IFR ASIA: Good afternoon. Let’s start with an introduction from our climate bonds expert. Sean, what are Green bonds, and why should we care?

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: Maybe the best way to answer that is to explain the origins of the market. This is a type of bond that was introduced by the European Investment Bank, and then the World Bank soon afterwards, where they simply allocated proceeds to certain projects as a means of picking up some additional investors.

In those days most SRI investors – socially responsible investors – had minimal bond exposure and were in equities. In 2008, they discovered they had made a mistake. There was a need for diversification, and the World Bank and EIB tapped that. There was a tussle for a few years around price and structure, but the EIB established, after a couple of false starts, that a vanilla bond was the way to go.

Now what do we mean by green proceeds? Well, initially it was simply renewable energy and then energy efficiency. The World Bank – and now the IFC – has extended that to a range of projects, but essentially the theme is climate change. The reason investors have become more and more interested in this is that they have become more and more aware of the macro risks in their portfolios around climate change.

At the UN climate summit we had US$43trn of investors signing statements that they stood ready to invest in climate change, subject to risk and return. So the other characteristic of this market is that it’s comparable pricing – and it was the IFC that really broke the back of this particular argument between investors and issuers. The IFC’s £1bn bond in March 2013 sold out in about one and a half hours, it was two times oversubscribed and it was flat pricing. Since then the bulk of issuance has been at flat pricing, that’s another key, defining characteristic.

IFR ASIA: Following on from that, then, what’s happened so far in Asia? How does a green bond market get going here?

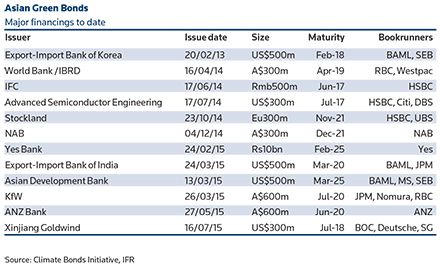

RAHUL SHETH, STANDARD CHARTERED: As Sean mentioned, this has been really concentrated in Europe and primarily the bulk of the green investors are really in the Nordic countries or in the US. In Asia, we’ve had roughly six senior green bond issuances and about a couple of ABS issuances. The policy banks like Korea Exim opened the market in 2013. India Exim came in this year, and we had Yes Bank, which was amongst the first private sector institutions and the first to do a rupee bond.

Issuance in Asia is currently being driven primarily by the policy makers, by the governments who are actually pushing this agenda. For example, the Indian government has pledged a commitment to have 175 gigawatts of renewable energy by 2022, which requires around US$200bn of investments over the next seven years. They have identified eight institutions both in the private and the public sector, including banks, to get the market going. Similarly, there is a steering committee under Ma Jun, the chief economist for the PBOC, whose primary objective is to look at how to “green” the financial system in China. They have put out a 14-point agenda in a fairly expansive report, which talks about everything from green bonds to green insurance to green IPOs, you name it. It’s taken ideas from different parts of the globe, and when these regulations are finalised, I’m very certain that you will have a bulk of the initial issuance from the state-owned issuers, followed by the private sector coming into this in a slightly bigger way. In summary, Asia will be an ‘issuer-push’ rather than an ‘investor-pull’ growth market.

IFR ASIA: Mushtaq, where do we stand in terms of bringing out Green bond standards?

MUSHTAQ KAPASI, ICMA: Our organisation is based in Europe, and most of the work that’s been done on the Green Bond Principles has been driven by European underwriters, along with investors and other NGOs. So the interesting thing is in Europe, standards are being developed from the bottom up, whereas in Asia, we’re seeing it a bit more top-down. The governments of India and China have recognised that the environment is a huge priority, and that something needs to be done immediately. In China, you’ve just seen a massive amount of work done over the last few months in order to develop the standards, and the report, for those who’ve looked at it, is pretty phenomenal.

In China and, from what I know, in India, instead of being developed more in an evolutionary way by the markets, the governments are going to gather the information from all the relevant experts and then develop their own policies, which they’re going to implement top-down. That’s really going to drive the market.

IFR ASIA: Even if the regulators do provide some sort of push factor, we need still companies to issue. So what’s the appeal?

PHILIPPE AHOUA, IFC: Well, we’re a project finance house and we’re a development bank. We have a huge need for green assets. In this part of the world, India and China are two of our largest portfolios – India is IFC’s largest country exposure across the emerging markets. So for us it’s a natural niche. As Sean mentioned we were one of the innovators in this particular process. We basically worked with investors, who were already following our regular plain vanilla bond issuances, and started carving out different portfolios for green energy for Green bonds. So what’s in it for us? It’s the same level of issuance, the same sort of cost-effective funding opportunities that we have in every market, but also we have a huge deployment need for green financing. We need to work across the spectrum of green financing.

IFR ASIA: Madhur, you were involved in the India Exim deal, one of the first out of Asia in the dollar markets. Is that something that gave them access to a completely new market?

MADHUR AGARWAL, JP MORGAN: There were two key reasons why Exim Bank of India wanted to explore Green bonds. One was the diversification of investors, and they did manage to achieve a good diversification. A number of investors in the Exim Bank deal were green investors including some investors who were not existing buyers of its bonds. Some of the existing investors were also able to increase their participation given the green nature of the bond.

The second reason was to make a statement about sustainability. As Rahul mentioned the Government of India is very focused on the green initiatives, trying to push banks to support the new projects. Exim Bank, being a policy bank, wanted to make a leadership statement that India is taking action on this climate initiative. And this was their way of doing it. Initially they were planning a smaller issuance of US$250m. But given the deal’s success they could raise US$500m, which signifies lot of investor interest. This time they started with just the use of proceeds being green, but at their end they do a lot more in terms of project evaluation and sustainability reports.

IFR ASIA: Did they go for a second opinion?

MADHUR AGARWAL, JP MORGAN: No. They have not gone for a second opinion for this bond, but I think over a period of time things could change, but they do have independent consultants that review the projects they’ve funded. Most of the projects are in Sri Lanka and, given these are government to government projects, they could not make some of this information public.

IFR ASIA: Ludovic, perhaps I can bring you in here. What’s the role of the second party, independent opinion provider in the green bond market?

LUDOVIC D’OTREPPE, VIGEO: We are basically there to support the market, to respond to the ongoing questions of “What does green mean?” and “How green is green?”

Our expertise is in assessing the non-financial performance of companies and projects. We don’t ourselves define what is good or bad behaviour; we base our evaluation on international norms and standards. And from there we look at three things. The first thing is the project itself, to make sure that the core objective of the project indeed contributes to, for example, climate change. We’re also going to look at the social responsibility in managing the project. The second aspect is the reporting to the market, as there is a need to be able to convey to the investors clearly the outcome of the financing. And last but not least, we’ll also look at the issuers.

There is a big request from the market to make sure that we don’t fall into the trap of “greenwashing”, and although issuers could fall short on their non-financial performance, they may actually finance green projects. So it’s a combination of those three aspects that we bring together.

IFR ASIA: You mentioned the ongoing accountability. If you certify a deal at the beginning do you track it all the way through?

LUDOVIC D’OTREPPE, VIGEO: Actually, we work alongside the issuers, so they can define until what stage they need our support. There might be some cases where we support the issuer in defining the reporting KPIs, guidelines and processes that will be set in place. And from there on they will manage that themselves. Or the issuer may request that we stay alongside and that we provide clear communications on a six monthly or yearly basis on the outcome of the project. That being said, it’s not our role to verify and certify the actual allocation of the money raised. We focus on all that relates to the non-financial aspects of the issuance.

MUSHTAQ KAPASI, ICMA: In terms of the transparency, I’m curious what your experience has been with different issuers in different markets. Are there any confidentiality issues in what they’re disclosing? And do you sometimes get feedback from investors half way through a bond that this is inadequate?

LUDOVIC D’OTREPPE, VIGEO: It’s actually a very good question, because we get a lot of questions from the investor community. They expect that the reports that we provide are publically available, and you will find a lot of them on Sean’s website. When the bond is issued the issuer can decide whether to provide access to the report that we have developed. What we have experienced over the last two years is that every time we have worked alongside an issuer they’ve always made the report public.

For the reports themselves, we are talking about a five-page document. Most of the time the investor market will expect the same level of detail and information as they get in the financial documentation for the bond issuance, but actually the budget, time and resources allocated to do those two reports are completely different. At the moment there is a sort of a flight towards more and more low-cost second opinion providers. So we devote more of our time to those verifications which are complex and exhaustive.

On the issuer side you see two types of clients. There are the ones that really want to provide full transparency to the market and will make sure that second-party opinion providers, such as Vigeo, get enough time and resources to provide full transparency. Then you see another group of issuers that are eager to get the rubber stamps but don’t really want too many people looking into the details.

And on the other side you have the financial markets, where the maturity of investors regarding green aspects is really growing extremely fast. They know what they are talking about, and they know what they are looking for. And they expect the report provided by the second party to have the same level of detail and precision as the one they get from financial information.

MUSHTAQ KAPASI, ICMA: There’s still no real consistency across the board?

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: Well, let’s be clear. We’ve had a big win last year in this market in terms of trust and confidence for investors, which is we’ve shifted to a market where 81% of all issuers in 2014 had an independent review in some form or other. That’s step one. So thank you World Bank and IFC for establishing the precedent. Now even the EIB has adopted a form of review by KPMG after some time, not because they need it, but because they understand their role in setting an example to the corporate sector. We log every single bond in the market by the way, so if you want to find Ludovic’s opinions they’re all on our website on the list.

This is the big disappointment with the Export-Import Bank of India was that they didn’t get a second opinion, and they should have. It was a good bond in the end, but the disclosure was messy and complex and not as transparent as it should have been. Getting a second opinion is a way of solving that problem.

The next question is the nature of the independent review and the quality. There is definitely varying quality, and there are different views about how this works. According to the Green Bond Principles, this is a market that is about assets and projects, as we’ve always said, not about entities. I’m going to say something which is very controversial for one of Ludovic’s competitors: an oil company can issue a Green bond. Total, for example, happens to be the world’s second-largest developer of solar power. There’s nothing wrong with Total issuing Green bonds if the transparency and reporting provisions are solid enough to provide confidence to the market that the money is going to the right place. Now you can’t do that in the ESG frameworks that are currently dominating Europe.

From a commercial banker’s point of view, of course, this opens up a much bigger market, because it means that you suddenly have a lot of big corporates around the world who could issue, but to make this really fly we need some kind of standardisation and commodisation of reporting so traders in the secondary markets are comparing apples with apples. I think this is the big challenge of this year. What we would like to see is a clear identification of assets and public reporting in a way that everyone can understand and everyone can trust. This is really important in India and China.

Last year was a very big win for this particular market. So what is only a voluntary guideline under the green bond principles is now becoming, effectively, mandatory in the market. And now we just need the second India Exim bond to follow this, as I think they will. I’m sure Madhur and JP Morgan have been pushing them hard to consider doing this.

MADHUR AGARWAL, JP MORGAN: As an arranger we try to make sure that issuers do their part, so even if there is no independent report the disclosure is still transparent. The investors coming into the Exim bank issue knew there was no second-party opinion, and they knew the amount of disclosure Exim Bank would be making on an annual basis. Exim Bank agreed to get the use of proceeds vetted by its statutory auditor on an annual basis.

We always try to make sure that investors know what they are getting into. So, as long as you make it transparent, people can decide whether they want to make that investment decision or not.

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: I’m going to disagree on one thing. Once you get beyond the investors that have their own due diligence capability – which is a very small subset of the market – it actually gets really hard and people tend not to look. And so you might provide the information, but people don’t know how to compare it with something else. So I’m happy to trust the Exim Bank because of who they are, but as a template for middle level Indian commercial banks it’s a bad example. The role of the public sector is not just to raise money on their own, it’s actually to set an example for others.

MADHUR AGARWAL, JP MORGAN: I think that may happen over time. You see, as we are looking at new markets people are still learning the benefit of green bonds. At present you don’t have any major pricing benefit, but you do have investor diversification. And that diversification could lead to better pricing year to year down the line. As issuers see the benefits, they could be more willing to invest resources, go for independent reports, more periodic reporting. So I think this reporting disclosure should improve as we move forward.

RAHUL SHETH, STANDARD CHARTERED: I think a bit of it is to do with where you are investing the proceeds. If it’s renewables, it’s a little more straightforward versus water treatment, waste management and so on. If I were an SRI investor and looking at a pure play green company, which does not have a green opinion but everything on its balance sheet is in the renewables sector, I’m probably that bit more relaxed in my investment guidelines versus maybe an entity with only a small portfolio of renewables. Then you need to know what the mix is going to be, where the money is spent, and how it will be utilised.

PHILIPPE AHOUA, IFC: From a multilateral standpoint, it’s relatively easy to come up with green principles when you have 185 member governments and you’ve been lending to renewable energy for a long time – way before we did green bonds. Every time we put a penny into a company we’ve got to go through fairly robust due diligence and get approval from over 100 member governments. So going from that process to the green bond principles that Sean was mentioning is relatively straightforward, but it will be a little less straightforward for companies or private banks. So I do have some sympathy when it comes to that.

IFR ASIA: Doesn’t this need to be driven by what investors demand? The standards will come if investors only go for deals that have a particular kind of review.

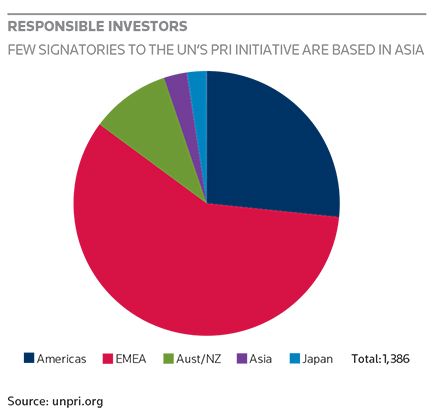

MUSHTAQ KAPASI, ICMA: Well, I don’t completely disagree, but I actually want to echo something that Sean said. A lot of the investors right now have been more the SRI investors – those with a particular interest in Green bonds and sustainable investing. And in some ways that has allowed the industry to grow without a real need for standards and without a real need for very robust ongoing disclosure. But what we’re seeing is that if we as an industry want to grow the Green bond pool, then actually there has to be a bit of a push for the standards themselves, because that will grow the investor base to those who are less sophisticated. It will allow them to invest without having the kind of expertise that a lot of the investors at this table already possess.

SABITA PRAKASH, ADM CAPITAL: I would like to add to that point, Mushtaq. It’s very true that if you attract only the SRI investors, they’re already primed to see certain things and they would look for certain factors when they invest in green bonds. But when you start involving the commercial investor, the private investor is not investing necessarily for green reasons, but more because they’re getting a return. They may not look so much at the green aspects, but what they will bring to the table is a demand for disclosure, for transparency of information. My personal opinion is that for the green bond market to develop not only in scale but also in quality, you need a combination of both SRI as well as commercial investors to look at that space.

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: Let’s go back to the original impetus for this market, which is around climate change. According to the IEA it’s some US$53trn above business as usual that’s got to be invested in this space by 2050. It can’t be an SRI market if we want to achieve those kinds of objectives. If we just create a nice little market for SRI investors, frankly we’ve failed and we’ve wasted our time for years. What we have to look at is building the foundations for a market that will contribute materially to the rapid transition to a low-carbon and climate-resilient economy globally. For that to happen, we must engage mainstream investors. We need to keep the characteristics that make it suitable to insurance and pension fund investors. We need to make sure that we have simple and easy standards, commoditisation of rules and all those sorts of things, otherwise there are other ways we can all spend our time.

LUDOVIC D’OTREPPE, VIGEO: Maybe just to make sure that there is no misunderstanding, we as a second opinion provider don’t define what is a good or bad sector to invest in. So, for example, we will be extremely pleased to support Total issuing…

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: I’ll introduce you tomorrow!

LUDOVIC D’OTREPPE, VIGEO: That is a company that has demonstrated over the last 10 years that they understand the expectations of their stakeholders, and their environmental, social and corporate governance performance goes beyond their peers. As Sean just mentioned, the need for investments is so huge that we will never want to claim to the market that this is a good sector or not to base your investment on. What we provide, once again, is transparency. We see if these issuers are applying the international norms and guidelines that are imposed not by us, by rating agencies, but actually by the markets.

IFR ASIA: I’d like to come back a little bit to the investor base here, because it does seem to me stimulating an Asian investor base will be a challenge. Is there a growing awareness of climate change in this part of the world?

SABITA PRAKASH, ADM CAPITAL: Absolutely. I may have to differ from the rest of the panel on this regard, because my personal observation is that there are any number of funds – it could be pension funds, as Sean mentioned – who have patient capital to put to work. Some US-based endowment funds have publicly announced that they will avoid or exit investments in polluting industries. There are multilateral funds who invest along strict ESG guidelines. Even family offices in Asia are very interested in participating in environment preservation and protection. All of them are very interested in investing in the environment space.

My concern is actually something a little different. With the amount of capital that is going to be available to invest in the environment, what is the kind of return that we’re getting at the other end? Will the investee companies, the borrowers be really incentivised to remain honest? And in that respect what Ludovic and others are doing is going to be very important in terms of rating. Because my personal concern is, at the moment anyway, the problem is not finding investors, but finding good and decent investments – or at least finding investments that are of adequate scale, are well governed, and have a business proposition to make a difference to the environment.

IFR ASIA: That’s an interesting question. Are there checks and balances in place if an issuer does end up using the proceeds for something that it’s not supposed to?

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: It’s not a problem so far because we’ve got blue-chip issuance in the market – within Asia, as well as in Europe and the US. There’s a lot of reputational risk in it for issuers, and that gives you a fair amount of protection. But this does become an issue as we go to mid-caps. And we’ve already seen one problem in the US where a shopping centre developer in took at a US$300m tax credit to retrofit a shopping centre, but changed its mind. After two years they had just built a bog-standard shopping centre, and a local investigative journalist broke the story. The IRS another year later finally did a review and said: “Well, actually, under the legislation they only had to promise, they didn’t need to do.” Go figure.

So how do you protect an investor who’s concerned about their green credentials? There are investors like Aviva who are pushing us hard to talk about penalties of some sort or another: a put option or an interest-rate ratchet if you default on your agreed credentials. Going forward we’re going to have a global legal workshop made up of all the major law firms ¬– and one in the audience here is going to be joining soon, we hope – to look at covenants in bond contracts going forward as the market matures.

It will become a consumer protection issue as we move into a retail audience. China has the world’s largest domestic savings pool, and we know that there is going to be an enormous demand for quality instruments that address air pollution. We will see retail growth in the US, because we’re seeing a price benefit. Will there be penalty arrangements as part of the consumer protection? I suspect the industry would serve itself well if it came in ahead of consumer protection and started putting some covenants in the bond structures and keep a self-managed approach. I think that will be positive for the industry.

MADHUR AGARWAL, JP MORGAN: I completely agree that mid-cap issuers would be willing to include penalties in the bonds, if it’s facilitating them to raise money. What will be challenging is convincing the sovereign-type issuers who do not see that much benefit in issuing green bonds, and who do not want to take some adverse penalties of increasing rates or put options in case of non compliance. But with mid-cap companies, if it enabled them to raise the money they would be very open to these discussions.

RAHUL SHETH, STANDARD CHARTERED: The issue is whether high-yield issuers will be driving the market, or whether you’ll have the sovereign gold plate the issuance standard. As we’ve seen from the West it’s always been the development banks and the sovereigns, and there are very few high-yield issuers in the labelled green bond market. Putting in covenants is a very difficult conversation with issuers and, if it’s an investment-grade issue, it’s almost non-existent. And to Madhur’s point, as an issuer, will I get an extra investor for the green covenant ? Or will I get more diversification? Maybe yes, but the price will be the same or similar. So, yes, maybe I can say I have 25% of green investors. But I have this looming covenant and I’m not getting any pricing benefit for it. Since high-yield issuers will not be setting the standards for the industry, it may be a while before we witness green covenants.

IFR ASIA: But is that where the opportunity lies then in Asia? We’ve had policy banks and financial institutions so far. Are we going to move into the high-yield market in Asia?

SABITA PRAKASH, ADM CAPITAL: I have quite a strong view on that. I feel that preliminary issuance has to be from the development banks and then the commercial banks, and it has to be an orderly development particularly because they will be the ones to set the standards. As we have discussed on the panel, there’s not much of a governance issue or concern with these entities as issuers, because they have a reputation to protect. What I fear is that unless the issuance is controlled and measured, there is a risk that funds will be raised by all kinds of companies under a “green” label just because it is better received. We don’t want companies just labelling themselves as green when they are doing the same old, non-green thing. So that’s the reason it’s important that the development of the market is quite systematic.

IFR ASIA: Well, let me take the devil’s advocate side on that one then. The development banks are already investing in these areas, so isn’t it the high-yield companies who will be driving new investments into green projects? Isn’t that the end game?

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: Well, not entirely. You’ve got different sources of project finance. You’ve got pure play high-yield companies, yes. You’ve got project bonds and so on, but who does most of the investment? It’s the intermediary institutions, who are really risk bridges. These guys borrow cheap and lend slightly higher and make money on the difference, and they’ve proved the point that development finance can be profitable. Now that is what we need in a rapid transition. We need more banks and more corporates to enter this market and take on that risk.

But it’s a misunderstanding that the role of bonds should be to finance new projects directly. Bonds are better seen as a refinancing tool to allow other organisations to then take on the risk, or a direct refinancing of mature assets through the securitisation of post-construction assets. And that’s what you really want to grow. We actively encourage refinancing bonds, because liquidity and scale and refinancing emboldens equity investors, emboldens banks and emboldens all sorts of other parties. It’s an important difference.

MUSHTAQ KAPASI, ICMA: That’s a very interesting point. If we want to attract new investors, would they be more interested in investing directly in projects than through the intermediary development institutions? I’ve done some work with family offices in the past trying to market socially responsible investments, and the response from Asia was very difficult actually. Family offices didn’t want to invest in a fund based in Zurich that was going to decide over 14 years what to invest in. They wanted to know exactly where it was going, they wanted to track it.

SABITA PRAKASH, ADM CAPITAL: I would agree with that. If there is a chance for a private investor or a regular mainstream, commercial bond investor to look at a direct investment in a company that can make a difference on the environment side, they would look at it. There would have to be some kind of government standards or some kind of ratings to measure them across a common platform and provide guidance to investors. Like any other asset class, there are bound to be investments in this space that don’t do well for all sorts of reasons.

SEAN KIDNEY, CLIMATE BONDS INITIATIVE: But I’d be saying to family offices: “If you really want to develop new projects, what’s needed is equity.” Think of the US$53trn requirement. That can’t all come in one form. When it comes to the bond market it’s going to come from pension funds and insurance funds who want post-construction risk.

SABITA PRAKASH, ADM CAPITAL: And also there’s not enough liquidity because there’s not enough scale. These companies probably raise max US$100m, and that is not enough for liquidity in the bonds in the secondary market.

To view all special report articles please click here and to see the digital version of this report please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.