open up the arbitrage opportunities. And that’s another reason why we don’t see them, because there’s more arbitrage in a lot of other currencies, whether it’s Norwegian Krona or Australian dollar, than sterling. So I’d say it’s M&A activity, continued international demand and a better swap spread background that makes issuance attractive.

Fraser Ross: Why don’t I take it from a corporate standpoint? To be honest, it’s all about pricing. It’s great if that some SME that most of us have never heard of comes along and does £200m. That’s not going to affect things. If you look at corporate non-financial investment -grade issuance last year, it was £45bn. If you look at 2005 through 2008, it was £15bn-£20bn. This year, it’s £7bn.

What needs to change? The basis swap needs to normalise. It’s coming back as the world is feeling a little bit better. We need swap spreads to come back as well, which is happening. But you also need the high-level Gilt spread to move lower vis-à-vis euros and US dollars. So relative value is important. Once relative value is there, great. But does that mean Tesco, Vodafone etc need to fund. No-one needs money from a corporate standpoint. Corporates have very good balance sheets. They’re not paying huge dividends, they’re not funding capex, they’re too scared to hire. So what does that mean? You actually don’t need to raise a lot of money.

So from the corporate standpoint, I think issuance across all markets frankly, especially sterling, is going to be relatively light. It will come back with M&A; there’s a very big mining transaction out there potentially. But if it goes through, it would make sense for them to be doing a sterling deal. So those are the other things impacting supply.

Sam Hill: From my more macro perspective, my starting point would be to recall that next year, government funding in the UK is actually going to be higher than this fiscal year by £5bn. So we’re actually going to go up to £170bn next year because of the level of refunding of rollover risk. And actually in the context of significant cuts to public expenditure, which will be a drag on growth, the concept of high government borrowing having the potential to crowd out, and potential corporate issuers still being very cautious about the medium-term outlook for the economy, it’s likely that issuance in the corporate sector and other sectors could still remain low for some time.

Robin Stoole: Last year, the number of non-UK issuers issuing in sterling for the first time ever (in the corporate space) was higher than the number of UK borrowers issuing in sterling. It was extraordinary. This year, I think there have been two or three corporate transactions for non-UK borrowers in the sterling market, and that’s purely because pricing is appalling. If it remains as it is, the supply picture won’t materially increase, which will lead to a huge contraction in spreads. We’re consistently get asked by UK investors when a UK borrower goes and does something in another currency: “Why aren’t they doing it in sterling?” Of course they’re not going to do it in sterling, because they can get much better funding elsewhere relatively easily.

I think that over time, we’ll see spreads, in particular spreads versus Gilts contract and hopefully over time that will lead to better pricing. We’ll see people opportunistically using the sterling market again.

Steven Major: I’m quite relaxed about the backdrop for the Gilt market, as I said in the beginning, I can see lower yields in 2011. I do think swap spreads will go wider because looking ahead. I think Gilt issuance is peaking and will inevitably contract. That’s one factor. But if we look ahead one or two years, we’ll probably see some normalisation in base rates, some shift in Libor, which would be consistent also with swap spreads going wider.

Now what that means for non-government issuers is another question because if the level of yield is rising, that’s one challenge. But maybe that would prompt non-government issuers to think opportunistically and think: “right, we need to issue now, this is going to be the opportunity of a lifetime”. The crowding-out idea is fallacious, but people should get their heads around that. It’ll take a few years to realise the government isn’t crowding anyone out. Eventually, I think the environment is going to be more favourable for non government issuance.

And on top of all that, just remember the UK has a very long average life for its debt and it is linking this to some of the other points today about longer-dated corporate issuance. I would have thought that naturally the DMO could move away from issuing very, very long, if the pension funds ever allowed them to, because we have a very, very long average life. So there could be space for other types of issuers in the longer end.

Georg Grodzki: Very much in agreement with what was said before. It will take an increase in M&A activity to spark an increase in corporate bond issuance. I very much hope the sterling market regains some of the momentum it had in 2009 and which it lost in 2010 as it has clearly fallen far behind the dollar and euro market in terms of relative year-on-year performance. I mentioned emerging market issuers as a potential feedstock for issuance, but one other sector which is very close to our hearts, especially our parent company’s heart, is the infrastructure bond sector. We haven’t had any infrastructure issuance since the demise of the monolines, with exception of some rolling stock deals.

But it will be really nice to see the sterling market redevelop its ability to absorb long-dated, secured bonds with decent credit profiles given the underlying nature of the assets which are being funded. We hope that there will be a transaction in the next few months which will break the ice, and bring issuers and bond investors back together again and make the bond market more attractive and competitive relative to the bank market. And that could easily be good for a couple of billion, if you look at the ambitions which the government has with respect to green infrastructure.

So we hope that 2011 will be the turning point with respect to resurrecting a market which was once a core component of long-dated sterling bond issuance, index-linked or fixed. So fingers crossed that something will happen in that space, which will lift issuance volumes and provide interesting diversification opportunities with very defensive cashflow profiles.

IFR: Samantha, you talked a bit about the retail bond market and the LSE’s attempts to propose bonds as a savings option for retail investors. Would you consider issuing onto that platform?

Samantha Pitt: It’s certainly something we are looking at. Certainly it would be great if we could sell our bonds to the person on the street, and it’s certainly something we’ll keep an eye on what happens with the LSE retail platform. It’s is a work in progress at this point in time.

IFR: But beyond that, in terms of your own funding and your outlook, you’re comfortable about what you need to do?

Samantha Pitt: Yes, pretty comfortable. We continue to issue long-dated sterling inflation-linked debt. That pretty much all gets sold to UK investors, so we do like the international demand because it offers us investor diversification. I think nominal sterling is going to come down to whether it offers us an attractive cost of financing compared to other markets.

IFR: Final word to you Thomas. You’ve heard a lot of comments today about the sterling market, are you enthused or slightly depressed by what you heard?

Thomas Schroder: On the LSE retail bond initiative, we actually have two bonds on the platform, a fixed-rate 3% bond and an FRN both maturing in 2015. We opted to make our minimum denomination £100 to make it retail friendly. So we’ll have to see how it develops.

IFR: There’s little turnover, I’m assuming?

Thomas Schroder: Not that much. There are some technical problems, around the issue of trading bonds clean and dealing with the accrued interest. There are a few things to be solved to make the whole electronic trading system for retail seamless. We will monitor how it develops. In general, sterling is a strategic currency for us and we try to be in the market all the time. It is not always easy to be in the market along the whole curve, as I mentioned. It’s quite expensive for us to issue long-term in sterling; there are better funding opportunities in other currencies. But we try to maintain and develop our yield curve. I’m pleased to say that this year, we’re celebrating the 10th anniversary of our sterling dealer group.

IFR: Okay, we’ll continue to see you in the market. On that note, ladies and gentlemen, thank you very much for your comments.

Click here to view the Online magazine version.