Memories of the 2001 banking crisis motivated Turkey’s financial watchdog to deliver a seamless transition to new Basel II capital rules.

To view the Digital edition, please click here.

Like the elephants that once roamed Turkey – and remain a lucky charm on amulets for sale in Istanbul markets – the country’s regulators never forget.

But unlike elephants it would appear that the Banking Regulation and Supervision Agency (BDDK) is also capable of a light touch.

Prudential regulation founded on bitter memories of the 2001 banking crisis motivated the Ankara watchdog to engineer a strict introduction of Basel II capital rules while fine-tuning them to ease their impact on some banks.

While banks were reportedly nervous about the way they are now being required to model risk, smooth transition will enable them to maintain vigorous growth and high capitalisation.

Hale Tunaboylu, head of strategic performance management and investor relations at Yapi Kredi Bank, said: “The transition to Basel II has been free of problems. A lot of people were expecting some problems might come up. Instead it has been a smooth transition helped both by the BDDK’s effective handling of the transition and also the banks’ diligent preparations.”

In 2010, all G-20 countries agreed to fully implement Basel II rules on calculating the risk exposure of banks as soon as possible in preparation for even tougher Basel III capital and liquidity requirements to be phased in from next year.

Turkey had been among a number of countries yet to fully implement Basel II, although the switch was expected – meaning institutions were adjusting portfolios.

Stronger but gaps remain

The changes, which took effect in Turkey in July this year, represent both a challenge and an opportunity for emerging economies while complicating surveillance of their banking supervisory systems by multilateral bodies such as the IMF. The Fund has just released the report on last year’s Financial System Stability Assessment on Turkey, concluding that while banking supervision has been strengthened, gaps remain in the supervision of risk.

The official line in Turkey has been typically upbeat – on the eve of the Basel II launch, the BDDK’s new chairman Mukim Oztekin told Reuters that Turkish banks were well placed to comply. The consensus is that the move will strengthen the financial sector even if it dents capital ratios in the short term.

Stricter risk-weights for certain assets are pushing down capital adequacy ratios although estimates of the negative impact overall of Basel II have varied, with the BDDK initially estimating a fall in CARs of about 140bp, ratings agency Fitch downsizing ratios by an average of 100bp, and some bankers hoping for a much lower 40bp–50bp.

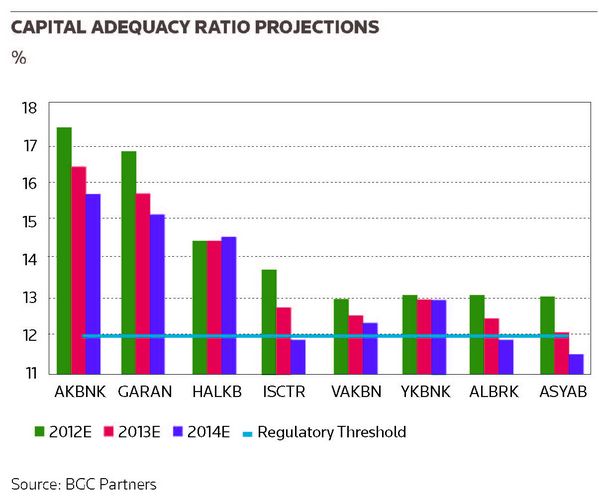

Either way, even a high decline in the CAR – at 16.5% in June on the eve of the switch – would maintain the average for the sector well above both Basel II’s 8% minimum threshold and the 12% that the BDDK itself requires of Turkish banks.

A report this month [September] by Muge Dagistan of BGC Partners in Istanbul suggested that all the banks the broker covers – Akbank, Garanti Bank, Halkbank, Isbank, Vakifbank, Yapi Kredi Bank, Albaraka Turk and Bank Asya – can sustain CARs above the regulatory threshold of 12% except for Bank Asya.

Perfect storm

This helps to explain why Turkish banks have been taking Basel II in their stride and this, in turn, owes much to the deep aversion to risk of the BDDK – founded in the wake of the 2001 crisis when political and economic instability combined in a perfect storm to deliver a knockout blow to 24 banks. A risk-management framework constructed since, together with an aversion to complex derivatives, have set the scene for a surprisingly relaxed embrace of the new rules.

As if to put their imprimatur on this conservative regulatory culture, senior Turkish officials such as finance minister Mehmet Simsek have constantly reiterated the lessons learnt from past crises while emphasising the virtues of risk management.

Accordingly, the BDDK engineered a strict application of Basel II under which FX-denominated Turkish sovereign bonds – a favourite in banks’ portfolios – now attract a 100% risk-weighting (previously 0%). Moreover, banks must apply the standardised risk-weighting rigidly and cannot adopt Basel II’s internal modelling approaches without BDDK approval.

However, it is the BDDK’s discretionary implementation of the rules to alleviate the pain that has gained most attention.

Any hit taken by banks is largely in relation to their FX-denominated government bond exposure, principally Turkish eurobonds. Some Turkish banks reduced their FX securities exposure ahead of the Basel II implementation but in June BGC said that, with its relatively high exposure to FX securities, Yapi Kredi Bank would be hit worst by this measure. However, it added that Yapi Kredi – co-owned by Istanbul-based Koc Holding and Milan-based UniCredit – was seeking to relocate its eurobonds in order to mitigate the negative effects of the Basel II introduction.

To soften the measure’s blow, the BDDK used its discretion to allow banks to apply a zero risk weighting to gold and foreign exchange reserves held at the central bank, instead of the Basel II requirement of 100%.

BGC has suggested that the BDDK’s fine-tuning on the risk-weightings of FX reserves kept at the Central Bank of Turkey would protect some banks from falling below the regulatory threshold of 12% at least for the next two years and will reduce the negative impact on CARs by an average of 100bp, pushing down the regulator’s initial estimate in the third quarter of 2012 to 20bp – significantly lower than previous forecasts.

The amendment came as a relief to banks with traditionally lower CARs such as Isbank, Yapi Kredi, Vakifbank and Albaraka Turk.

Yapi Kredi, which maintains the lowest securities ratio and concentrates on core retail banking, has confirmed a 120bp–150bp negative impact from Basel II – keeping it comfortably above regulatory thresholds. The bank undertook capital strengthening measures earlier in the year in preparation for the switch that included issuing a US$585m long-term subordinated loan and introducing a risk-weighted asset optimisation project. It is reorganising its insurance arm Sigorta, together with private pensions unit Emeklilik.

Conservative instincts

Other discretionary tweaks by the BDDK in implementing Basel II further reveal its conservative instincts. The regulator maintained the risk weightings it applies on residential mortgages and credit card and retail loans that are already substantially higher than expected under Basel II.

Several factors have empowered the regulator – known as one of the toughest in developing markets – to combine a strict application of Basel II with deft footwork.

Turkey’s banking sector is already well capitalised and profitable, and leverage is moderate, despite recent rapid credit growth. In August, the BDDK reported that the sector finished the first half of 2012 with strong indicators – sector profits rose 11.4% year-on-year.

BGC’s Dagistan Muge reported that continued improvement in loan-deposit spreads mean the third quarter of 2012 is likely to be another strong quarter in operational terms, and the broker has revised upwards its 2012 and 2013 earnings estimates. BGC’s preliminary third-quarter earnings projections suggest Yapi Kredi, Akbank, Vakifbank and Albaraka Turk should post quarterly earnings growth in third quarter while Isbank, Halkbank, Garanti Bank and Bank Asya should experience quarterly earnings contraction.

Fitch has been among those reassured by the BDDK’s tight oversight, which it believes will keep the sector strong and prevent a rapid build-up of leverage.

Moreover, despite reports suggesting that some institutions that use market and credit risk models to calculate exposure were frustrated at being compelled to use the standardised Basel II approach, this has not been an issue and many banks are already well-placed to switch to advanced modelling if required.

Yapi Kredi’s Hale Tunaboylu said: “Because of Basel II requirements, which are stricter and higher than Basel I, Turkish banks will need to be more disciplined in terms of usage of their capital. But this is a good thing because I am expecting that it will affect the strategic behaviour of banks in a rational way – in some cases maybe a conservative way depending on the bank – but definitely a more responsible way compared to the past.”