To view the digital version of this report please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

IFR: Welcome to this IFR Roundtable on the Future of Debt Capital Markets. The bond market finds itself at a fascinating point, not least because of where we are in the cycle of quantitative easing but perhaps more strategically because of the changing relationship between DCM and bank lending amid expectations that the lending cycle won’t return to what it was pre-crisis, given the regulatory burden and the ongoing reappraisal of client relationships.

There’s a clear expectation that DCM will pick up a lot of the slack where the lenders are withdrawing. Is that justified or even reasonable? Assuming that we do get a better take-up of DCM, who will the new issuers be and what form will issuance take?

There are a number of sub-themes within this broad topic. Can specialised bank risk such as infrastructure, shipping and real estate really be institutionalised and securitised in the bond market? I think it’s an open question at this point. Will a pan-European private placement market emerge to rival the USPP market? How will SMEs finance themselves? What happens when banks are done deleveraging? What happens when central banks withdraw stimulus?

Some big subjects, to be sure. In short, are we heading towards a fundamental change in DCM? Demetrio, can you make some introductory comments?

Demetrio Salorio, Societe Generale: What I would say when assessing the future of DCM is, to one of your points, Keith, I don’t believe the bank loan cycle is going to come back and I really believe there will be a fundamental change in the way financial institutions use their balance sheets. It’s not only a matter of quantity of balance sheet that is going to be put at the service of corporations; it’s also a matter of the price that financial institutions will need to charge for loans to be able to generate a minimum return on equity on a much bigger equity base. I don’t think loans are going to be competitive compared to bonds when financing the strategic needs of corporates, for instance, so DCM is going to become much more important as a financing tool in general terms among our client base. That’s going to bring changes; changes in the sense that we’re going to see new actors, we’re probably going to see new products and we’re going to see new markets. You mentioned private placements. Why not? It’s something that is going to develop and we’re going to see new asset classes being offered to institutional investors in Europe.

So I think it’s good news, in the sense that borrowers will have a much more varied way of financing themselves, not only with banks but as well with other agents like investors. As DCM professionals, we’re looking forward to that.

Jim Esposito, Goldman Sachs: Setting the backdrop for this discussion is important because at the heart of it is what happens on the back of European bank deleveraging. If you actually look over the past couple of years, the dirty little secret in Europe is most people assume banks have started the deleveraging process and have already gotten a lot smaller.

The data actually suggest something quite different. Over the past couple of years in Europe, in aggregate, if you add up the assets side of European banks’ balance sheets, they’ve actually become larger, not smaller. If you think about ECB intervention and what LTRO was supposed to do, it helped avoid a violent deleveraging process in Europe that was hugely important and impactful for the financial system.

But now we’re supposed to be getting to a phase in the cycle where banks are doing more of a managed deleveraging, but the data do not really suggest that’s happened. So a lot of these trends, I would agree, are playing out. They’re going to play out in a more acute manner. But the question is: when do banks start to get on to doing the hard work they need to do getting balance sheet sizes down?

Banks have probably identified an order of magnitude of US$2trn of assets that they would like to get off their books. There’s been episodic sales of portfolios, aircraft, shipping and the like, but there just hasn’t been that much activity and I think there’s still a bit of a disconnect between where those assets are marked and where they’d actually get sold in the marketplace.

The banking system may or may not be adequately capitalised at this juncture, but there are very few banks that can take a large capital hit. So as the markets have rallied over the past 12 months, we’re probably getting closer to a point where some of these large portfolio trades can happen. But that type of activity has been far less than most of us would have predicted.

Two or three years ago, certainly pre-LTRO, a lot of us were setting up our businesses to play the deleveraging trend to get in the middle of some of the distressed trades we all thought were going to happen. Those have been few and far between.

Giles Hutson, BofA Merrill Lynch: The other thing you have to remember is that for many of these assets there is no market. For example, a lot of these things are unfunded, and therefore there isn’t a secondary loan market in Europe like there is in the US. Unfunded commitments can’t be sold as easily as funded commitments. So deleveraging happens via maturity and non-refinancing as opposed to selling the existing asset, which takes time.

If you look at the average duration of loan books, which is three to four years, that’s an appropriate timeframe to think about the deleveraging cycle. Doing it this way, you don’t have to take the hit from a capital perspective; you can earn your way through it to some extent, and you can find a secondary market through redemption rather than through secondary disposal.

Claus Skrumsager, Morgan Stanley: Having said that though, there has been a structural shift in banks’ behaviour. The structure of debt issuance volumes this year has been significantly skewed towards corporates, which was not the case pre-crisis. Pre-crisis, the credit space would be 70% FIG, 30% corporate. This year it has probably been 55%-60% corporate. So that is definitely happening and probably faster than people appreciate and moving towards a more US-type capital market.

Another thing I would say – and this is driven partly by regulation but more so by markets – is since the suggestion of PSI in early 2010, the average bank in Europe is funding itself in unsecured more expensively than the average corporate so it is a lower return business to lend to investment-grade corporates. So that’s really driven the change.

I think in terms of the portfolio sales we’ve certainly seen a big pick-up, especially in commercial real estate portfolios being prepared for sale or which have been sold already. The interesting thing, to your point, Keith, about who’s going to take up the slack is we have seen private equity firms play a very significant role, which brings us on to the whole shadow banking theme.

Peter Charles, Citigroup: There have also been developments around funding of SMEs. You can see across Europe a number of specialist funds have been set up by asset managers in the UK and insurance companies in France and Germany that are specifically there to lend to SMEs. Some of that is getting done bilaterally and some of those investors are doing their own origination; some of it’s getting done via the banks.

Then also on the project finance side, you can see the same thing beginning to happen. Investors are beginning to gear up their capabilities on the project financing side and are building project finance teams. So I think there is a shift that’s naturally taking place and the economics are really dictating it and making it encouraging for investors to look into these areas.

Bryan Pascoe, HSBC: Those things are happening but I think the pace will still be quite slow, because what the market hasn’t yet got to grips with is dealing with illiquidity. It’s putting together these portfolios that can’t find a home off the bank’s balance sheets because the investor base hasn’t yet been able to price them at a level that the banks are willing to sell them. So you have this disjoint around pricing which can be extrapolated into other asset classes and which I think is probably impacting the ability of banks to delever.

I agree with Peter’s point that it’s inevitable that we’re going to move down that route. And to Claus’s point, because of the issues we have about negative funding costs etc, you end up doing a huge amount of analysis around corporate relationships – where the ancillary’s going to come from, how do you improve the returns, what kind of business do you need to be doing to ensure that you can make that a profitable relationship – because clearly, purely on a lending spread, the dynamics don’t add up.

So I think what’s basically happening is that there’s a concentration around a lot of the bigger clients who have a lot of ancillary business and who have a global wallet that makes sense for banks to be involved with.

Charlie Berman, Barclays: Keith, bringing this back to the title of the panel, to my mind a lot of what we’ve talked about comes down to the issue of central bank stimulus. It’s important to remember we’re talking about trends and the future from the point of view of a position where we are nowhere near business-as-normal.

We are in an unprecedented environment of a central distortion of markets. When we look at the balance between bonds and lending, alternative suppliers of credit and all of these factors, it’s against the backdrop of a world awash with official money. That is not a natural situation. It goes to Jim’s point about we didn’t see the deleveraging deliberately because the centre took away the need to sell and put everybody, whatever position they were in, on life support.

So the day of reckoning didn’t come but the day of reckoning will have to come. Regulators want it to come but they’re on a different policy track to central banks and monetary authorities. Regulators want to bring in all the controls that will prevent another crisis but central banks want growth. So in terms of trying to determine what it’s going to look like, it’s very difficult for us as bankers against such a totally distorted underlying end-market.

Jim Esposito, Goldman Sachs: I think Charlie’s spot on with that. The way I’d say it is we still don’t know where supply meets demand for unsecured funding for banks. To the point about deleveraging and what the size of the European financial system should be, we know it’s outsized compared to the underlying economies. In the US, the banking system in aggregate literally matches one-for-one the size of the US economy. It’s in perfect harmony. When you look in Europe, whether it’s the EU or in aggregate, the banking system is multiple times the size of the underlying EU economy and certain countries on the Continent are much more dramatic or drastic than that. But we don’t yet know how much unsecured funding is going to be available for banks going forward, given banks are still leaning into the LTRO for, whatever it is, US$750bn in size.

I think that’s going to be an incredibly important question to get on to when we live in a post-stimulus world. How big banks can be and how they size their balance sheets will be completely correlated to how much unsecured funding is available. We don’t know the answer to that question yet.

IFR: So based on the conversation so far, we’re saying we’re in unchartered territory, we’ve got central banks manipulating markets for reasons they clearly think are sound and we don’t know where we’re going in deleveraging. We’re in a bit of a fog really, aren’t we Fabio?

Fabio Lisanti, UBS: You say we’re in a fog but I think we have seen a change in behaviour. We are being very selective around the type of business that we look for and there have, I think, been developments in the corporate market. We as banks have explained to our clients the shift that we’re going through and they’re behaving and reacting accordingly.

In Europe, we still have this problem where there’s an expectation that banks will lend to corporates whereas the US has shifted away from that. So relationship lending unfortunately is still there but I think over time that will fall away. Our clients understand that there needs to be a shift in our behaviour from a regulatory standpoint.

Charlie Berman, Barclays: But is this really any different to where we were 10 years ago in terms of banks’ attitude towards lending? I’m sure we all sit in approval committees and we discuss this deal and that deal, XYZ company wants to acquire ABC company etc so OK what’s the M&A wallet, what’s the DCM, ECM take-out, how much bridge do we have to put together? I don’t see any difference in those conversations.

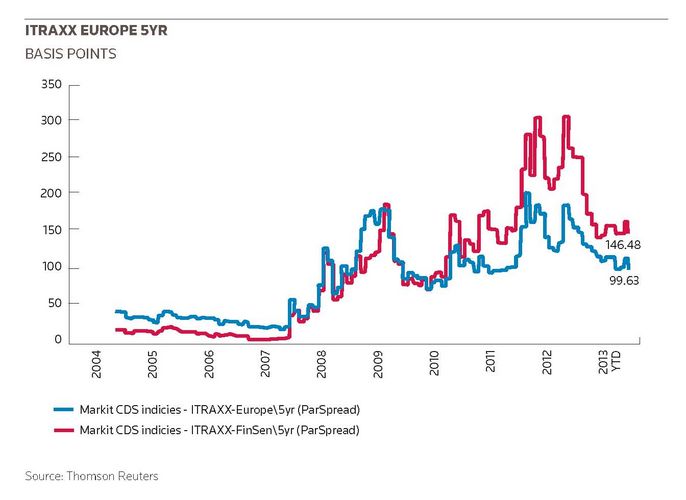

Sandeep Agarwal, Credit Suisse: The difference I see, Charlie, is that you’re talking about short-term bridge lending as opposed to the loan book or revolvers, which have a three to five-year commitment. If you look at the iTraxx Main today relative to the financials index, you will see that the Main has been trading through the financial index for the last four or five years. If you go back 10 years, the credit story was such that the banks were able to borrow cheaper than the corporate sector in general so bank lending was a sensible route.

Couple that with capital requirements which make the cost of loan book funding very expensive, not only because of capital cost but also because of liquidity cost. Therefore disintermediation of banks will happen for the higher-grade corporates, where the cost of borrowing is cheaper than that of the banks.

I don’t think we can extrapolate this to the SME sector or to project finance, which are long duration or higher credit-intensive cases and which I don’t think will be able to borrow from the capital markets at the price the banks can. So I suspect that some level of loan book exposure to those assets will be required. Now it may well be that the non-regulated sector may be the better financing source than the regulated sector like the banks, because of capital requirements.

But I think such shifts have yet to materialise. I think on the deleveraging point, my only comment would be, and maybe it’s not true for everyone else, but where I get confused is IFRS accounting versus US GAAP which changes the size of the balance sheet in Europe on a relative basis so significantly that you can get confused whether deleveraging is happening or not.

Bryan Pascoe, HSBC: I think 10 years ago, the average funding cost for a Double A bank in five years was Libor plus an eighth, right? You could be pretty much guaranteed that every time and that was considerably cheaper to where we are now. So I think the relationship dynamic around lending has definitely changed.

Charlie Berman, Barclays: But my point is the terms have changed but as far as process that we as capital markets professionals have to go through, where is the fundamental difference? Do you think major companies have any less ability to finance a major acquisition? The composition of that package may be different but I don’t see the process having changed at all.

Peter Charles, Citigroup: Maybe the impact on clients is a little less, but I think within the banks, clearly there’s a lot less focus purely on revenues and a lot more on returns.

Ryan O’Grady, JP Morgan: The attitude of the borrowers has changed as well. I would contest that the reinforcement of the trend line re: European bond markets getting bigger is as much about corporates not wanting to have all their eggs in one basket. Doing the incremental bond for a corporate on the margin is a good idea when they look at how their overall exposure to banks adds up.

Corporates are relying on banks for letters of credit, working capital, trade receivables and all kinds of things. The notion that they also have their term financing with banks is an issue for a lot of corporate treasurers and CFOs. I think they now see the role that our market offers. I’ve been quite encouraged by that.

Demetrio Salorio, Societe Generale: Coming back to Charlie, I really don’t think that there is a problem of capacity. OK, so a big corporate wants to conduct an acquisition with bank loans. Are they going to be able to find loans for that? Yes, but I insist on the point of the price. I think that if a corporate wants to fund an acquisition with a fully-drawn five-year loan, the spread which is going to finance all that is not going to be competitive compared to the bond market.

So beyond the capacity that can be put in play – and we need to wait to see what happens after the deleveraging process and the unveiling of capital buffers for banks – I do believe that we are going to see a bond market which is more competitive in terms of price than the banking market.

Claus Skrumsager, Morgan Stanley: I think it’s very important also to distinguish between liquidity and capital. There’s no doubt that there’s excess liquidity in the system, I think, Jim, you highlighted that. That’s part of why leverage hasn’t come down. There’s at least €200bn of excess liquidity in Europe alone. So it’s more about the capital consequences of what you do with a leverage ratio which is at least half of what it used to be 10 years ago.

The velocity of balance sheet and capital is going to be absolutely critical. So we have definitely seen in our firm a transition away from asks of long-term commitments into bridge commitments. Clients are much more willing to accept shorter-dated take-out financings and they are available to our common clients here in any size. Some of the situations that I think some of us are working on are very large and we don’t see the provision of capital as an issue.

IFR: Martin, can I bring you in here? Can you comment on the transitioning of financing from loans to bonds? Where do you come in on this?

Martin Egan, BNP Paribas: I agree with much of what’s been said. It’s very clear to me that the trend has turned in Europe so the dependence upon bank lending which was so pronounced, is going but this is not an overnight thing. It’s already happening in the euro zone periphery, especially where the domestic banks have high borrowing costs. They’re a strain in the system but they haven’t got the liquidity to provide to their corporates etc. The money has to come from somewhere. So I think longer term for the bond markets, that’s very good.

Against that, if you’re involved in a loan today for a British or a German, a Scandi or a Dutch corporate, the pricing of loans in that marketplace is minor, it’s truly minor. There is absolutely no shortage of liquidity at all to go into those large deals. Large European corporates are already into the great mix of loans for short-dated activity, capital markets for longer-dated activity. The real pendulum is in the next level down: the companies that have historically always been dependent upon bank lending.

They now smell the coffee and they’re beginning to look at capital markets. Unfortunately it’s not a short-term process; it will take time and education. I think many are forced into a position because of the constraints in the marketplace, which I think to me means that the European marketplace will be attractive longer term. However, there are many counterparties involved, there are restrictions in place and there is uncertainty, which suggests to me that the process will be quite painful along the way.

For the time being, many banks around this table are still actively lending in the marketplace. They’re not necessarily doing long-dated project financings, and to me that’s going to be critical long-term. How do you fund the infrastructure build-up that’s required? But the market is evolving and it’s evolving in a pretty good way. Of course, economics is relevant but I think most counterparts, of course the banks but I think borrowers generally, have woken up and realised the conditions we’re in and realise that we have no option. To me that’s the most relevant point.

Deleveraging in Europe is one thing but we’ve been talking about disintermediation for years. Has it really happened? To some extent. The trend is set but It has a huge way to go.

IFR: Hakan, where do you stand on this debate and some of the pricing issues that have been articulated to date?

Hakan Wohlin, Deutsche Bank: Like Martin, I agree with pretty much everything that’s been said around the table. Jim said the European banking system is much bigger relative to the size of the economy than the US, where the two are in harmony. On that point, it’s worth noting that European banks are a lot more international in general terms than their US counterparts so you have to adjust for some of that.

In the deleveraging process, it may not necessarily just be Western Europe clients who are going to be affected; they may also be in emerging markets so in the EMEA context, it’s Central and Eastern Europe, Middle East and Africa. But what do we mean when we say ‘deleveraging’? What are these banks going to delever? Is it prime finance, financing hedge funds? Is it US real estate? Is it Japanese asset-backed, longer dated cross-currency swap portfolios etc?

In any of those areas, what would the effect be in terms of corporate lending? Actually you could argue – I’m just throwing it out there – that it could actually end up being marginally helpful if it’d free up resources for Western Europe where regulators would like to see more lending into the real economy.

As Claus alluded to, we have all seen more and more corporates coming to market in the last three to four years. In fact, more than 250 new Western Europe corporates have come to the bond market that otherwise would have funded in the bank market. So this is already happening, representing a pretty large chunk of money. And all of our large-cap clients are also funding more of their needs in DCM. If you talk about EM, some borrowers are going direct to DCM. They don’t necessarily have the problem of banks funding less because in many cases, they may never have gone to bank market in the first place.

In any case, I think it’ll be extremely healthy if we have European banks operating in a more commercial way, i.e. fewer banks funding long-term assets with short-term deposits and creating ALM mismatches or currency mismatches, to intermediation by funding from savings, pension, insurance, retail etc into infrastructure and other use of proceeds that may be in the corporate landscape.

My last point on the topic of how to build stronger capital markets in Europe is we need help from the policy and regulatory side. There are a a number of green papers floating around and I suspect a lot of people around this table are commenting on some of them. That’s very helpful but some very fundamental points need to be addressed.

First of all, you have to stop throwing dirt at securitisation as a corporate finance tool because all of us would probably like to see lending to SMEs, securitizs such loans and sell them into the institutional market. Two: a common bankruptcy code in Europe to dramatically grow the high-yield bond market. There are basically 17 different high-yield markets in the euro zone alone when perfecting your claim. How do you harmonise that?.

Three: State and muni markets. We should encourage this, maybe with tax-exempt income structures such as the US. Lastly, one of the regulators’ bigger issues is whilst they encourage us all to get busy funding corporates, they’re at the same time making it more difficult to carry secondary bonds which reduces liquidity and they propose FTT which again will reduce secondary bond liquidity. That speaks to your point, Keith, about private placements to source larger blocks of bonds. In short, we need even more joint encouragement from policy makers and regulators to grow these markets.

Jim Esposito, Goldman Sachs: I think the discussion’s been very focused on bank behaviour and issuing-client behaviour but to make this trend happen in a more acute fashion, you obviously need developments on the buy side too. I don’t think, as banks in Europe de-lever further, that large-cap investment-grade corporates are going to have any trouble accessing credit whether that’s a relationship loan or accessing the bond markets for size and term. As Martin has already pointed out, this is really not a large-cap investment-grade issue.

Where this trend is really going to play out and where it’s going to get interesting in Europe is for medium and smaller-sized companies, most of which are rated below investment grade. The big question on the buy side is how do you develop a deeper, more consistent and sustainable pool of capital to finance high-yield companies in Europe?

Over the last decade in Europe, the high-yield bond market has proved itself more fickle than its US counterpart. I think the big question is: is it for real this time around? We’ve seen more globalisation of the buy side over the past five years. I’d like to think that’s a good trend for the European high-yield bond market. The large buy-side funds are much more global in nature. I think that should provide a more sustainable pool of capital to fund high-yield European companies going forward.

Bryan Pascoe, HSBC: This is where private placements, I think, are particularly important because it’s tough to fund esoteric corporates in the benchmark space because of the amount of credit work that would need to be done by the various investor bases. You need dedicated guys, so as the private placement market develops – and I think you are starting to see signs of that – you’re seeing French and German investors in particular reaching out to banks to discuss what they have in terms of their small and medium-size portfolios and whether there’s a partnership that can be grown around them investing and taking some of that exposure.

But the risk we have is that we haven’t really reached the wall of refinancing added to requirements from SMEs. We haven’t touched yet on the potential disruption we could see in the market. Unless the DCM space can really develop quickly, the risk is still on the downside because I think the markets have had a lot of liquidity for a long period of time, probably more than they expected. We did have a reprieve from the capital perspective with Basel 3 being pushed back. For a lot of banks, that enabled them to continue lending in a slightly more relaxed way without the actual physical requirement coming in.

At the same time, the lack of liquidity to offload a lot of these illiquid asset pools has meant that, as has been mentioned before, we’re in a period of run-offs. So I think your risk in 2014 and 2015 is running into a confluence of factors which is going to create a large amount of refinancing plus a number of new entrants to the market from the issuer side. I guess the question’s been begged: can the buy side pick up its game and develop fast enough to fill that entire space?

IFR New Styles for DCM Roundtable 2013: Part 2