Equity investors who have helped finance a doubling of US oil and gas production over the past few years are sitting on losses of around US$60bn, according to an IFR analysis, as plunging commodity prices destroy the economics underpinning much of the nascent industry.

US oil and gas companies have been frequent issuers of equity, selling over US$200bn of stock over the past five years through IPOs and follow-on offerings to raise funds for investment in rigs, refining plants and pipelines to support their rapid growth.

Continued visits to equity markets – as well as high-yield bond and loan inflows – helped drive a rapid uptick in production that has turned the US into the world’s biggest supplier of oil. Oil rigs in the country numbered just 179 in mid-2009, but reached 1,609 at their peak five years later.

But a collapse in oil and gas prices has left the industry’s financial plans in tatters. As losses pile up and rigs are mothballed – just 515 are now in operation – markets have wiped about a third, or US$60bn, off the value of the stock issued by the industry since 2010.

“Looking back it was clearly a bubble and things have come crashing down,” said Hinds Howard, a portfolio manager at CBRE Clarion who specialises in the industry. “Much of this equity was priced for perfection when it was issued, but you simply can’t have so many people expanding so quickly without creating problems.”

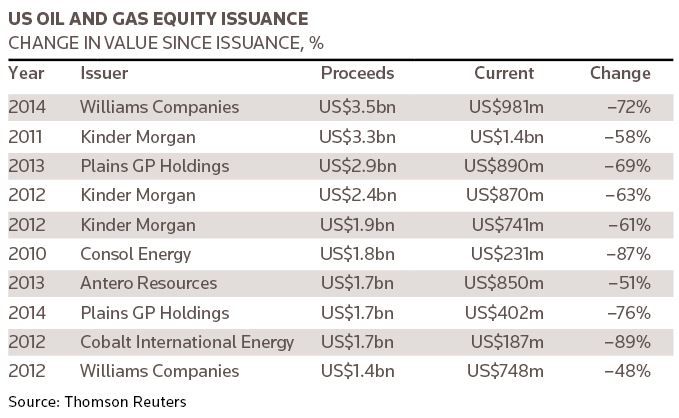

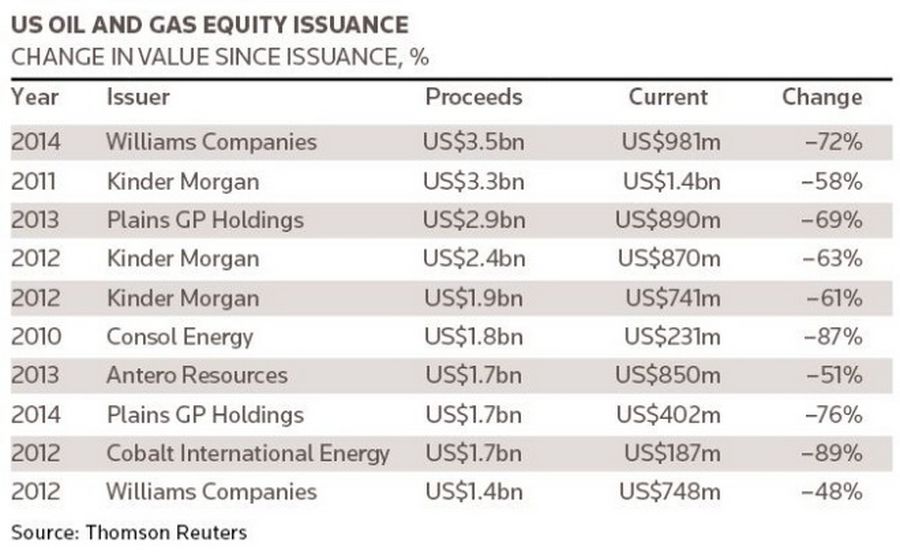

Shares in just three companies – Oklahoma-based gas services provider Williams Companies, Houston pipeline and terminal operator Kinder Morgan, and Houston energy logistics firm Plains GP Holdings – account for more than US$10bn of lost value.

Williams launched the biggest stock sale in the sector back in mid-2014, when oil prices were above US$100 a barrel compared with last week’s low of US$27. It sold US$3.5bn of equity as part of a US$6bn financing round to fund its purchase of Access Midstream Partners.

Losses

The shares, which currently trade below US$16, were sold at US$57 a piece, meaning investors that held on to the equity are now sitting on losses totalling US$2.5bn, or about three-quarters of the proceeds that were raised in the transaction.

Williams, which was founded in 1908, has sold fresh equity on no fewer than eight occasions over the last five years through itself and linked company Williams Partners to fund its expansion. A US$1.4bn stock sale at the end of 2012 has lost half its value.

“There is a massive amount of money that has been lost in the sector,” said Howard. “There were clearly too many IPOs, too much equity issued, fuelled by bankers who were happy to go along for the ride. Now there are too many projects, and a struggle to survive.”

Kinder Morgan – like Williams – has also been one of the more prolific sellers of equity to fund expansion, being responsible for three of the biggest share sales from the sector that together raised about US$7.5bn. The shares have slumped an average 60%.

“There were clearly too many IPOs, too much equity issued, fuelled by bankers who were happy to go along for the ride”

Meanwhile, shares sold in Plains GP Holdings’ October 2013 US$2.9bn IPO are down 70%. A subsequent US$1.6bn follow-on deal a year later is down three-quarters.

The splurge of capital expenditure helped transform the US oil industry into the largest supplier in the world, supplanting Saudi Arabia. But it has also left the country littered with a legacy of loss-making rigs and infrastructure that some believe will lead to a wave of defaults and restructurings.

Brian Gibbons, a senior analyst for the oil and gas sector at CreditSights, predicts restructuring rates of around 50% on high-yield debt raised by oil and gas players over the years. Still, he believes it would be too strong to call the flood of money into the sector – and subsequent loss in value – as a misallocation of capital.

“Shale was a revolution for the US and the world,” he said. “The result of all this investment [was] getting US production back up. The world really needed it, and these new rigs will become increasingly important swing producers as demand increases.”