The noise in and around Deutsche Bank’s AGM last week was all about who’s going to replace Josef Ackermann when he retires in 2013. But as there’s little concrete news at this point, I thought I’d focus instead on an intriguing comment Ackermann made at the AGM in response to a question.

Someone asked if Deutsche Bank had the potential to rise to the top in investment banking, to which Ackermann replied: “I can imagine that one day we could overtake Goldman Sachs.”

The first thing to note is that Ackermann sees Goldman as the firm to beat. No surprises there; that’s generally, if begrudgingly, accepted across the industry. But it’s interesting nonetheless to hear it validated by a rival bulge-bracket CEO.

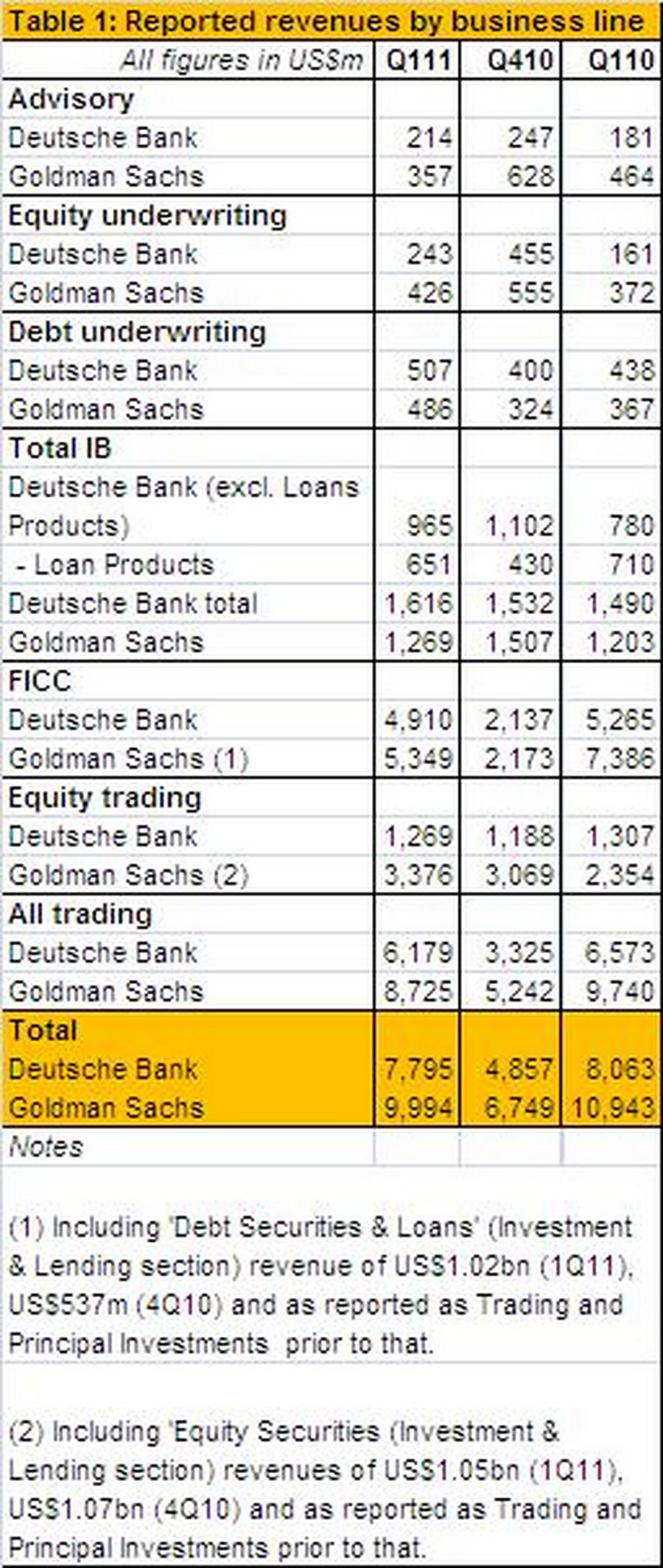

So I took a look at the 2011 year to-date deal volumes and fees earned by both houses across advisory and capital markets, as well as reported first-quarter trading revenues. While it’s not exactly a one-sided contest, there’s no doubt that Deutsche Bank has some way to go to catch Goldman, which in fairness will take some beating by anybody. Goldman generated net revenues from advisory, capital markets and trading of just shy of US$10bn in the first quarter of 2011 (see Table 1), while Deutsche Bank came in at US$7.8bn. That quantum of difference has been pretty constant over the past five quarters.

However you cut M&A or ECM, Goldman is well ahead of the field, both from a league table and revenue perspective (see Table 2). DCM, one of Deutsche Bank’s marquee products, is a different story. Goldman inhabits the bottom half of the top 10 or below in league tables and doesn’t profess to be a flow DCM house, unlike Deutsche. Over the past five quarters, Deutsche Bank has averaged plus 24% to Goldman in debt underwriting in net revenues terms.

In advisory and equity underwriting, though, the differences are more marked in Goldman’s favour. In advisory, the US firm has on average reported net revenues 2-1/2 times bigger than Deutsche’s. In equity underwriting, Goldman has averaged plus 72%. On the hard performance data, in summary, it’s hard to see anyone taking Goldman’s crown at this point across the range of product segments.

Now or never

Of course, Goldman’s reputation as the “world’s best” investment bank is a huge advantage, even if that position is now somewhat tarnished. Softer factors, such as legacy, history and reputation, make it notoriously difficult to persuade naturally conservative corporate clients to switch their allegiances.

Doing that takes time and patience. Investment banks need to nurture clients over years, often involving offering services and support pro bono to start with in the hope of getting business in the future. To become the trusted adviser at the centre of your client’s world is a long haul.

But there are a lot of people out there forecasting the demise of Goldman. I’ve been arguing for some time that if anyone’s going to get Goldman, it won’t be competitors; it’ll be regulators and politicians backed by the baying crowd. The deafening cacophony of criticism directed at the firm is pretty damning.

For the past three years, Goldman has been repeatedly held up as the example of everything that’s wrong with Wall Street and the global financial industry. Even if a lot of criticism is misguided, wrong or plain vindictive, if it goes on for long enough, it’ll have to have some sort of impact.

At this stage, there’s no hard evidence that Goldman is losing clients. But you do wonder where it’s all going to end. Senator Levin hasn’t had his pound of flesh, and the full effects of Dodd-Frank haven’t yet kicked in. Of course, Deutsche has been implicated or is under investigation for a host of supposed misdemeanours, and recently lost a case in the German courts over a structured derivative it sold to a client. So it’s not as if Deutsche is in the clear on the reputation front.

All of that notwithstanding, though, I get the impression that if things are going to change, the next year or two offers the best opportunity for some considerable time. This could be the perfect time for competitors to turn up the heat.