Broader appeal

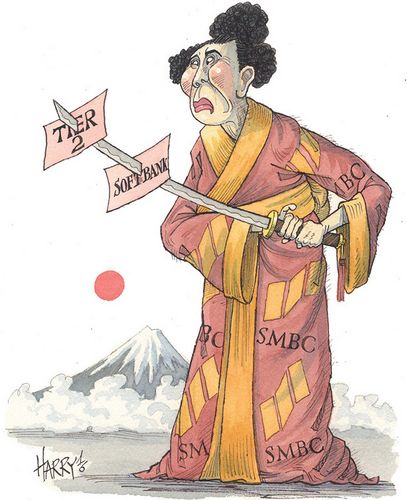

The yen market in 2016 had to react to unprecedented market conditions as the Bank of Japan took radical steps to reinvigorate the economy. For doing more than its peers to deepen the market for higher-yielding assets and reach new investors, SMBC Nikko is IFR’s Yen Bond House of the Year.

SMBC Nikko began 2016 as it ended the previous year, with a series of popular Samurai bonds for global financial institutions, but it was its performance after the introduction of negative interest rates in late January that set it apart from its competitors.

After the Bank of Japan’s move, senior bonds from Double A rated issuers such as Pohjola Bank and Westpac no longer offered enough yield to tempt Japanese investors, despite the spread over JGBs. After a period of adjustment, higher-yielding paper was now the focus, whether that was from issuers from a few notches down the credit curve, with longer tenors or subordinated structures.

When the Samurai market reopened in the second quarter, SMBC Nikko brought Credit Agricole to market with a concurrent ¥130.1bn (US$1.2bn) senior bond with tenors of five, seven and 10 years and a two-part Tier 2 offering, meeting the maturity targets and risk tolerance of a varied group of investors.

SMBC Nikko spent a lot of time on investor relations, including non-deal roadshows for potential new issuers, and spent time engaging regional investors, who would later prove crucial to the success of long-tenor deals and bank capital trades.

There was one group that was missing out, though. Following extensive internal training and customer suitability tests, SMBC Nikko brought French banking group BPCE to the market for a repeat of its concurrent senior and bank capital offering from December 2015, but this time added a Tier 2 tranche aimed at retail investors. This was the first time any issuer had targeted retail investors for a Basel III-compliant Tier 2 Samurai.

The retail tranches of a 10-year bullet and 10-year non-call five raised a combined ¥53bn, despite being priced only a few days after Britain voted to leave the European Union, and prompted other banks to seek internal approvals to allow them to market to the same investor base in future deals. SMBC Nikko had sold yen Tier 2 bonds targeting Japanese retail investors before, so it had already come up with testing criteria for its sales people.

In September, SMBC Nikko was a bookrunner on Standard Chartered’s ¥45bn five-year bond, the first Samurai offering from a British institution to fall under total loss-absorbing capacity rules. Despite the uncertainty of the Brexit vote and the complex British bail-in rules, it printed a respectable size and paved the way for a similar deal to follow a week later.

HSBC Holdings’ subsequent ¥181.8bn three-tranche Samurai, its first TLAC-eligible offering in yen, was the standout deal of the year, drawing strong demand across three tranches from five to 10 years.

SMBC Nikko had earlier helped lead Citigroup’s first TLAC-eligible yen offering in the Pro-bond market, since US bank bonds sold through the Samurai market do not count towards TLAC.

Citic’s debut Samurai in October was another highlight. The first Samurai from a Chinese issuer in 16 years drew a huge oversubscription, reaching ¥200bn for a ¥100bn deal, and showed the strength of demand for paper from new, higher-yielding markets. SMBC Nikko had helped bring ICBC to Japan for its debut Pro-bond a few months earlier.

The bank also showed its mettle when the Republic of Indonesia returned to yen, this time printing ¥100bn across three and five-year tenors, and for the first time not requiring a guarantee from Japan Bank for International Cooperation on any tranche. The order book also showed increased demand from regional and other investors, repeating a theme that was evident in deals throughout the year.

JBIC still had its place, though, guaranteeing a ¥80bn 10-year transaction for Petroleos Mexicanos, or Pemex, in its first Samurai offering this decade, again via SMBC Nikko.

All in all, SMBC Nikko racked up ¥285.6bn of league table credit for Samurai bonds during the period, topping the table with a market share of 19.6%.

In the onshore market, SMBC Nikko was involved in most of the largest trades for the likes of Panasonic, Sony and debutant Fast Retailing. While locking in low yields for issuers, it enabled investors to access higher returns through hybrid bonds, including a role on SoftBank’s ¥400bn 25-year non-call five, the first hybrid to be sold to Japanese retail investors.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com