Rock-solid structure

One bank was an outlier this year by increasing structured equity activity even as market issuance fell. For taking leadership roles on ambitious fundraisings and tripling its market share, Goldman Sachs is IFR’s US Structured Equity House of the Year.

Equity-linked transactions were low on the list of preferred funding options again this year. But even though issuance fell in the awards period to an almost two-decade low – US$22.1bn versus US$34.7bn in the previous year – Goldman Sachs cemented its leadership in the asset class.

It was a bookrunner on 14 deals (for an almost 15% market share) and lead left on 10 of those, including significant trades for Great Plains Energy, Hess and Chesapeake Energy. Goldman went on to achieve a 10 percentage point market-share gain.

Goldman led deals in every active sector during the year, but it was through lead-left roles for recapitalisation and M&A on behalf of natural resources companies that the team was able to flex its muscles.

A US$2.5bn dual-tranche offering as part of the financing for Great Plains’ pending US$12.2bn acquisition of rival utility Westar pushed the envelope with a US$7.3bn cash component to finance, versus a US$4.8bn market cap.

The bank extended an US$8bn bridge loan and helped secure US$750m from Ontario Municipal Employees Retirement System in the form of a mandatory convertible preferred.

The remaining US$6.75bn cash would need to be raised (ex-OMERS) with US$2.35bn of equity/equity-linked and US$4.4bn of debt.

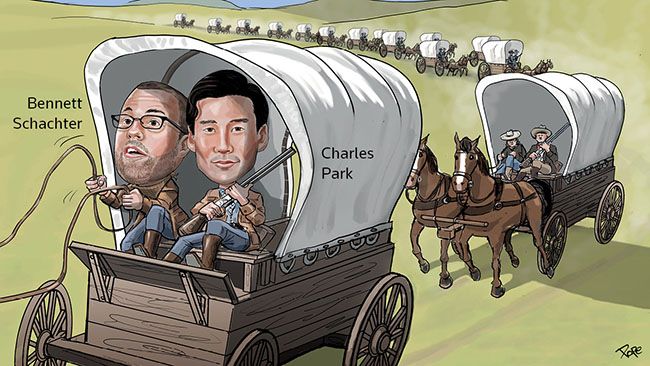

As the process unfolded, Great Plains CFO Kevin Bryant was holding daily calls with Charles Park, a managing director in ECM.

“Chuck was my best friend for two months,” Bryant said. When Bryant wondered if they could get all the equity done in one transaction – which would make it the largest overnight transaction and largest major fundraising by percentage of market capitalisation ever in the sector – Park told him: “Yes we can.”

In September, a peak for utility stocks and well ahead of the acquisition closing, Goldman Sachs confidentially marketed a US$2.15bn, two-part equity and mandatory raise. The overnight execution culminated in the placement of shares representing 40 days’ trading at just a 2.6% discount. The mandatory secured a 20% premium to the equity leg, with a 7% coupon. The greenshoes pushed the combined size to US$2.5bn.

The mandatory was an important tool in the sector, which was also employed on NextEra’s US$1.5bn issue – won by Goldman Sachs in an auction – and when Hess was looking to maximise equity credit while limiting equity dilution.

Goldman Sachs helped devise the first deal of its kind for Hess: a mandatory convertible preferred (100% equity credit) that included a call spread.

The addition of the capped call meant investors bought 8% paper with a 17.5% conversion premium, but Hess was able to raise the premium to 37.5% and potentially reduce equity dilution to below the minimum shares on the mandatory.

Only after the transaction was shown to select investors were other investment banks invited to participate on an overnight marketing.

The capped call, unprecedented on MCPs because of the high equity content, helped mitigate any equity flow back because purchases of the underlying by counterparties to hedge their risk offset selling by hedge funds purchasing the bonds. Marketing also targeted Hess shareholders to reduce pressure on the stock.

Chesapeake Energy’s US$1.25bn 10-year CB saw Goldman again working alone. The deal followed a series of liability management exercises that the embattled natural gas producer had conducted earlier in the year. In addition to a 10-year tenor, the security was subordinate to some US$8.5bn of debt.

It was also provisionally callable beginning in 2019 to provide the issuer with flexibility, but robbing investors of potential value.

“Goldman Sachs were pitching us on a convertible note, unsecured, which we have not seen for some time in this space,” said Patrick Heringer, assistant treasurer of Chesapeake Energy. “It’s essentially the way to issue equity at premium in the form of a bond at a lower coupon.”

Adding even more complexity were simultaneous negotiations with holders of existing convertibles – whose coupons were in arrears – on an exchange into equity.

“Chesapeake had been chipping away at various components of the capital structure,” said Bennett Schachter, managing director, structured equity. “The convertible really loosened the noose that was hanging around the company’s neck.”

In the end a US$1.1bn CB was priced at a 5.5% coupon and 40% conversion premium, through price talk (5.75%–6.25% and 37.5%–42.5%) and an increase from the US$850m initially targeted. The overallotment pushed the overall size to US$1.25bn.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com