Adam Cohen’s shiny aluminium desk, topped with five computer screens, sits in stark contrast to the old wooden bureau he keeps against his opposite window, next to a wilting money tree.

The antique piece of furniture - nearly buried under a mountain of paperwork - was produced to commemorate the 1939-40 New York World’s Fair.

“It might be the only one of these on Earth,” Cohen says, before turning to point to the vintage posters for the event that adorn the walls of his corner office in midtown Manhattan.

This iconic incarnation of the international technology and culture exposition - the event’s slogan was “Dawn of a New Day” - is one of Cohen’s obsessions, alongside comic books, motorcycles, skiing and metal music.

“They created this vision of what America would look like in the future, that we would have picture phones, that we would live in suburbs, that kind of thing,” he says. “By the sixties a lot of that had come true already.”

Making educated predictions of possible futures is something Cohen applies to his other obsession - bond and loan covenants.

The approach paid off big-time earlier this year, after a fiery report grabbed investors’ attention and almost immediately forced bond issuers to drop new language he had highlighted.

“IT WORKED. WE WON”

Cohen used to be a corporate lawyer, helping borrowers such as energy company Calpine craft arcane bond covenants that, in many cases, would help them gain the upper hand over creditors.

But in 2006 he had a change of heart and decided to sell that expertise to investors rather than issuers. He founded Covenant Review that year.

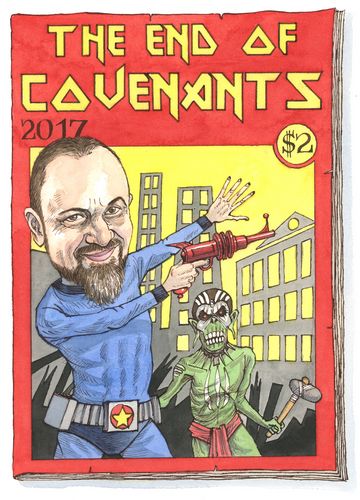

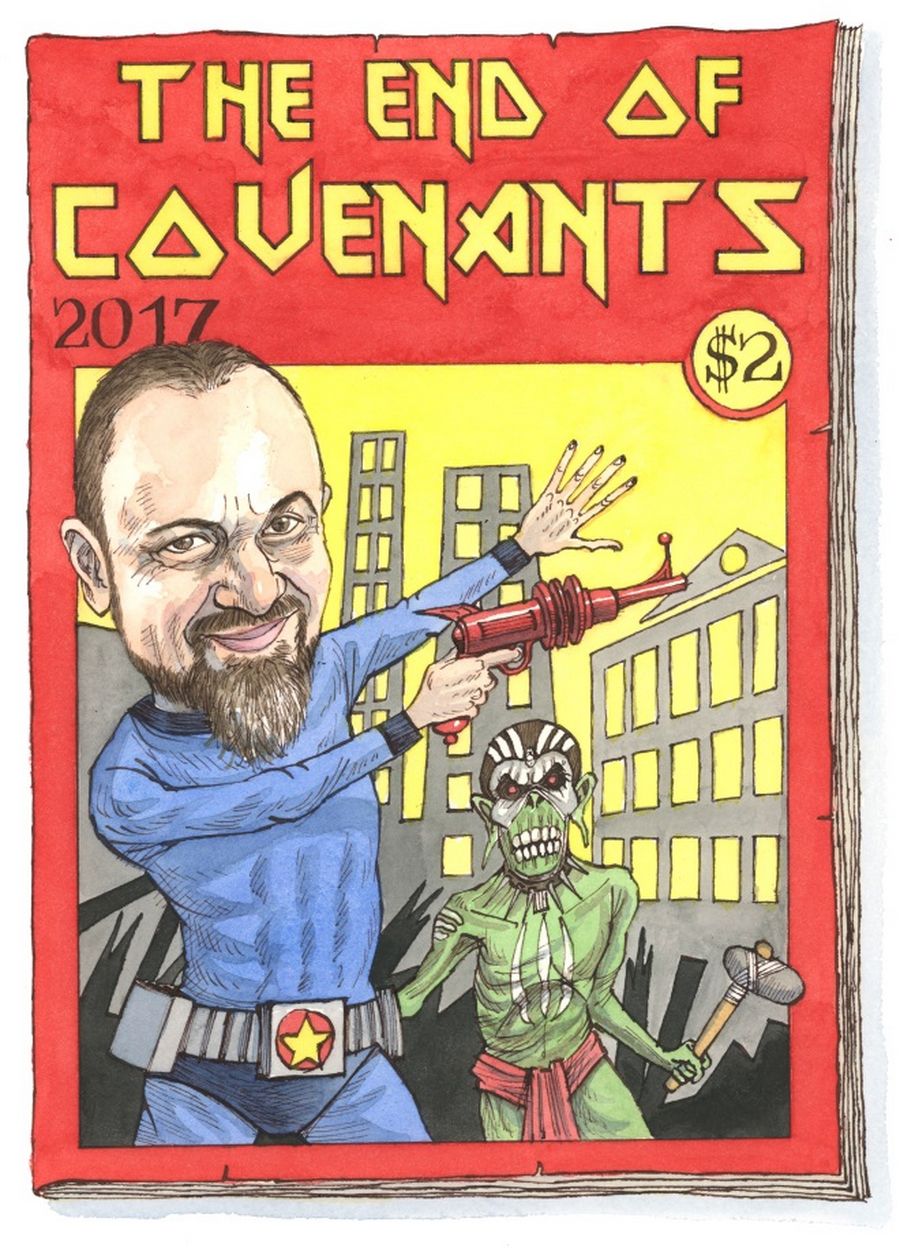

The firm grabbed headlines earlier this year when Cohen released a report titled “The End of Covenants”.

It highlighted several bond deals that included new language removing investors’ right to seek extra compensation if the companies breached certain deal conditions.

“As some law firms and issuers are wielding a sledgehammer against your right to enforce bond contracts, the buyside needs a simple, blunt response to end this attempt,” he wrote in a postscript to the main text. He then encouraged people to share the report widely - something the firm generally forbids.

If bond research can go viral, this was an example. It galvanised bondholders to push back against the new terms, and no new deals have included the language since.

A corporate bond lawyer recalled Cohen’s reaction: “I got an email from him the next morning, saying ‘I cannot believe the army I have mustered’.”

Cohen chuckles quietly at this recollection, running his hands over his long goatee.

“It got people kind of excited, in that you never had anything where the buyside shut it down so quickly once they woke up,” he says.

“It was really 48 hours from the time we published that piece to the time this got killed in the market.”

In the weeks since the report, Cohen has been inundated with phone calls.

More than 400 people dialled in to listen to him on a conference call organised by Goldman Sachs, forcing the bank to turn some callers away. He also spoke at last month’s Fixed Income Analysts Association meeting and will present at the American College of Investment Counsel this month.

But while his stirring call to arms resonated with bondholders, some market participants - particularly lawyers involved in drafting the contentious clauses - criticised him for being over-dramatic.

In his defence, Cohen paraphrases Barry Goldwater’s speech at the 1964 Republican National Convention.

“Extremism in the defence of bondholders is no vice,” he says, shrugging his shoulders and grinning gleefully. “It worked. We won.”

“It took me 11 years to write something that incendiary - if I have to do it again, it will have to be for a good reason.”

Indeed, many see his firm’s outspokenness as necessary in a market where investors need as much help as they can get to resist looser underwriting.

Several years of low interest rates have driven rampant bond issuance, making it harder for investors to be conscientious and selective about what they buy. The rise of passive bond buyers such as exchange-traded funds and index trackers has further enabled issuers to gain the upper hand.

“DEFENDERS OF THE BUYSIDE”

These factors have been a boon for independent and highly focused research firms such as Covenant Review, says Cohen.

“Defenders of the buyside, that’s kind of what we are” he says - implicitly evoking the superheroes of his beloved comic books.

Since founding Covenant Review Cohen has pored through countless pages of the same type of documents he used to write, this time to inform traders and portfolio managers about how borrowers can treat them in the future.

“When I was doing sales calls in the first couple of years, investors would say that lawyers would always find a way to screw them and why bother reading an indenture when it’s just random,” he says.

“I would try to convince them that it’s not just random - you can predict what’s going to happen. After a while people realised it kind of is predictable if you do the homework.”

Now, Cohen has put issuers and their lawyers on guard.

“The lawyers and sponsors know we are out there watching for them. They may try and push something through but usually we are going to spot it and call out the trick.

“It’s hard for non-lawyers to do this work and keep track of it. The idea that all investors are going to read the bond documents alongside the slide deck and everything else they have to do … it’s just not really possible. We have a hard enough time ourselves.”

Cohen is moving the firm to a larger space not far from its current spot, and he’s hiring more lawyers as demand for their research continues to grow.

“It’s a way better lifestyle than you’ll have at a law firm,” he says. “We make a lot more things happen than if you are just a random associate.”

As well as a new office, he’ll soon have another reward for Covenant Review’s recent successes: he’s doubling down on a dream to see Iron Maiden in concert - first in Hamburg, and then in New Jersey.