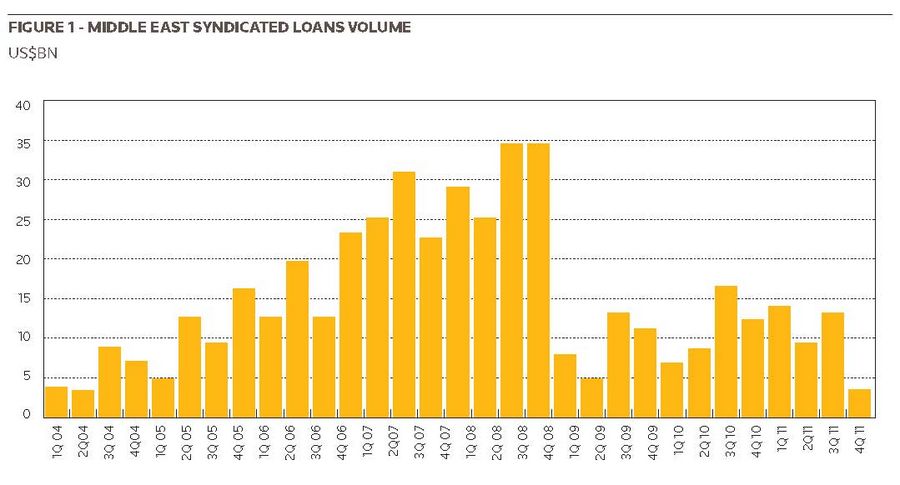

Political uprisings, the deepening eurozone crisis and lenders’ tightening liquidity have severely dented internationally syndicated loan activity across the Middle East this year, bringing volumes to the lowest level since 2004. By Michelle Meineke.

Middle East syndicated loan volumes totalled US$26.2bn for the first nine months of this year, marking a 31% drop from US$38bn for the same period in 2010, according to Thomson Reuters data. “The Middle East is still on a downward trend in terms of volumes versus last year. There hasn’t been a lot of new money across the region at all,” said one emerging markets loans specialist at a European bank.

While liquidity remains limited, the loan market is open for certain blue-chip companies that are well known to lenders in the stronger economic states – notably Saudi Arabia, the United Arab Emirates and Qatar – but the eurozone crisis has resulted in price hikes.

“The liquidity is there for a higher price,” said Raouf Jundi, senior vice-president and head of origination at Bank of Tokyo-Mitsubishi UFJ. Bankers say borrowing activity among Middle Eastern companies is not expected to pick up before 2012.

“The significant risk in Q4 means it is not a good time to come to the market. If there isn’t an urgency to do the deal, it’s better to wait,” the emerging markets loans specialist said.

Japanese and American players are expected to have a bigger presence in the Middle East in 2012, largely compensating for the relative absence of French banks following several credit downgrades.

Handful of deals

There have been a handful of sizeable deals in 2011, including Israeli Teva Pharmaceuticals’ US$4bn loan to back its US$6.8bn acquisition of US drug maker Cephalon and Saudi Arabian SABIC Capital’s US$1.25bn, five-year revolver, which were both agreed in June. Prior to that, in March, Kuwaiti telecoms group Zain signed a US$1.2bn loan.

Abu Dhabi government-owned International Petroleum Investment Company (IPIC) secured a US$1.5bn bridge loan in August, and was followed by Dubai’s Port & Free Zone World (PFZW) with a US$850m, five-year loan refinancing in late September. In October, Egypt’s Orascom Construction Industries signed a US$2.2bn deal – its largest ever loan.

This year has seen some positive developments for Dubai, which has been stabilising its finances following a heavy hit to its economy in 2008, which was compounded in November 2009 when Dubai World announced that it wouldn’t be able to repay its debts.

In March 2011, Dubai World signed a final restructuring agreement with 80 creditors for nearly US$25bn of debt, and there was a further boost to the Emirate when Dubai’s sovereign wealth fund, Investment Corp of Dubai (ICD) launched a US$2.8bn loan in May that raised US$4bn, which would have marked Dubai’s biggest loan since the 2008 financial crisis.

Although loan bankers were ultimately left disappointed, when in August ICD opted to cancel the US$4bn loan and instead repay the loan in full, the huge oversubscription reflected banks’ improving sentiment towards Dubai. “This is not a market where Dubai is off-limits anymore,” said a second European banker.

M&A activity has stagnated in 2011 as a result of tough lending conditions and is not expected to pick up until early 2012 at the earliest.

“With valuations down in developed markets, it means the Middle East is in the perfect position to acquire. However, confidence in the market would also need to return,” said Jundi.

Qatar is “making acquisitions left and right”, but it is able to secure government financing, while Saudi Arabia’s liquid position means small to medium-sized enterprise mergers and acquisitions are do-able without international participation.

Tough times

The eurozone crisis and dollar funding issues mean that European lenders are highly selective of the deals they participate in and some are adopting a “sit on our hands and wait it out” strategy. Many lenders have adjusted positions on current deals as the implications of tightened liquidity have taken their toll.

“Lenders have been quite clear on what they can or can’t do and some deals have been moulded around that,” said one Middle East-based loans banker, citing strong relationships and investment grade ratings as key criteria.

The re-introduction of triple tranches may become increasingly evident in coming months, as seen with IPIC’s US$5bn syndicated loan in July 2009.

The need for a US dollar tranche in some large corporate deals, countered by European lenders’ restricted liquidity, means multi-tranche deals may include a premium of 30bp or more for dollar tranches in coming months.

While borrowers would typically focus on their own currencies, the requirements for large corporate are sometimes substantial and they have to include, at least, a US dollar tranche in their financing, said a third European banker.

The emerging markets loan specialist said: “It will continue to happen in the Middle East. Not on every deal though, as some deals don’t need European banks and margins may not be attractive enough.”

Three-year tenors are still generally preferred by European lenders, but some will stretch to five years if necessary.

Increased pricing

An illustration of increased pricing is on Qatar Petroleum (QP) and Exxon Mobil’s 16-year loan backing the Barzan gas project, which would mark the largest internationally syndicated loan from Qatar in three years. Between the time the deal was sent to the market in July and when the bank group was put together in late September, the pricing was increased – but only by around 20bp. This reflects the pull QP and Exxon Mobil have as clients, plus the fact the deal was well received by the local Gulf banks. The syndicate, however, contains a lot fewer European names than is normal for a long-term Qatari deal.

The pricing on the US$5.5bn of uncovered debt and Islamic tranches is 130bp during construction, then 175bp, 190bp and 200bp, compared with 115bp, 145bp and 175bp in the model. Fees are 150bp.

The deal includes US$2.6bn of ECA loans or covered debt, with half coming as direct loans from JBIC and Kexim. Nexi is covering half the rest, Sace US$400m and Kexim US$350m. The Nexi covered tranche is 130bp flat, in line with the commercial pre-completion, the Sace tranche 150bp, and the Kexim tranche 170bp. Fees on these tranches are 140bp, 125bp and 150bp respectively.

“Pricing has increased, but the deal was initially priced at the beginning of the year,” said a fourth European banker. All deals that were priced more than two months ago are likely to be revised as the economic outlook worsens, the banker added.

ICD faced a significant hike in borrowing costs of 125bp–150bp on its existing US$6bn loan because of Dubai’s recent debt troubles and continuing political instability in the Middle East. The loan was priced at 350bp and lenders were offered a 100bp participation fee and a 100bp structuring fee.

Lower than expected pricing also deterred some European banks from participating in Kingdom Holding and Bahrain Batelco’s US$950m offer for a 25% stake in Zain Saudi, which ultimately failed because of disagreements with the indebted Saudi telco’s lending banks in late September.

Commercial Bank of Dubai closed an increased US$450m, three-year term loan in August that paid a margin of 225bp over Libor, up from 75bp on the previous facility from 2008, while Dubai-based telecoms group du’s US$220m, three-year refinancing loan priced at 145bp over Libor, compared with 125bp over Libor for its Dh3bn, three-year deal agreed in 2008.

PFZW’s US$850m five-year loan agreed in September 2011 paid a margin of 350bp, up from 175bp for its three-year deal signed in 2008.

Going forward, pricing negotiations are expected to hike pricing on Saudi Oger’s long-running US$2bn dual-tranche loan for the construction of police training facilities, which is scheduled to close shortly, and the current search by Saudi Arabia’s second largest mobile phone company Etihad Etisalat (Mobily) for an SR10bn (US$2.66bn) refinancing.

A fresh wave of violence in Egypt in October means higher pricing is likely for Egyptian General Petroleum Corp’s renewed search for a US$2bn, five-year pre-export financing loan, after initial negotiations were put on hold amid heightening political tensions in January.

While borrowers aren’t enamoured with rising margins, “the big name borrowers can probably control the increase in pricing, or they can at least mitigate it”, said the third European banker.