When Royal Holloway unveiled its new £58m library two years ago, the university was keen to frame the moment as a milestone in its long history.

The building, named after suffragette and former student Emily Davison, had been its most ambitious project since the imposing Founder’s Building was built 130 years earlier. The new library was a sign of its ambition; it would be a key selling point as it strived to attract an extra 2,000 students a year.

Little was said about how the project had also been a milestone for a small and relatively unknown asset manager. Pricoa Capital had been approached a year earlier by Barclays, which wanted to know whether it would be interested in buying part of a £80m private placement being sold by Royal Holloway to part-finance the library. At first it was reluctant: the education sector wasn’t really its thing.

But as it looked over the numbers, the fund became more and more interested – so much so that it responded to Barclays with a request to buy the entire deal. “We took a look and quickly realised there was a lot to like about the university sector,” said Ed Barker, a vice president at Pricoa, a subsidiary of US asset manager Prudential. “There is clear underlying demand: people want to be educated and want to be university educated.”

Since signing the Royal Holloway deal in 2015 – its first with a university – Pricoa has been on a tear. In just three years, it has lent about £750m to UK universities, making it the biggest single provider of capital to the sector over that period. It has lent £200m to the University of Bristol for a new campus, and a further £55m to the University of Surrey to fund new student accommodation.

As UK universities embark on the biggest investment programme in their nine-century history, Pricoa and about a dozen mainly US funds have become their prime source of finance. While a handful of top-tier universities such as Oxford, Cambridge and Manchester have been able to sell public bond deals, most are not in that position. For the vast majority, the private placement market is the only option.

DEBTS MOUNT UP

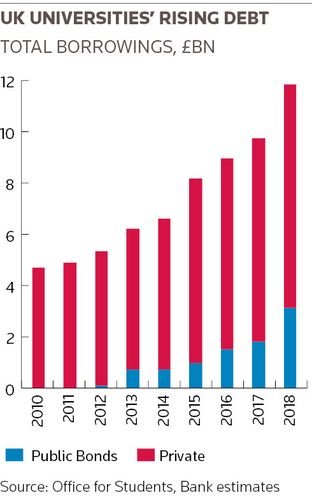

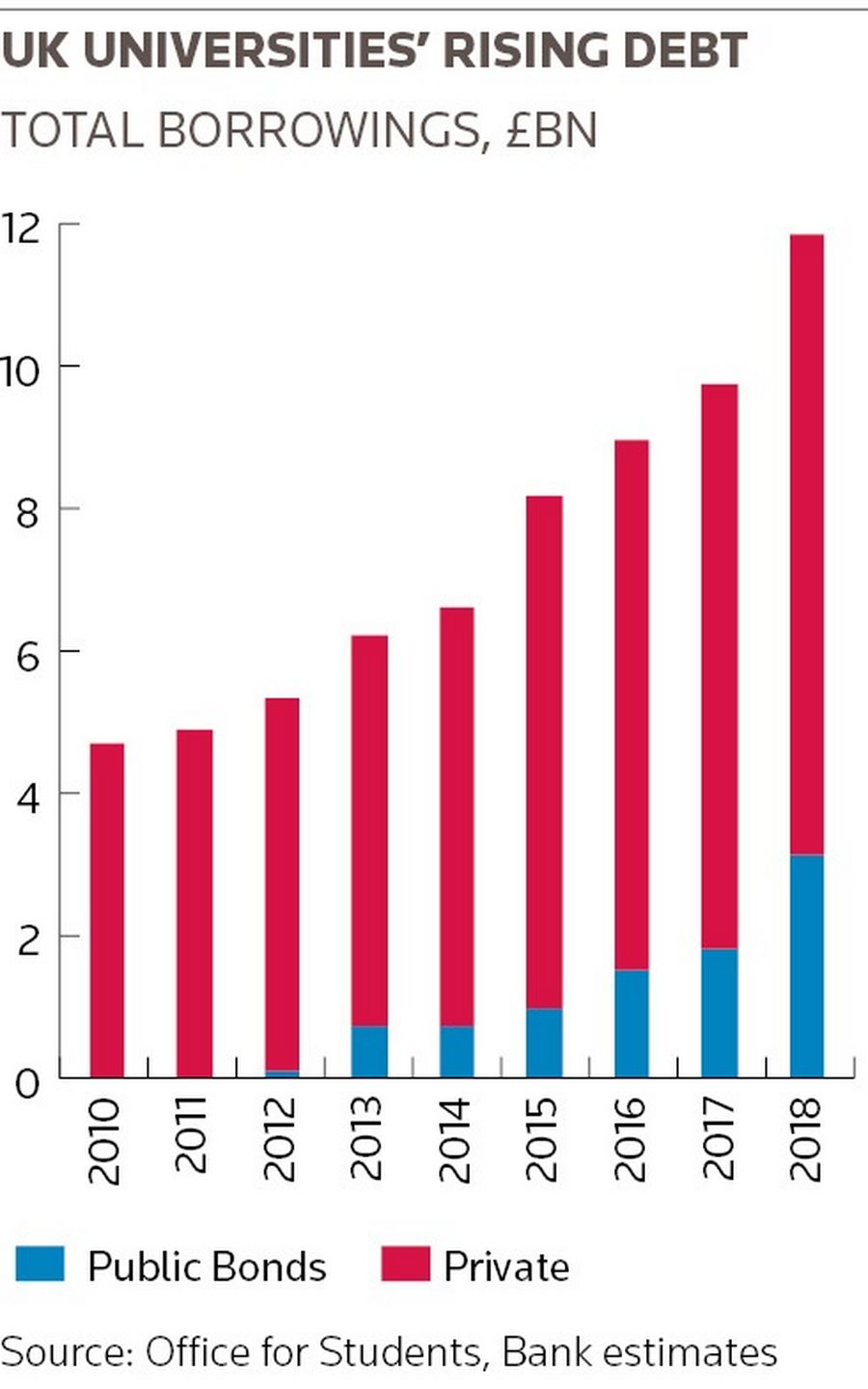

The market is growing fast. University debt has trebled over the past decade to £12bn, and much of that growth has come through private placements. With banks, traditionally the biggest lender to the sector, pulling back because of new capital rules, and the European Investment Bank – which has funded £2bn of projects over the years – halting new loans because of Brexit, private funding deals are in big demand.

“Before the financial crisis, there were a number of banks that were willing to write 20 or 30-year loans,” said Steve Valvona, US private placement director at Lloyds. “But, as a result of changes to capital rules, those loans can be capital-intensive, and so banks are much more selective. Consequently if universities need to raise long-term debt, private placements or public bonds are a much more compelling option.”

Edinburgh, Glasgow, Bath, the University of East Anglia and dozens of others have borrowed billions in private placements from Babson Capital, MetLife and Northwestern Mutual among others over recent years. For many, the funds provide cheap, long-term capital that doesn’t require universities to go through the cumbersome and expensive process of getting a credit rating.

Access to new sources of capital has become especially important for lower-ranked universities, some of which continue to run big operating deficits. With the potential pool of UK students expected to fall by about 200,000 by 2021 (due to demographic changes), Brexit looming (which could cut demand from foreigners), and government funding being cut, the market gives them the option to invest so as to remain competitive.

“Falling domestic applications and the demographic blip we have had has exacerbated what was already pretty intense competition between universities,” said Jeanne Harrison, who has rated some of the public bonds for Moody’s. “What we’ve seen is a lot of universities borrowing to invest in their campuses. The theme of borrowing to invest and remain competitive is extremely prevalent in the sector.”

Moody’s has put all UK universities it rates on negative watch, with the exception of just Oxford and Cambridge.

RAISED EYEBROWS

But concerns are beginning to grow about some of the deals that have taken place. In some cases, already heavily indebted universities running large deficits have been able to raise new funds in the private placement market. A growing assumption among investors is that the government will step in if a university ever gets into difficulties. Moral hazard, it seems, is very much alive and well.

One deal that raised some eyebrows was a £112m deal Heriot-Watt University did with three funds at the end of 2016. After missing its own targets on student numbers and revenues following an expensive expansion into Malaysia and Dubai, the Scottish university decided to double down on its strategy, borrowing yet more money to expand further. The university hasn’t revealed the terms of the deal.

“We feel like there are good opportunities to put a lot of money to work, but we have taken the decision to limit our investments to the top end of the sector – by ranking and safety of balance sheet,” said Barker. “But some of our peers have been willing to go further down the spectrum, and a lot of lower-ranking and objectively quite risky universities have been able to obtain financing in our market as well.”

“We have passed on a number of deals, but the fact that they are getting done doesn’t surprise me because ultimately the government has a vested interest in all creditors to universities getting their money back. Plus, most of these institutions have really good asset backing, so even in an extreme scenario the investor in the risky university still feels good about getting their money back.”

Indeed, most of the deals have negative covenants built in that prevent universities from pledging any of their assets to borrow in future. That could restrict options for universities should they need cash. Given that the vast majority of the private placements are unsecured, investors are keen to ensure that there would be assets to go after in the event of a university falling into difficulties.

But most investors in the sector don’t expect things to come to that. There is a widespread assumption that the government would step in to rescue any university falling into financial difficulties. That is at odds, however, with the official government position. Indeed, only last year the government introduced new legislation that effectively paved the way for universities to be able to fail.

“The idea that a university could just have its lights switched off overnight … theoretically it might be a new risk, but in reality I’m not sure UK education as a brand would allow anyone to believe that a student could turn up and one day find that the degree they have been paying for no longer exists,” said one senior banker who has been involved in several large university debt deals.

REPAYMENT CONCERNS

Concerns aren’t restricted to the private market. Some of the financials underpinning even public, rated bond deals have surprised some observers. Cardiff, for example, sold a £300m 40-year bond in 2016. While it can easily cover the 3% coupon, it is less clear how it will repay the capital when it comes due. It ran a surplus of just £145,000 in the year to July 2017. At that rate, it would take over 2,000 years to pay off the debt.

“There are varying degrees of plans,” said Harrison. “But over the case of 20 or 30 years, universities do have the time to put a plan in place. Many of these deals are based on the assumption that capital will be available to roll over the debt at a later date. Many of these institutions are operating with thin margins, so paying back these debts using internal funds will be challenging.”