UniCredit took a big step in its recovery last Wednesday, selling senior debt to US investors for the first time in a decade and laying the groundwork for an eventual non-preferred issue.

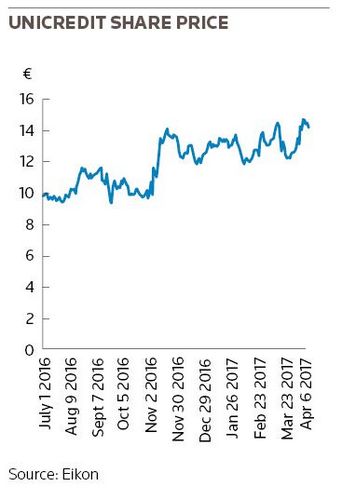

The US$2bn five and 10-year deal, which attracted more than US$6bn of orders before pricing, followed its €13bn stock offering, which was finalised in March.

“It’s another important step for us after the rights issue to reach out to global investors,” Mirko Bianchi, the bank’s CFO, told IFR.

“It’s increasing the range of our investor base, but it’s also a good way for us to reposition the UniCredit name in the fixed-income market as we execute our restructuring plan.”

The deal was offered in 144A/Reg S format, opening it up to US investors alongside other US dollar investors worldwide.

The last time the US buyside had the chance to get their hands on the bank’s paper in 144A format was in 2007.

UniCredit has sold plenty of euro debt since then, but US dollar issues - such as its debut Additional Tier 1 transaction in 2014 - have only been in Reg S format.

US investors have been wary of Italian banks for some time, mindful of problems with bad loans at lenders such as Banca Monte dei Paschi di Siena and indeed UniCredit itself.

But the rights issue helped change the perception of UniCredit’s name in the US, said market participants.

“If they hadn’t done the rights issue, no one would have touched them with a 15-foot pole,” said a banker away from the deal.

The new trade priced at Treasuries plus 200bp for the US$1.25bn five-year tranche and plus 240bp for the US$750m 10-year.

Fellow Italian lender Intesa Sanpaolo’s 5.71% January 2016 bonds, issued in January, were trading at a G-spread of 385bp over before the deal was announced, according to MarketAxess data.

Over 200 investors placed orders for the trade, with around half the deal going to US investors, bankers involved in the deal said.

UniCredit itself was joint books on the deal along with Citigroup, Goldman Sachs, Morgan Stanley, Nomura and UBS.

NON-PREF COMING

Getting in front of US buyers has one particular benefit over and above diversification.

UniCredit wants to eventually tap the US market with a senior non-preferred deal - to comply with TLAC and MREL regulations - so it needs to build a curve.

“We will be tapping the US dollar market two or three times a year, not only in senior unsecured but also in other types of instruments, like Tier 2 or senior non-preferred,” said Bianchi.

Unlike France, which finalised its non-preferred legislation last year, Italy does not yet have its rules for the asset class in place, so the timing of a deal is still up in the air.

While legislation is in the works in Spain, Banco Santander nonetheless went ahead and priced a “second-ranking senior” deal in recent days that is expected to comply with the eventual rules.

But Bianchi suggested UniCredit would wait until the law was passed in Italy to bring a non-preferred deal.

“Once the Italian legal framework is established, there should be a common standard which would be easier for investors to subscribe to,” he said.

“That is why we are preparing ourselves by bringing the market up to speed on our story, so we can access the market when the instrument is ready.”

UniCredit is planning to issue around €13bn of senior non-preferred paper by 2019, he said.