Safe pair of hands

Investment-grade bond issuance in the US set another record in 2015 of well over US$1.2trn, driven by massive M&A and share buybacks as companies locked in cheap financing before rates finally begin to rise. For being a leader on some of the biggest of those deals, and navigating massive headwinds at the same time, Bank of America Merrill Lynch is IFR’s US Bond House of the Year.

The themes that dominated the US bond market in 2015 were the massive resurgence of M&A, the billions of dollars of investment-grade bonds that financed those acquisitions and the intense volatility that banks had to navigate along the way

Having a safe pair of hands was crucial – and Bank of America Merrill Lynch provided that and more.

In a year that saw a record US$4.2trn of M&A announced, BAML was a lead on four of the five largest M&A bonds: AT&T, Medtronic, AbbVie and Charter Communications.

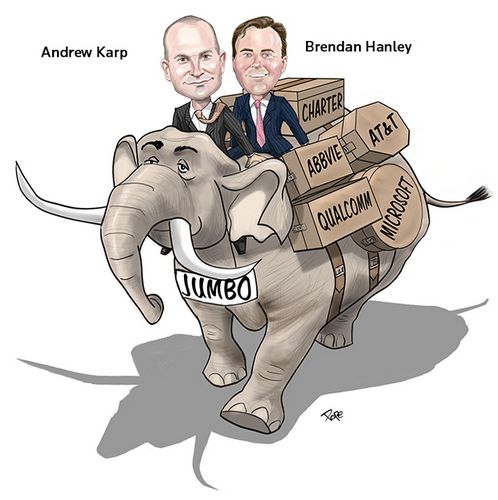

As liquidity became a greater concern, investors showed a preference for larger deals; 2015 was truly the year of the jumbo, with 14 investment-grade deals sized at US$10bn or larger.

But that didn’t mean they were a simple slam dunk, given the market havoc caused by oil price volatility, Chinese growth, Greece’s woes and the unending will they/won’t they surrounding the Fed.

Yet as early as December 2014, when IFR’s awards season was under way, BAML – under the leadership of co-heads of Americas investment-grade capital markets, Brendan Hanley and Andrew Karp – was already blazing the trail to become US Bond House of the Year.

Mindful of the looming M&A pipeline, BAML was one of the banks on the US$17bn issue for Medtronic, which became the largest investment-grade bond of 2014.

Medtronic’s debt financing needs for its US$43bn acquisition of Covidien skyrocketed after the US government closed the loophole on so-called tax-inversion M&A trades – a move that increased the cash portion of the financing to US$16bn.

To offset concerns about higher leverage and subsequent credit rating downgrades, Medtronic offered juicier new issue concessions of about 15bp–20bp.

Though high at the time, the plump spreads allowed the company to attract US$45bn in demand, lock in cheap rates on long-term debt and keep refi risks in balance.

BAML had plenty of other standout issues as well: the US$17.5bn bond for AT&T that financed its US$48.5bn purchase of DirecTV; the US$16.7bn deal for AbbVie to help fund the pharma giant’s acquisition of Pharmacyclics; and the highly structured US$15.5bn trade for Charter Communications – a vital part of the financing backing its headline acquisition of Time Warner Cable.

BAML also showed it was on top form in getting deals done when the moment was right.

One such deal was the US$10bn debut from chipmaker Qualcomm. The bonds, which financed share buybacks, were priced in mid-May and weakened within a couple of months after reports that the company was considering a break-up.

That risk was well known to investors when the debt was raised. But BAML, one of three bookrunners on the trade, smartly spotted the window to issue, picking a time when the buyside was less leery of activist threats to split up the business.

In September, BAML helped reopen the high-grade primary sector with a US$10bn trade for Gilead Sciences – and the next month was one of three banks on a US$13bn issue for Triple A rated Microsoft.

In high-yield, BAML helped restore confidence in October with a US$300m issue for Scotts Miracle-Gro that ended an eight-day primary hiatus.

Shortly thereafter, the bank was left-lead on a US$3.4bn deal for First Data, a trade rated Triple C by Moody’s that was quadrupled in size – one of the largest one-day upsizings in high-yield since the financial crisis.

Getting it done

Bond sales for Southwestern Energy and Halliburton were also tricky – sizeable issues at US$2.2bn and US$7.5bn respectively in a sector plagued by the slump in oil prices.

Southwestern’s deal, part of a package to pay for its purchase of assets from Chesapeake Energy, was one of the toughest acquisition financings of 2015.

BAML’s deft performance translated into market share. The bank was second in the high-yield league table with a more than 9% share, and a top-five player in consumer ABS, winning an 8.1% share of the US$164bn of deals sold as of mid-November.

To top it off, BAML served as the left-lead on Ford Motor’s US$1.05bn prime auto ABS deal in September.

It was the only ABS deal to be priced in compliance with new rules for loan-level and reporting disclosures under so-called Regulation AB II before that regulation came into effect on November 23. Bank of America Merrill Lynch, as it was all year, had been ahead of the curve yet again.

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .