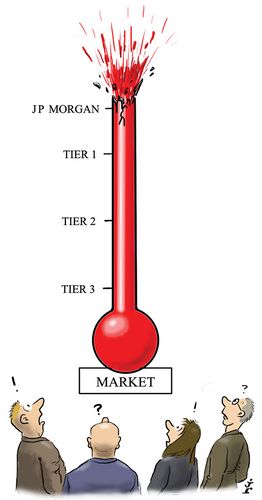

One firm was the bookrunner of choice in a number of landmark transactions in 2014, with its strong underwriting capabilities, superior distribution and structuring skills excelling in a climate of intense competition. For finding a role in almost every talked about trade, JP Morgan is IFR’s US Investment-Grade Bond House of the Year.

JP Morgan was simply in a different league to its rivals in 2014. No matter how the data are cut, it was the biggest underwriter of investment-grade bonds during the review period, showing an unmatched commitment to a market brimming with supply.

The firm topped the Thomson Reuters league tables with a market share of close to 16%, a data point noteworthy because JP Morgan is one of just a few banks in history to maintain its number one position in the tables – and a similar market share – for five successive years.

It was JP Morgan’s unmatched global reach and reputation as the one-stop shop for the most complicated financings that ensured it was on top of an incessant flow of deals.

JP Morgan led a majority of the largest deals and debut transactions, and helped companies that had not been in the market for several years to find success with their bond offerings.

It was joint bookrunner on eight of the 10 largest deals, including Oracle’s US$10bn offering, a US$8bn deal by Cisco, acquisition deals for Roche (US$5.75bn), Anheuser-Busch InBev (US$5.25bn) and Sysco (US$5bn). All these deals were hugely successful.

Cisco’s US$8bn seven-tranche issue ended with a deluge of US$22bn in orders, while about US$12bn of orders poured in for AB InBev’s six-part US$5.25bn jumbo bond.

JP Morgan was one of four bookrunners that navigated German pharmaceutical company Bayer’s US$7bn six-part acquisition financing through a nervous market. The bonds attracted US$27bn of demand, as investors rushed for a piece of a Single A name that had not tapped the Yankee market in 16 years.

The US bank also shepherded Swiss drugmaker Roche’s first US dollar bond market foray in five years, internet giant eBay’s return to the market after two years and Bed Bath & Beyond’s US$1.5bn three-part debut trade during the year.

It also had a primary role as active bookrunner on close to US$10bn out of Verizon Communications’ US$14bn of bond issuance during the year.

On top of all this, it was also one of just two underwriters on the most defining acquisition financings during the review period – one that backed Tyson Foods’ bid for Hillshire Brands and swayed the balance in favour of the company in a competitive bidding situation.

In FIG underwriting, it featured among the top banks chosen for its ability to market and sell complex transactions. JP Morgan was one of the bookrunners on the US$3.6bn spin-off of GECC’s private label credit card business Synchrony and was also joint bookrunner with Citigroup on Apollo’s US$500m debut in the senior unsecured market.

Synchrony’s trade was a stand-out. The four-part US$3.6bn debut trade as a standalone credit found US$17.4bn of orders. The issuance, which comprised three, five, seven and 10-year notes, was increased from an initial US$3bn, while pricing was tightened in as much as 15bp–20bp across the tranches from initial price thoughts, as investors jumped at the opportunity to add a new FIG name to their portfolios.

The US$3.6bn in proceeds helped Synchrony develop its new capital structure, after GE spun off 15% of the retail credit card business in a US$2.8bn IPO.

The bank was also heavily involved in helping a number of Latin American names navigate complex market conditions and take advantage of a narrow window of opportunity in the US dollar markets. A case in point was Falabella’s US$400m 10-year bond issue, which reopened the LatAm debt markets after a pronounced bout of volatility, and Mexichem’s successful return to the international market after an absence of nearly two years with a new US$750m 30-year trade.

To see the digital version of the IFR Americas Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.