Creative energy

A long-expected wave of restructurings in the energy sector finally arrived in 2015 as oil prices hit multi-year lows, forcing high-margin producers and servicers to seek radical cures for their ailing businesses. For stepping into the breach and offering innovative restructuring solutions that have been the hallmark of its practice, Lazard is US Restructuring Adviser of the Year.

It’s no mean feat to restructure a company in an industry that’s in the midst of upheaval – even if you’ve had plenty of time to plan for the inevitable.

The writing had been on the wall for some time in the energy sector, which saw exploration and production companies take on often unrealistic levels of debt as oil and gas prices surged. When prices collapsed in the past year, it was finally time for many of those companies to face the music.

Over and over, Lazard helped companies battle their way to solid and durable solutions, rebuilding balance sheets that could weather an ongoing industry downturn while not asking creditors to give up too much.

One great example of Lazard’s handiwork was for Hercules Offshore, a Texas-based oil rig operator that slid off the Nasdaq and into bankruptcy as crude prices fell through the floor.

Lazard found that optimising the Hercules balance sheet meant clearing away the company’s existing debt entirely – and helped devise a pre-packaged plan to convert more than US$1.2bn of senior notes into 96.9% of equity.

The plan won the support of 99% of bondholders, many of whom ponied up to fund US$450m in new debt financing to get Hercules out of bankruptcy.

Hercules CEO John Rynd said restructuring the balance sheet early in the cycle generated significant benefits. “With our new capital structure, we are much better positioned to compete successfully in the offshore drilling market,” he said.

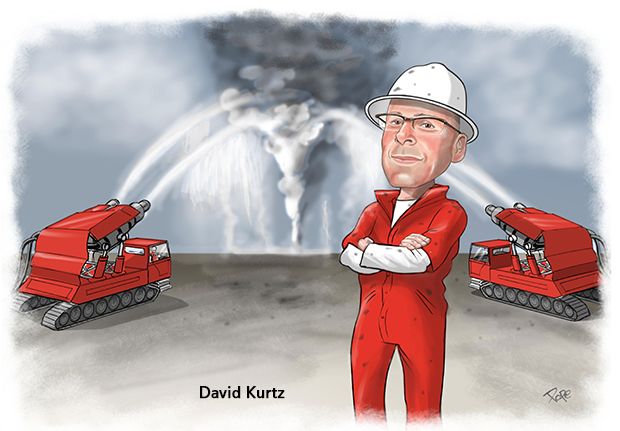

David Kurtz, the head of restructuring at Lazard, told IFR that the conservative approach – including an infusion of new financing – would be used again in the sector.

“People made the most conservative assumptions at Hercules and built the balance sheet from there,” Kurtz said.

But Lazard also knows that, when it comes to energy restructuring, one size definitely does not fit all.

It was hired as adviser to offshore drillers Vantage Drilling, Paragon Offshore and SandRidge Energy, as well as Goodrich Petroleum.

The operational structures of these companies are vastly different, and the solutions to their woes will be as well.

At SandRidge, for example, Lazard is helping reduce the debt load with a novel convertible bond exchange that swapped secured debt for a convertible.

Creditors are generally reluctant to convert debt to equity, especially if there will still be debt on the books and they cannot quickly sell the equity without impacting the share price.

But the SandRidge convertible, which gives the company some breathing room, has been described as a delayed debt-for-equity exchange. In the short term, it allows creditors to maintain the full amount of their debt claims in case of a bankruptcy.

Longer term, if the company is able to rationalise its balance sheet and the price of oil rebounds, the share price will likely rise and trigger the conversion – thus niftily erasing debt from the balance sheet.

Lazard of course does more than just energy. It created an innovative solution for Millennium Health, formerly Millennium Laboratories, one of the largest urine drug-testing labs in the US. The company, accused of billing Medicare for unnecessary tests, was nearly put out of business when it was assessed for a US$250m fine.

Millennium didn’t have the cash to pay the fine, which would have ended its ability to do business with US social insurance programme Medicare, its largest client.

“It was a race to get the deal done before the government exercised its rights to pull the company’s Medicare license,” Kurtz said – something that would have effectively put Millennium out of business.

The company restructured its balance sheet, cutting outstanding term loans by two-thirds to US$600m and handing the equity to creditors. The new owners agreed to pump US$325m into the company. Most of that went to pay the fine. The remainder was left for operating expenses.

The restructuring was the result of a tough four-way negotiation between Millennium, its creditors, its shareholders and the government, including Department of Justice attorneys and Medicare officials. It was a tricky and difficult deal – and a successful one, which showed why Lazard has earned its kudos as US Restructuring Adviser of the Year.

To see the digital version of the IFR Americas Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .