Europe’s second-worst high-yield sell-off in a decade has been a wake-up call for some banks that have been left struggling with a multi-billion buyout debt exposure after using aggressive underwriting tactics to win market share.

Banks have piled into the asset class over the past year, boosting teams, raising leverage, underwriting on aggressive terms and bringing riskier Triple C rated credits to the market – to challenge industry leaders Credit Suisse and Deutsche Bank for a bigger slice of the fee pool.

But the sovereign-inspired freeze in debt markets may help determine who has the staying power over the long term, and separate the leaders from the laggards.

Goldman Sachs, for example, has hung on to second spot in the Thomson Reuters high-yield league tables since April – its highest ranking since 2003 – while BofA Merrill has also entered the top 10 table and Morgan Stanley has increased its market share by about 1% since last year.

Other relative newcomers, such as HSBC, Nomura and Societe Generale, have also joined the party. But underwriters are now on the hook with an €11.5bn mass of unsold leveraged loans following a rapid retreat in risk assets by investors after the music stopped two months ago. About €4bn of that backlog is expected to be funded in the bond markets, which has been closed for two months with the exception of one bond deal from high-yield darling Fresenius Medical Care.

“Until banks clear some of the backlog that they have on bridges, it’s going to be hard for those banks specifically to be very aggressive and to underwrite new deals,” said Kevin Connell, managing director of European high-yield syndicate at RBS.

The new unstable environment – driven by fears outside of high-yield factors such as the eurozone sovereign crisis and economic growth – has cast uncertainty about the scale of potential bank losses on those bridge facilities and the sustainability of aggressive strategies to win business.

Some bankers were keen to reassure that they were not suffering from this exposure at the Barclays Capital high-yield gathering in London in September. “The mere fact that they went out of their way to say that implies they are,” said an attendee.

Investors are well aware that they can name their price as liquidity has dried up. “We would be interested in some of those LBO transactions. If they come at an appropriate discount, then we might be able to exploit a forced selling opportunity from a bank or underwriter,” said Anthony Robertson, head of high yield and distressed debt at BlueBay Asset Management.

Clearing the decks

The debt overhang includes bonds planned for the buyouts of steel manufacturer Ascometal, cable businesses Coditel and Com Hem, Polish telecoms business Polkomtel, Swedish alarms group Securitas Direct and French mechanical engineer Spie on which banks committed financing between May and July this year.

“The market was getting overheated in the late spring and summer, and transactions were either too leveraged or the credit quality was declining, reflecting very robust conditions at the time,” said Mathew Cestar, managing director and head of leveraged finance in EMEA at Credit Suisse.

Credit Suisse has taken a more pragmatic approach, stepping away from underwriting deals unless they have been able to syndicate the risk, a source said. Up until recently, investors have been keen to take on some of this bridge risk to guarantee a better allocation on bond deals. A portion of the Polkomtel bridge has been syndicated, two sources familiar with that transaction said.

Of the bond deals waiting in the wings, seven times leveraged Securitas Direct, is considered the riskiest and most aggressive. BofA Merrill, Goldman and Morgan Stanley – who have all boosted market share significantly – signed up for the Securitas Direct buyout financing along with HSBC, Nomura and Nordea.

Those banks were helped off the hook with the €395m subordinated high-yield bond backing that deal after private equity firms Bain Capital and Hellman & Friedman struck a “club” mezzanine deal last month. But the underwriters may still lose money on a near €1bn senior secured bond yet to be launched.

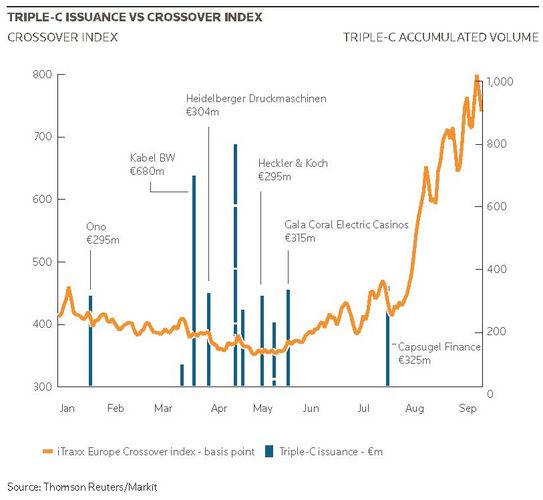

A doubling of credit index spreads since May also means the cost of borrowing is likely to soar, especially for risky Triple Cs, which descended on the market in April and May as the Crossover tightened to around 350bp. Payment-in-kind bonds – features of the Polkomtel and Com Hem buyouts – may also be a harder sell, some bankers said.

Morgan Stanley has one of the greatest exposures by number of deals, including some of the most highly leveraged, according to Thomson Reuters LPC data. It pulled the €260m bond for Coditel in early summer after pushback from investors saw the coupon rise to 12%. Regulation changes in Belgium since then means it will probably struggle to garner bondholder interest even if it is restructured, investors say.

Even smaller banks such as RBC and Nomura – virtually non-existent players in the high-yield market last year – have been hit but the sudden spike in risk aversion. Ironically, the focus has now turned to potential job cuts – just as many teams have been beefed up.

Nomura is among a growing number of banks that have announced job cuts, while the axe has already fallen in BofA Merrill’s leverage finance team as tighter regulation and tough markets force banks to rein in costs.

At €3.6bn-equivalent, the debt financing the acquisition of Polish telecom firm Polkomtel is by far the largest – underwritten by Credit Agricole, Deutsche Bank, Royal Bank of Scotland, Societe Generale and PKO BP.

The €1.9bn loan portion was completed last month – increased by €300m after drawing strong demand – which has boosted confidence that the bond financing will also go well.

Equity cheques to swell

Overall, the growing consensus among bankers is that leverage has to come down. That means private equity firms will struggle to raise sufficient debt to fund acquisitions.

A divide has already emerged between seller price expectations and what private equity firms are prepared to pay for assets – due to the difficulty in valuing businesses in the current volatility and frozen debt markets. French retail group PPR postponed the sale of its catalogue business Redcats after bids came in well below expectations, people familiar with the situation told Reuters.

Sponsors may have to club together to boost equity or turn to the much smaller, and more expensive, mezzanine loan market. On average, the mezz market is still 2%–3% more expensive than high-yield even after the latest rout, bankers say.

“In certain cases, private equity sponsors may need to fund deals entirely with equity,” said Cestar. “In those instances, sponsors will look to recapitalise these deals at a later point – removing excess equity – provided market conditions normalise.”

On a brighter note, bankers point out that the €75bn–€80bn overhang in 2008 dwarfs the “hung” bridges after this crisis.

“The committed capital in the wings is relatively low. This is a real positive, and an even better signal is that it is a much smaller percentage of the overall supply that we have seen in leveraged finance through 2011,” said Michael Marsh, managing director, leveraged finance capital markets and syndicate, at Goldman Sachs. “This doesn’t mean that the market is going to open up tomorrow, but it does mean that the market should not be as concerned about the overhang.”

Put into perspective, the €4bn bond financing, accounts for just over a tenth of this year’s €34bn supply and even less compared with last year’s record €42bn high-yield issuance.

When these LBO bonds will be launched in the market remains unclear. Some are earmarked for September, but no one seems to want to go first. As for the 15-20 debut companies that had been preparing high-yield bonds for the summer, the advice being given to them is to sit tight and wait.

“We have had to tell those companies that the conditions are not right for them,” said one high-yield syndicate banker. “The market is shut.”

Inconceivable default spike

Investors are in a good position. There is no doubt there is value in high-yield, and many are cash-rich. The strong performance of the near US$1bn-equivalent dual-tranche bond from well regarded BB-rated healthcare company Fresenius Medical Care – which rose five points in its first week of trading – should provide some faith.

However, the volatility of credit indices is making transaction strategy harder. The Crossover has swung in a 130bp weekly ranges and hit a two-and-a-half year high of 818bp earlier this month – and up from 350bp in May.

S&P is predicting default rates to increase to between 5.5%–7.5% next year from just under 2% now, and way below the implied default rates of 30%–45% percent that the Crossover is pricing in, depending on recovery rate assumptions.

BlueBay’s Robertson said it was “almost inconceivable for default rates to go above 3% to 4% on a 12-month time frame.”

“An investor buying high-yield at 800bp over today is being more than adequately compensated for future default risk in any environment other than a full-scale blow up of the eurozone,” said Robertson.

A low growth environment bodes better for high-yield than equity markets. Year-to-date total returns in global high-yield are still positive, but are down 5.7% in Europe, according to Barclays Capital. The total return of the MSCI Global stock index, meanwhile, is –6.75%. The near 10% coupon income that high-yield is currently generating provides an attractive buffer against further mark-to-market declines, said BlueBay’s Robertson.

“Corporate balance sheets are in as good a shape as I have seen in the potential onset of recession than has historically been the case,” he said.

Click here to see the Digital Edition of this report.