Battle of the bulge

In a challenging year for many investment banks, one made aggressive use of balance sheet and expanded its origination and distribution capabilities as part of an all-out effort to become the institution of choice for mid-market clients. For big service at a small size, Stifel is IFR’s US Mid-Market Equity House of the Year.

One thing that helps a bank succeed is knowing what it wants to achieve. And after making a name for itself over the past decade as an eager buyer of assets, Stifel is now making an unapologetic effort to provide the kinds of services typically seen at much larger bulge-bracket banks.

Stifel is using balance sheet to keep expanding, and this year found itself securing bookrunner roles on more deals – 39 IPOs or follow-on stock sales above US$50m during the awards season, for a total of US$1.6bn.

The largest of these included a US$458.9m follow-on for Omega Healthcare Investors, a trio of follow-ons for restaurant operator Dave & Buster’s Entertainment, a US$297.9m add-on for data centre REIT QTS Realty Trust and independent investment bank Houlihan Lokey’s US$253.6m IPO.

Overall, one-fifth of equity issuers that raised between US$50m and US$500m this year looked to Stifel to help manage their transactions.

“We have a true and absolute commitment to being full service across capital markets products, advisory and now selective lending,” said Craig DeDomenico, senior managing director in equity and equity-linked capital markets.

“We want the middle market to look at us as sort of a mini-bulge. They don’t need to go to Bank of America Merrill Lynch or Morgan Stanley. We can really provide them the breadth of services they need.”

The bank’s penchant for acquisitions helped bolster the credentials of Stifel’s ECM division.

The purchase of Sterne Agee as well as Barclays’ US wealth management business have increased the firm’s ability to place stock with retail investors and target retail-type product.

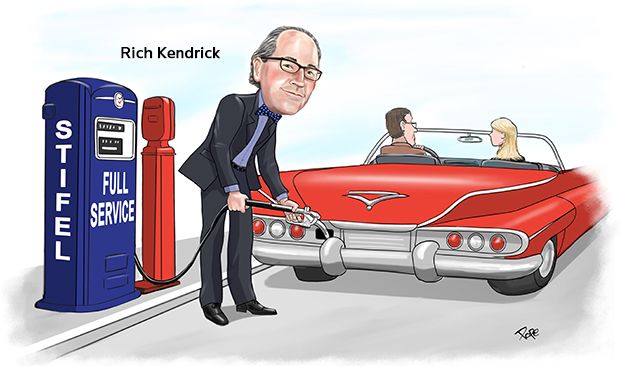

“Because of our girth in pure raw retail and our big research platform, we are going to have to be included in deals where we might not have needed to be included in the past,” said Rich Kendrick, co-head of capital markets.

In the block business, for example – a sector traditionally confined to the bulge brackets – Stifel in August took onto its balance sheet a block of stock in regional bank Talmer Bancorp sold by noted distressed investor Wilbur Ross.

“On Talmer, we caught a lot of people totally off-guard by stepping in front of everybody and buying that US$138m deal and having it done by 7pm and in the middle of August,” Kendrick said.

An indisputable measure of the firm’s progress is the number of bookrunner slots on equity underwriting deals alongside the bulge-bracket firms – something Stifel bankers acknowledge is a useful endorsement of the bank’s increasing credibility.

“As the market gets tough, not only do the bulge brackets walk away a little bit from the mid-market IPO business, but they have difficulty banking clients that are sub-US$1bn [in market capitalisation],” said Seth Rubin, a senior managing director.

Another example in the convertible equity market – and one of Stifel’s largest deals – was a US$500m convertible senior note offering for biotech ISIS Pharmaceuticals that Stifel was joint books on with JP Morgan.

“I would give Stifel a lot of credit for helping to advise us about creative ways to refinance the business by looking at different ways we could use corporate partnerships but also through private equity transactions and project-based financing,” said ISIS CFO Beth Hougan.

Like other mid-market firms, Stifel has seen extraordinary growth in its ECM revenues from healthcare and biotech in recent years. In 2015, the firm was involved in nine healthcare IPOs raising US$1.2bn, including six as a bookrunner.

But while nearly one-third of its equity deals during the year were in healthcare, Stifel sourced deals from a broader industry spread than other mid-market firms. It raised money across the consumer, energy, financial – a particular strength of its separately branded KBW franchise – industrials, real estate, and technology, media and telecommunications sectors.

“In good years and bad years, we are always going to find places to make money,” Rubin said.

To see the digital version of the IFR Americas Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .