Syriza’s convincing victory in the latest Greek elections offers a little clarity about the direction the country is going in. Questions remain about how far it is willing to go in pursuit of its anti-austerity agenda and what concessions it can extract from its debtors. But analysts do not expect Greece to leave the euro, with a compromise expected to enable it to avoid a default.

The dramatic rise of left wing political party Syriza has been interpreted by many as evidence of a spike in euroscepticism, raising fears that Greece will default on its debts and leave the euro. But polls have consistently shown Greeks want to stay in the euro – and in Europe.

This is something both sides appear to agree on. Syriza has a clear anti-austerity agenda but official party policy is committed to Europe and the single currency.

Meanwhile, there is clearly a desire to keep Greece inside the club among European politicians. Partly, this is down to concerns that a Greek exit – or Grexit – could pick away at the stitching of European integration and lead to wider break-up.

Although Grexit would be likely to lead to the collapse of Greece’s financial system and GDP, such is the anti-bank and anti-politician Zeitgeist, that radical parties across Europe could still present it as a win.

Between the pain of unpopular reforms that will not bear fruit for years, and a collapsing banking system and chastised politicians, many disgruntled European voters could be emboldened to vote for the latter.

“Europe’s desire to keep Greece in the club is not economic, it’s political,” said Zeina Bignier, head of public sector DCM at Societe Generale.

“The restructuring in 2011 has already seen European governments take big losses on Greece, it now accounts for less than 3% of the continent’s GDP. But historically and culturally it is European and its location in the Mediterranean is strategically important.”

These concerns are held by the majority of Eurocrats. One banker dismissed perceived differences between the views of European countries regarding Greece, suggesting German intransigence is little more than a good-cop-bad-cop routine designed to exert pressure on Greece to reform.

The possibility of a Greek default is a separate issue. Berenberg Bank estimates there is a 5% probability Greece will default but remain within the euro, but this outcome has negative implications for both Greece and Europe.

Greece’s financial infrastructure would probably collapse and the scale of capital flight would be massive. If it also left the single currency, which to which Berenberg ascribes a 35% probability, it would soon start to grow but it would be starting from a very low level and would be much worse off than it is now.

Michael Michaelides, fixed income strategist at RBS, said: “Greece wouldn’t risk defaulting on its debt to the ECB as that would mean the Emergency Liquidity Assistance programme would be pulled. It would only not pay the ECB if there was an agreement in place – debt forgiveness, rather than default, and a ‘velvet exit’.”

It has been suggested that Greece is now in a position to fund itself without additional external financing, raising the prospects for default.

However, Greece only has a current account surplus because of the support it is receiving, which would soon be withdrawn if it defaulted. Neither does it take into account the additional spending plans that Syriza and its leader Alexis Tsipras have made.

“The truth is that Greece will not be able to finance itself without additional external finance beyond July, so it will need to see a deal cut with its lenders by then,” said Michaelides.

Greece had been far along in plans to issue bonds until late in 2014 when political upheaval set those plans back. Now the election of the new Syriza-led government means an imminent visit to the debt capital markets looks a remote possibility.

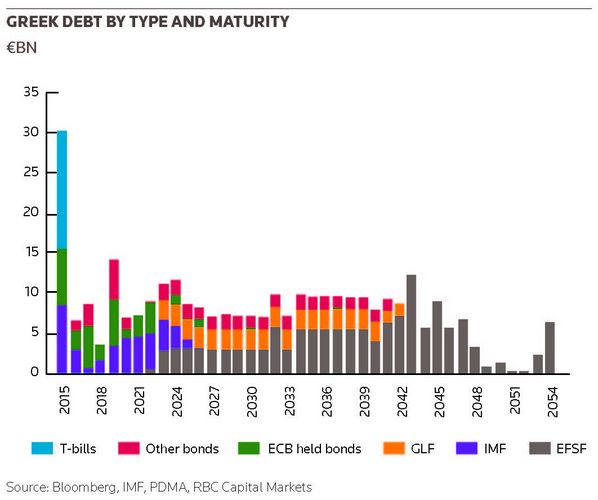

It does have some breathing space as long as negotiations with the Troika stay on track: the maturity profile of Greece’s debt burden is quite favourable, with much of it not due until 2024. In the meantime, the country is being financed by a €11bn credit line from the EU and IMF.

The repayments on the IMF loans, and Europe bond payments, is more pressing. Bankers are convinced Greece will not consider defaulting with either of these institutions, given that in the absence of the capital markets they are its sole lifeline.

“There aren’t many examples of countries defaulting with the IMF, the only examples are very poor African countries. Neither does defaulting with the ECB look any more attractive,” said Giovanni Zanni, economist at Credit Suisse.

Unknown quantity

It is hard to assess the implications of Syriza’s victory because the party and its leader remain something of an unknown quantity.

“Will Tsipras stick to impossible campaign promises and ruin his country, just like Kirchner did in Argentina, or turn into a centre-left reformer, as the erstwhile Brazilian left-wing firebrand Lula?” asked Berenberg economists Holger Schmieding and Christian Schulz. “We expect pragmatism to prevail. But it will not come easy to a collection of inexperienced left-wingers.”

Tsipras’ decision to form a coalition with the far-right Independent Greeks has further clouded the water, dashing hopes of an alliance with a more centrist party that might act as a force of moderation. By choosing a coalition partner with which it shares only one opinion – opposition to austerity measures – Tsipras has upped the ante, suggesting he is in no mood to back down.

Syriza has called for a restructuring of the European tranche of its debt and the flexibility to pursue measures that will boost demand, such as increasing public sector wages, which should prove beneficial for growth. It would also like to renationalise some industries.

“The IMF is sympathetic to Greece’s predicament to some extent and supports measures to boost demand, though it will not back down on the need for reforms,” said Zanni. “So there is room for negotiation and compromise. They are not there yet, both sides will need to change their position, but neither side wants Greece to leave the euro.”

Increasing demand makes a lot of sense, but the traditionally socialist measures Syriza proposes are more controversial. If Tsipras pushes on with those plans Greece will become a rogue state in economic terms. But even that would not necessarily force it to leave the euro if the rest of the union provided enough support.

“While the lion’s share of the stock of Greek debt is owed to the European partners and the IMF, this portion only represents a minor share of the actual interest payments”

“I have some sympathy with the view that Greece’s level of debt is unsustainable, and that it would be appropriate for Europe’s politicians to discuss the options around debt relief, or a debt extension, because there are alternatives scenarios that are a lot worse,” said Sean Taor, head of European DCM at RBC.

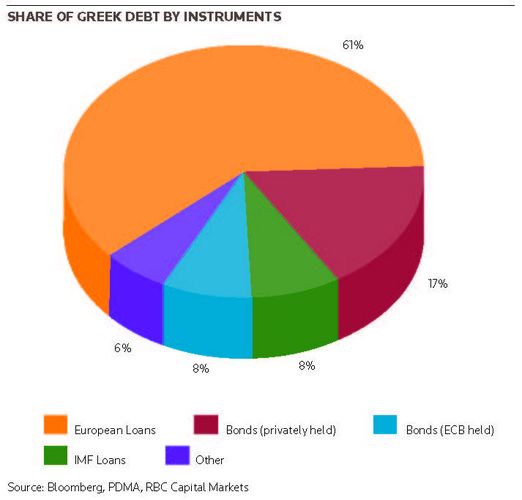

Yet European countries will feel there is a limit to their flexibility. Kim Asger Olsen, a partner at Origo Asset Management, said: “The banks that held Greek debt have already taken the losses at the first haircuts in 2012 and 2013. Other European central banks hold what is left of the debt, hence yet another haircut will be carried by the tax payers in other countries.”

“While the lion’s share of the stock of Greek debt is owed to the European partners and the IMF, this portion only represents a minor share of the actual interest payments. In contrast, the privately held debt, ie, the post-PSI bonds and the recently issued GGBs, represent only a small proportion of the debt, but are the most expensive elements for the Greek Treasury,” said Peter Schaffrik, head of UK and European rates and economics research at RBC.

Debt reduction on the aid facility loans would therefore yield an optical reduction in absolute debt levels without delivering a reduction in budget spending, he said.

Bruegel, the European think tank, has proposed a number of options to reduce the net present value of Greek public debt servicing costs by more than 15% of GDP without incurring losses on creditors. Options include reducing the lending rate and the maturity of the loans in the Greek Loan Facility; extending the maturity of the EFSF loans; using a European Stability Mechanism loan to buy back the Greek government bonds held by the ECB and national central banks; and swapping floating-rate loans into fixed-rate or GDP-indexed loans.

RBC identified similar measures, though its calculations envisage a more modest saving of €1.35bn, or around 0.75% of GDP. Crucially, however, it would smooth out the maturity profile in the near term, reducing the urgency for refunding.

Critics would doubtless see such a course of action as another example of Europe ducking a big decision and kicking a problem into the long grass, undermining Greece’s incentive to resolve its core problems. But it would certainly help both sides achieve their goal of reaching a workable compromise, while alleviating the suffering of the increasingly desperate Greek people.

Herculean reforms

Ultimately, however, the Troika is only likely to entertain the idea of a restructuring if it gets renewed commitments over reform, especially on the fiscal front, which is seen as perhaps the biggest long-term obstacle between Greece and growth.

Greece has attracted a lot of criticism for perceived foot-dragging when it comes to reform. But the scale of its challenge arguably dwarfs anything that has been required of other European countries, even those such as Ireland and Italy that also needed a bailout.

“I don’t think the market was focused around how different the social welfare structure was in Greece when compared with other countries in Europe,” said Taor. “So when it began its process of reforms it was from a different starting point than others. That those reforms may stall doesn’t mean that no meaningful progress has already been made.”

An agreement that satisfied the Greeks while ensuring it pushed on with the required reforms could transform the perception of the capital markets very quickly, said Taor. “Germany was granted debt relief four times in the last century, look at what it went on to achieve,” he added.

While such a compromise is sought, a delay in payments is possible and would be likely to trigger considerable volatility for Greek debt in the secondary market. Markets are already anticipating such moves.

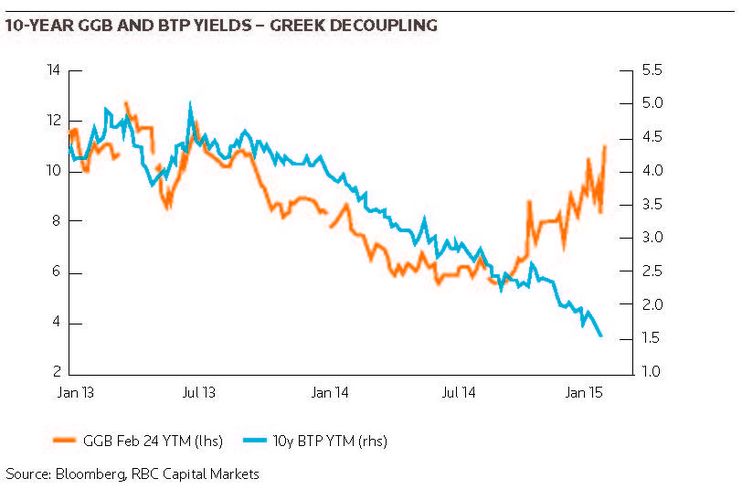

The announcement of the European QE programme in January saw significant tightening on European bonds across the board. Even Cyprus, which is often used as a comparable for Greece – although in truth their state administrations are worlds apart – saw spreads tighten by around 60bp. Greece was the only exception, its spreads widening by 70bp, meaning the differential between the two widened by 130bp.

Greek equities and bank debt markets also took a hit. Shares were down around 3% on the morning of the announcement. The yield on Alpha Bank’s June 2017s broke 12%, while Eurobank’s June 2018s and Piraeus’s March 2017s also widened further, yielding 12.4% and 14.3% respectively, according to Tradeweb.

Things got worse after the coalition had been formed, with early signs that the government would prove intransigent in its negotiations with the Troika seeing Greece’s 3.375% July 2017 bonds widen to 346bp to a bid yield of 17.21% at one point, according to Tradeweb.

The fate of Greek banks is seen as closely tied to the fate of the sovereign and there have been deposit outflows that have seen them record losses of around €20bn since December, according to Darren Ruare, head of fixed interest at Investec Asset Management.

“We see Greece so far remaining quite isolated with little spillover into other peripheral markets in both the fixed income and equity space”

Moody’s said this was likely to continue until there was some certainty regarding the outcome of negotiations between the new government and the Troika.

In due course QE should help Greece by lifting the continent as a whole, while the price of oil should also be a short-term stimulus. But unless Greece pushes through more fundamental reforms it will not resolve the underlying problems causing its sclerosis.

“Greece has systematic problems that will make it very hard to issue in the market,” said Bignier. “Who would buy Greek debt right now? There has been no visibility in Greece for the last two years. I can’t see any sovereign issuance from Greece for the next few years.”

Happily for others in Europe, however, most see little risk of imminent contagion. “We see Greece so far remaining quite isolated with little spillover into other peripheral markets in both the fixed income and equity space,” said Schaffrik.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

| Greek debt and interest payments by type | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total | Privately held | Of which Bonds (ex ECB) | T-Bills | Bonds (ECB held) | Aid Loans | Of which IMF | EFSF | GLF | Other | |

| Debt (€bn) | 322 | 55 | 39.9 | 14.8 | 27 | 220 | 25.5 | 141.9 | 52.9 | 20 |

| Average interest rate (%) | 1.60% | 2.30% | 2.50% | 2.00% | 5.10% | 0.60% | 4.30% | 0.00% | 0.60% | 5.00% |

| Interest paid (€bn) | 5.1 | 1.3 | 1 | 0.3 | 1.4 | 1.4 | 1.1 | 0 | 0.3 | 1 |

| Debt (as % of GDP) | 174% | 30% | 22% | 8% | 15% | 119% | 14% | 77% | 29% | 11% |

| Interest (as % of GDP) | 2.70% | 0.70% | 0.50% | 0.20% | 0.70% | 0.80% | 0.60% | 0.00% | 0.20% | 0.50% |

| Debt (as % of total) | 100% | 17% | 12% | 5% | 8% | 68% | 8% | 44% | 16% | 6% |

| Interest (as % of total) | 100% | 25% | 19% | 6% | 27% | 28% | 22% | 0% | 6% | 20% |

| Source: IMF, PDMA, RBC Capital Markets | ||||||||||