The US has become the top global trading hub for over-the-counter interest rate derivatives, overtaking the UK after an exodus from Europe’s negative rate environment drove surging demand for dollar-denominated swaps.

Average daily turnover of US dollar contracts more than doubled to US$1.4trn from US$639bn between April 2013 and April 2016, according to the Bank for International Settlements’ latest Triennial Central Bank Survey of foreign exchange and over-the-counter derivatives activity, released today.

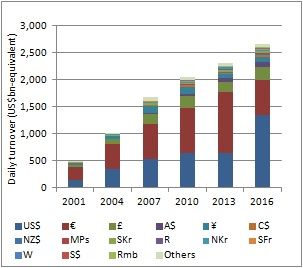

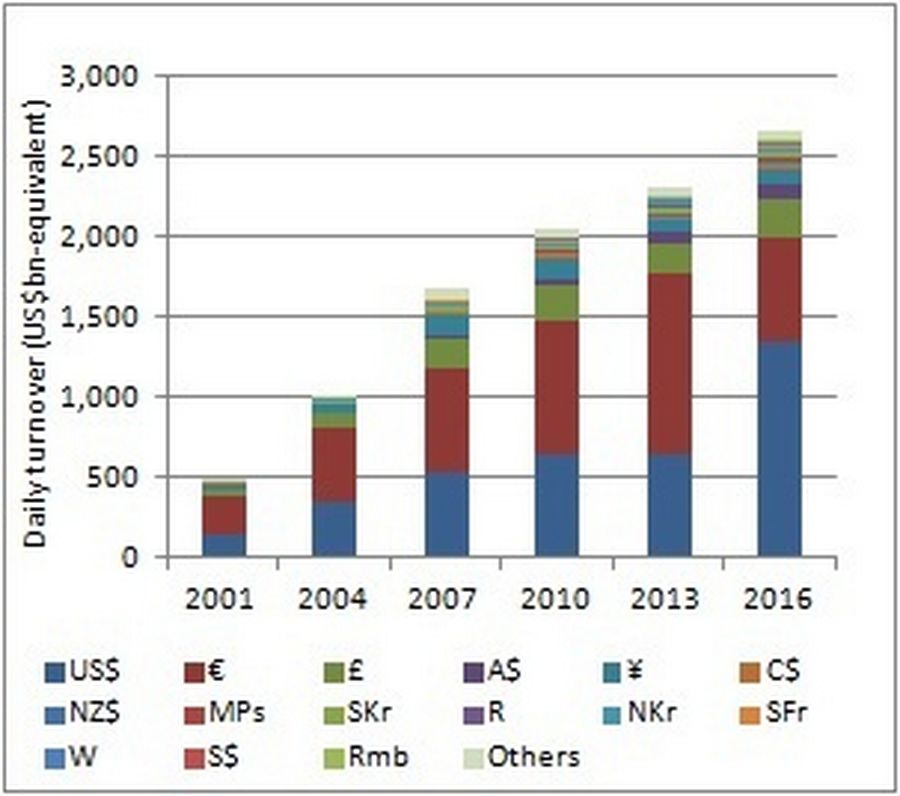

Data collected by authorities across 52 jurisdictions and collated by the BIS show that the surge in US demand contributed to a 15% increase in global OTC derivatives activity over the three-year period, with daily turnover hitting US$2.7trn-equivalent in April 2016.

“The increase in OTC market turnover for interest rate derivatives was entirely driven by interest rate swaps,” said the BIS in its report, noting a 33% hike in activity across the instruments. “All other categories of instrument covered by the Triennial Survey recorded declining average daily turnover in notional amounts.”

US-based derivatives sales desks recorded their highest share of OTC interest rate derivatives turnover since the survey began in 1995, with US$1.2trn in daily activity corresponding to a 41% share of global trading volumes.

The US dollar increase came at the expense euro-denominated derivatives activity, where trading almost halved over the three year period. Once the most actively traded segment, average daily turnover in euro swaps almost halved from to just US$638bn in April 2016 from US$1.1trn in 2013.

The UK, which accounts for three-quarters of euro swaps trading, suffered a 12% fall in turnover between April 2013 and April 2016, meaning the jurisdiction lost its crown as the world’s largest centre for trading interest rate derivatives.

Trading desks across Europe also felt the squeeze. Turnover in Germany and Switzerland fell sharply, by 69% and 75% respectively. Belgium, however, posted an increase with daily activity almost doubling in the period to US$17bn.

The shift in the balance of power from the UK to the US reflects an ongoing search for yield as investors gravitate away from markets with negative short-term interest rates. Euro swaps are currently negative out to five years and traded in negative territory out to seven years in July.

Other markets with negative short-term rates suffered similar declines. Swedish krona-denominated rate derivatives recorded average daily activity of US$19bn-equivalent - a 46% drop since April 2013. Daily volume in Danish krona swaps fell 57% to US$1.7bn over the same period, while Swiss franc contracts suffered a 5% drop to US$14bn.

Japan proved to be the exception, with yen-denominated contracts posting a 20% increase in daily activity despite negative swap rates out to seven years. At US$83bn-equivalent, however, daily volume was still almost 40% down on 2007 levels. A significant chunk of yen trading activity moved from Japan to the UK over the past three years. UK desks traded US$30bn-equivalent in yen derivatives in April 2016 - a 122% increase over the three year period for a 30% share of all yen swap trading.

Japan-based desks suffered a 16% reduction in yen contracts over the three-year period, accounting for just over half of all turnover in the contracts in April 2016.

Secular shift

Despite the decline in activity across Europe, buoyant demand for interest rate derivatives globally defies critics of sweeping derivatives reforms stemming from the G20 agreement signed by global leaders in 2009.

Many derivatives participants warned that a widespread move to central clearing and centralised trading venues would kill off the OTC swaps market or drive a widespread shift to listed futures-style products.

The data show that average daily activity is up almost 30% since 2010, before any of the reforms took hold.

A surge in US swaps activity has come alongside new requirements for US-based traders to execute standardised contracts on swap execution platforms that are regulated by the CFTC. Contrary to some concerns that the increased price transparency would lead to a drop of in liquidity, a recent study by the Bank of England found that products mandated for SEF trading benefited from reduced execution costs equating to daily savings of US$20m–$40m.

A shift towards central clearing of standardised swaps trades was evident in the survey’s counterparty breakdown, which showed an increasing portion of swaps activity executed by non-dealer financial institutions that include central counterparty clearing firms. Non-dealer financials saw their share of turnover increase to 66% from 59% over the period, while trading between reported dealers accounted for just 26% of total volume, down from 34% in April 2013 and the lowest level on record.

OTC interest rate derivatives turnover by currency

Source: Bank for International Settlements

Spot FX decline

In foreign exchange markets, the survey showed a jump in FX derivatives even as spot trading declined for the first time since 2001. FX swaps traded US$2.4trn per day, up from US$2.2trn three years ago, while daily turnover in FX forwards was up 3% at US$700bn.

Spot activity was down 15% at US$1.7trn daily, despite heightened activity in Japanese yen on the back of monetary policy developments during April.

The US dollar retained its position as the dominant currency, representing one side in 88% of trades during April 2016. The euro retains second place, but its share fell to 31% - below the 2010 peak of 39%.

Five markets - the UK, US, Singapore, Hong Kong and Japan - increased their share of the FX market, accounting for 77% of activity, up from 75% in 2013 and 71% in 20