Eurozone yields have been leading the charge, largely due to a turnaround in excessive ECB QE expectations. With 10-year Bunds having firmly breached the 1.00% level, the question now is what happens next?

Technically there will be a lot of focus on the 10-year Bund yields around the 1.12/1.125% level, which acted as support during 2012/13 and then shifted to resistance late last year (seehttp://link.reuters.com/dys84w). A break here would certainly help to pressure more structural longs, who had been hoping to invest in an asset with lower volatility and predictable yield.

The degree of pain should not be overestimated, though, as many of these buyers will be buy-and-hold types. But for those not in this camp, it will be a difficult end to the half-year and quarter given the recent price action. Multi-asset managers will have the luxury of taking some profit on their equity holdings to help compensate for the dismal returns on bonds. We are likely to see volatility remain a feature for both equities and bonds heading into quarter-end.

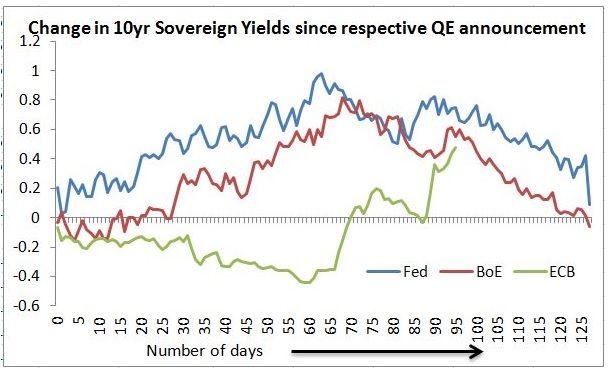

A roadmap that could provide a useful guide is the lesson from the early months of Fed and BoE QE. After QE was announced by the Fed and BoE in March 2009, yields on 10-year Treasuries and Gilts moved higher by 80-100bp in the following three months. And indeed we were surprised that 10-year Bunds did not follow a similar pattern after the ECB QE announcement in January.

While 10-year Bund yields are up some 100bp from their April lows, some 45bp of this move was largely a reversal of excessive optimism over the impact of QE. If Bunds are to follow the pattern of Treasuries and Gilts back in 2009, then we could be looking at a further 15-45bp upside on 10-year yields.