Into its own

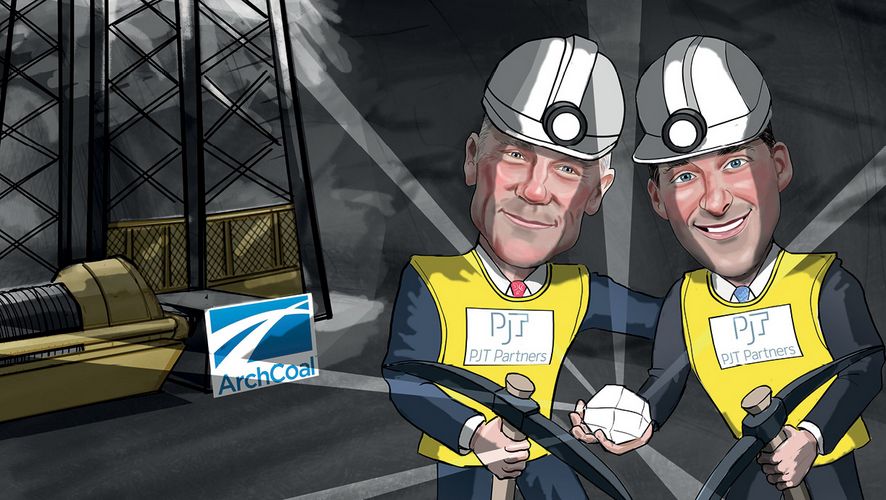

In the year since its spin-off from Blackstone, the restructuring arm of PJT Partners has picked up momentum, winning assignments from private equity firms beyond Blackstone and closing tough transactions. PJT Partners is IFR’s US Restructuring Adviser of the Year.

“Restructuring is about how you make lemonade out of lemons,” says Tim Coleman, head of the restructuring and special situations group at PJT Partners.

The crucial part is keeping warring creditors from destroying the lemons – or breaking the jug.

In another relatively quiet year for restructuring, PJT was ranked at the top of the list for closed assignments owing to the firm’s determination to push transactions over the finish line, getting the best result for both its clients and all parties involved.

It was honest broker in significant deals in energy, gaming and banking as well as the municipal space. One of the best examples of PJT’s skills was the speed with which it moved Arch Coal through the bankruptcy process in less than nine months.

“So much of a company’s success in managing the process is who they align with from a financial advisory standpoint,” said John Drexler, chief financial officer at Arch Coal.

The ongoing collapse of coal prices finally pushed some of the largest and strongest producers over the edge in 2016. PJT’s deep sector experience made it well prepared to advise Arch. Initially, the firm worked on a distressed debt exchange. But the continuing fall in prices made that unworkable.

“When we started the case we told the judge it was our goal to emerge from bankruptcy protection in September,” said PJT partner Mark Buschmann.

The firm was determined to drive the process and that meant keeping creditors engaged and willing to negotiate.

“From the time we filed bankruptcy to the time we reached a consensual resolution between the secured lenders and the unsecured parties, the entirety of the focus was to get us in position to allow those groups to arrive at a consensual agreement,” Drexler said.

That put PJT in the middle as the honest broker closing the gap between the two groups. When PJT put the creditors in a room to hammer out a final agreement it was risky but it paid off. An agreement was struck in July allowing Arch to eliminate US$4.8bn in debt. The spot price of the metallurgical coal that Arch mines was US$70 per tonne when the company filed.

The company emerged from bankruptcy protection in October. By November the price of met coal had surged above US$300 per tonne.

“Despite the fact that we’ve seen this type of market recovery without a restructuring it still would have been incredibly difficult to support the US$5bn debt load,” Drexler said.

PJT was also able to complete a 35-day pre-packaged bankruptcy reorganisation for Halcon Resources. The energy company had 15 creditor classes – including first, second and third-lien bank debt – but its cashflow was too weak to service the debts.

PJT was able to reinstate the second lien and renegotiated with the third-lien holders and other categories of unsecured creditors to get value down to the equity.

Another innovative deal saw PJT advise insurer MBIA on its position in Puerto Rico, as the commonwealth succumbed to a US$70bn debt crisis. The firm took a leading role restructuring the state power utility’s debt, creating a template for a larger restructuring of the island’s liabilities.

A key element of PJT’s success this year was that, since it was no longer part of Blackstone, it was able to advise other alternative investors in their restructurings more freely. Even under the Blackstone umbrella, the practice was strong enough to be able to pick up some prized mandates.

It is advising Apollo and TPG, for example, in casino group Caesars Entertainment’s restructuring. That long-running case may finally close if a novel approach advocated by PJT to turn Caesars Entertainment Operating Co into a real estate investment trust wins approval.

“This was one of the last pre-crisis LBOs – Apollo and TPG will retain a sizable equity interest in the company — an equity interest that probably was not worth anything before the restructuring,” said PJT partner Steve Zelin.

And in Energy Future Holding – formerly TXU – PJT was engaged by KKR and TPG, even though at the time it was still part of Blackstone, which through its GSO Capital credit investment arm was a creditor in the case, opposed to the interests of KKR and TPG.

“It was monumental for us to advise KKR,” Coleman said. “We were told that we could never win them as a client.”

Now freed from potential conflicts of interest, PJT has been successful in building its financial sponsor business, advising private equity sponsors, such as Bain and Carlyle, and their portfolio businesses, including Verso.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com