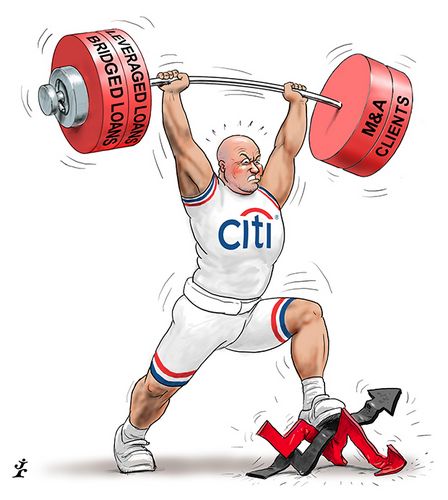

Riding the M&A wave

In a year when big acquisition financings dominated the US loan market, Citigroup showed the breadth of its lending business. It led the second-largest investment-grade bridge loan, participated in the biggest bridge loan and led the largest leveraged buyout loan to become IFR’s US Loan House of the Year.

The awards period was all about big acquisitions, with worldwide levels of M&A surpassing even the records previously set at the peak of the markets in 2007.

With great M&A activity comes significant financing opportunities and Citigroup was at the forefront of this movement across investment-grade and leveraged loans.

“Acquisition financing has been an extremely important part of the market this year and Citigroup has been right there at the forefront,” said Carolyn Kee, head of North America loans at Citigroup.

In particular, the bank made a strong showing in US investment-grade bridge loans, an important part of a marketplace that saw almost 100 global deals of more than US$5bn. These jumbo deals tallied 47% of overall M&A lending, the highest percentage ever for large deals.

“If you look where we were a couple of years ago and where we are now, I think [there’s] tremendous progress for Citigroup in acquisition financing,” Kee said.

Citigroup’s largest lead deal of the year was the initial financing for health insurer Aetna’s US$37bn acquisition of smaller competitor Humana, while it also participated in a US$26.5bn bridge backing Anthem’s US$54.2bn acquisition of Cigna.

The Aetna financing included a US$13.2bn bridge loan and a US$3.2bn delayed-draw term loan, as well as a US$1bn upsizing of the company’s US$2bn revolver.

The bank also served as power producer Southern Co’s exclusive financial adviser for its acquisition of gas distributor AGL Resources. Citigroup was the lead arranger on a US$8.1bn bridge loan, a US$1bn revolver, a US$400m 18-month term loan and a US$400m 13-month term loan backing this deal. It was the largest bridge in 2015 for a power/utility sector issuer.

The deal was particularly tricky as a competing US$6.5bn bridge loan backing Canadian energy company Emera’s purchase of US-based utility Teco Energy was in the market at the same time in the same industry. In addition, federal regulators shelved the proposed merger of Exelon Corp and Pepco Holdings.

Despite this less-than-ideal background, Citigroup was able to get all lenders that it invited to the bridge, revolver and term loans to commit at the ask levels.

The drawn cost on the bridge loan opened at 125bp over Libor with 25bp quarterly step-ups, a 50bp funding fee and a ticking fee of 12.5bp annually. The US$1bn revolving credit facility was also priced at 125bp over Libor with a 17.5bp unused fee.

The bank was able to complete the entire transaction in approximately three weeks.

Supporting old and new

Citigroup did more than just underwrite acquisitions on the investment-grade side, offering support to issuers that it had long-standing relationships with, as well as new borrowers.

“What we’ve been doing this year has been a lot of everything,” Kee said.

Citigroup was a lead arranger and bookrunner on eight transactions for first-time bank market borrowers, including a US$4.3bn revolving credit and term loan facility for paper and packaging company WestRock in July and a US$4bn revolving credit facility for technology company Hewlett Packard Enterprise in October.

The WestRock deal backed the merger between MeadWestvaco Corp and Rock-Tenn Co into a company with a combined equity value of US$16bn.

The deal included a US$2bn revolving credit facility, a US$1.2bn five-year term loan and a US$1.1bn five-year delayed draw term loan.

The Hewlett Packard Enterprise deal was notable as one of a pair of big spin-off financing transactions that Citigroup led. The bank also served as lead arranger on a US$1.5bn and €200m revolving credit facility for drug-maker Baxter and a US$1.2bn and €200m revolving credit facility for Baxalta as the biotech unit was spun off from Baxter.

Citigroup was one of just two banks to serve as lead arranger on all four revolvers.

The bank also made a push with existing clients and was “uptiered” to either administrative agent or joint lead arranger on eight transactions A further five uptiers were expected by the end of 2015.

“This is a very relationship-driven market,” Kee said. “So if your client does a deal, you want to be in it. You don’t see the picking and choosing and evaluation of which trade is better that you might see in the leveraged market.”

Animal magic

Citigroup did not shy away from the leveraged market in the awards period to go alongside its investment grade work. The bank led retail giant PetSmart’s US$4.3bn term loan backing its buyout by BC Partners. This was the largest leveraged buyout financing of the year.

Bankers at Citigroup said that this year required extreme judiciousness as 2015 was marked by periods of volatility in the first part of the year following the plunge in oil prices and questions over growth in China and general market concerns.

This led investors to be extremely choosy on what credits they would buy at specific times of the year.

“The market is more bifurcated than it has ever been,” said John McAuley, co-head of US leveraged finance at Citigroup. “The market is exercising extreme judgment.”

This caused them to look at network equipment manufacturer Riverbed Technology closely when agreeing to underwrite the networking company’s US$1.625bn term loan backing its buyout by Thoma Bravo and Ontario Teachers’ Pension Plan. This deal came to market after other tech companies such as Tibco Software had seen some trouble.

“Every single technology deal done last year was difficult,” McAuley said.

However, Citigroup, along with Credit Suisse, looked at Riverbed as a differentiated technology company based on the financials.

“We stepped up in an environment where tech was extremely difficult, and that deal went well,” McAuley said.

Riverbed ended up increasing the size of the term loan to US$1.625bn from US$1.525bn and cutting the bond portion by the same amount. The loan was priced at 475bp over Libor with a 1% floor after initially being guided at 525bp over Libor, showing that tech deals not only could still get done but could get done on issuer-friendly terms.

Next year will see additional tech deals hit the market that were signed after the strength of the Riverbed performance, including the biggest tech deal on record, Dell’s US$67bn takeover of data storage provider EMC. Citigroup is also providing commitments for this deal.

To see the digital version of the IFR Americas Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .