For many years sovereign debt was treated like a risk free asset. The discovery that it was not has shaken the market to its core, and had implications for other forms of debt, where the state was regarded as its guarantor of last resort. Investors in Western debt have had to look to their emerging markets peers to see how business should be conducted – a sign that rationality is returning to the market. Savita Iyer-Ahrestani reports.

Some buyers of sovereign debt have undoubtedly been enjoying this year’s roller coaster ride of headline-driven, rapidly fluctuating spreads. Hedge funds and prop desks at banks have participated in the volatility that’s characterised the secondary market for sovereign bonds in the aftermath of the Greece debacle. Sovereign bond market experts believe they will continue to drive this market for the foreseeable future.

However, all investors – be they opportunistic or dedicated, long-term sovereign bond buyers – must be extremely mindful of the underlying fundamentals. There are big questions being asked about the future fiscal and economic health of sovereign nations around the globe.

Most importantly, the rollercoaster set off by Greece has shown that no sovereign in the industrialised world – not even countries like the United Kingdom and Germany – is immune to credit and solvency problems. Gone are the days of the unconditional Triple A rated Western European nations, whose debt investors could buy with their eyes shut. Buyers of sovereign bonds have matured in terms of their analysis of the risk associated with sovereign debt, said Mohamed El-Erian, CIO at Newport, California-based bond investment firm PIMCO. Traditionally risk has only been seriously considered for the debt of emerging market countries.

A brave new world

“In the old days, we had a self-contained park of industrialized countries that traded according to interest rate risks and another park of emerging market countries that traded on credit risk.” El-Erian said. “But the new world is one where there’s a spectrum of countries, a huge category called ‘sovereigns’ that have to analysed but is much harder to analyse. It’s a lot more fun, but it’s also a lot harder.”

In this new world, any investor – a hedge fund or a dedicated institutional investor – must closely monitor the market at all times. “It is no longer about taking a position in a currency and holding onto an investment. You have to be aware of the specifics of each individual country,” said Tom Lydon, president of Irvine, California-based Global Trends Investments, an investment advisor managing money for high net worth individuals. “No matter what sort of an investor you are, you now have to be mindful of the long-term economic outlook of these nations regardless of how attractive their bond yields may be in the short-term.”

Times have changed from the days when investors could ignore the creditworthiness of industrialised nations and invest in their debt to hedge other more risky investments. Now, analysing these sovereigns for their individual credit risk is critical, said El-Erian, creating a challenge that investors must approach in a different way.

“A few weeks ago, Greece was coming with a new issue and they said it was being directed at emerging market investors in the US,” said El-Erian. “People with emerging market backgrounds are now being used to look at industrial countries.”

Contamination by association

Since the Greece debacle, investors have tended to paint all sovereigns with the same brush. In the short term, the sovereign market’s tailspin has caused the usual flight to quality associated with crises. But whereas emerging market countries recovered very quickly from the downturn, investors were slower to start differentiating between industrialised credits. Spain, Portugal and Ireland were treated in the same way as Greece and traded down in tandem. It was only after the announcement of a bailout package for Greece that some investors began to distinguish more carefully between different sovereign credits in Europe, assessing them individually.

“We’re now in a situation where Greece is out there on its own,” said Nathaniel Timbrell-Whittle, responsible for SSA DCM coverage at BNP Paribas. “Greece has been very volatile for a while now but recently, Spain and Portugal have only widened by a few basis points, so investors are increasingly looking to distinguish between different sovereign credits in isolation.”

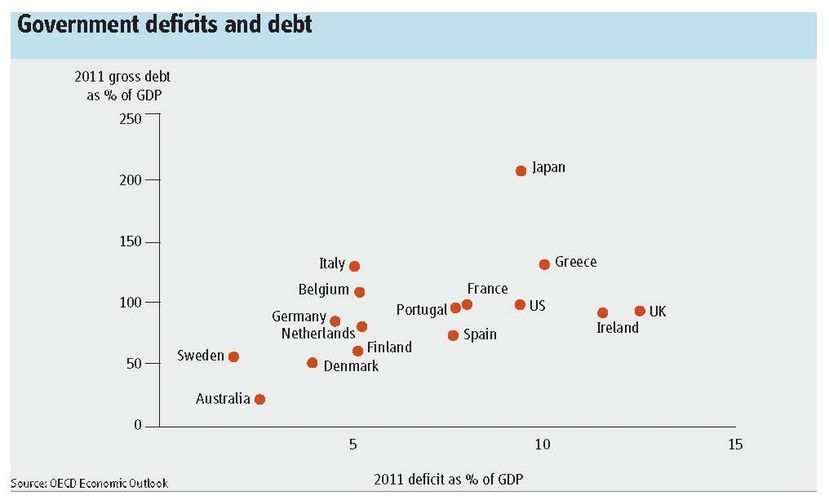

With sovereigns now an asset class unto themselves, investors have to focus on each country’s long-term fundamentals. They must analyse the fiscal and monetary disciplines of each country, at how both macro and micro factors will influence individual countries, their political situations and the volume and composition of outstanding debt they have. This will determine how they trade in the secondary market. There are opportunities to both make and lose money in the sovereign space, said Ron D’Vari, co-founder and CEO of New York-based NewOak Capital, and investors can play the spread between different credits, for example a risky name like Greece with a safe one like Germany.

“Germany and France are different from Greece,” explained D’Vari. “They are going to be affected by who they have to bail out, whereas the internal situation of Greece and what impact a rescue package has is going to matter in analysing that country. But ultimately, the fundamentals are going to matter.”

The domino effect

According to Simon Ballard, director and senior credit strategist at RBC Capital Markets in London, the secondary sovereign bond market is also becoming a far greater driver of corporate credit risk. In the past, traditional and dedicated corporate bond investors only had an exposure to sovereign debt through the hedges they put on their portfolios. Now, with sovereign debt trading as a standalone asset class, corporate bond investors are being forced to trade with a view to the health of underlying sovereigns. They have to take a view on the sovereign fundamentals wherever a corporate is domiciled, Ballard said, adding another layer of complexity.

“Not only are you seeing far greater volatility in the sovereign space, but if austerity packages do happen in places like Greece, they would certainly contain measures that would impact certain corporate credits,” said Ballard. “For example, a windfall tax on telecoms or utilities would influence the trading of bonds in those sectors.”

Yet bailout packages such as the one proposed for Greece and the austerity measures they inevitably contain are vital in many of the industrialised nations, said Ballard. Many countries need a comprehensive reassessment of their economic and fiscal profiles. There is no easy way to do this, but there is no other choice. Every industrialised country needs to analyse its budgetary and fiscal discipline, which, it is hoped, will eventually reign in the volatility in secondary spreads – even if spreads in general remain wide. Investors will eventually take a more granular and nuanced view of individual sovereigns.

The appetite for sovereign debt is still high. Recent issues in the primary market have fared well, especially on the emerging market side, where countries like The Philippines have been able to issue bonds at very competitive pricing. Liquidity is good and investors are prepared to buy debt from issuers that are further down the credit spectrum.

And even Greece saw its most recent bond issue sell, though it had to pay up for it. Investors seem willing to take on another issue should it come. However, primary market investors aren’t going to write blank checks either, said PIMCIO’s El-Erian: “The spotlight is now shining on the creditworthiness of all sovereign issuers and a lot of questions are being asked.”