Sculpting a solution

JP Morgan reinvented the mandatory convertible structure in a market-defining trade that left the market scratching its head. The client was so pleased that he returned months later. For true thought leadership plus diversity of product and geography, JP Morgan is IFR’s EMEA Structured Equity House of the Year.

When Viswas Raghavan became JP Morgan’s CEO in the EMEA region in summer he declared himself “a humble CB banker”. Achintya Mangla, head of ECM in EMEA, is also a graduate of the equity-linked market, so the bank’s commitment to what is sometimes seen as a niche sector is unquestioned.

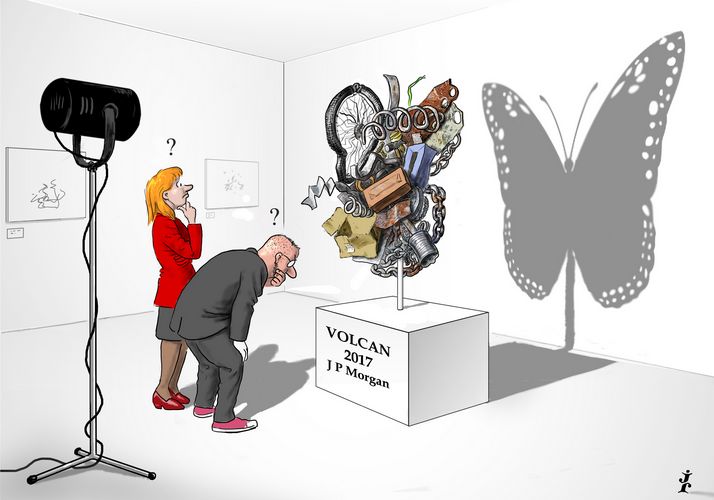

The culture of creativity nurtured by Raghavan and Mangla is undimmed today under current head of equity-linked Aloke Gupte and his team. The market-defining trades for Anil Agarwal, chairman and majority shareholder in Vedanta Resources, saw him also become the largest shareholder in Anglo American for minimal outlay. The Poems structure (purchase of equity via mandatory securities) was so good that Raghavan even popped out of his fancy corner office to play a part.

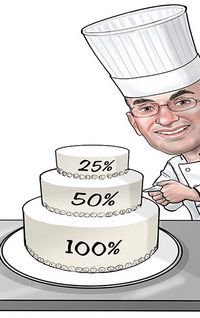

Both sole-led by JP Morgan, the two trades added up to an incredible £3.5bn and put the bank streets ahead of its rivals. Its US$7.4bn of league table credit in the IFR awards period is the highest since 2008 (when KfW was last active with a jumbo) and the highest ever for JP Morgan.

Market share of 25.3% even beats Raghavan’s record of 22.9% from 2005.

Without those two deals the bank would have ranked second, just a whisker behind Deutsche Bank – but with a far more varied portfolio of work.

When the first Poem deal hit the tapes in March it stunned the market. JP Morgan took the idea of a non-recourse mandatory exchangeable bond and applied it to stake-building to facilitate Agarwal’s purchase of a £2bn stake in Anglo American.

By using a mandatory structure, and with JP Morgan placing the bonds with arbitrageurs, Agarwal was able to secure most of the shares from hedge funds buying the bonds with the shares as underlying. Arbitrageurs bought the bonds, and sold the 80% delta to Agarwal’s issuing vehicle Volcan Investments, with JP Morgan then buying the remaining shares in the market.

“Buying the delta is established practice in the US, where you often see a convertible bond and buyback together. In Europe, mandatories come with delta placements and this is an extension of that – but just one person buys the delta,” said Gupta.

Agarwal is protected on the downside, but the cost of that protection is he only gets to keep the first 10% of the upside and then 9% of any rise above that. The cost to him is the net present value of the 4.125% coupons over the deal’s three-year life. In order for him to break even, the shares need to rise 30% over three years.

Rival equity-linked bankers therefore struggled to see the logic, with Agarwal choosing not to explain his reasoning for renting an 11% stake in Anglo. While from some angles it looked expensive, from others the method was elegant in its speed and simplicity.

The proof that it achieved exactly what the client wanted came in September when Volcan mark II arrived. It used the same structure and with £1.5bn proceeds enabled Agarwal to become Anglo’s largest shareholder.

Second time around the coupon was also a little lower at 3.875% over the three years and the breakeven was therefore in the twenties.

In the six months between issues the market had digested the structure and JP Morgan found twice as many buyers.

Only time will tell whether Agarwal has found a canny approach to stake building or an expensive vanity project, but three others have since seriously considered using the structure.

GETTING ACTIVE

JP Morgan was active in every area of the market. It had a top slot on the €4bn mandatory convertible bond from Bayer in late November 2016, got involved in non-dilutive convertible bonds with Michelin in January and through a BASF tap in October – which was fully sold despite rumours to the contrary – and employed a call spread on Qiagen’s US-style convertible. It was also on STMicroelectronic’s US$1.5bn CB, the largest vanilla CB in over two years.

The team ticked off many geographies with bonds from Russia, Italy, Germany, Austria, France and the UK, and minimised wall-crossing, preferring their own judgment to pricing by survey.

Most importantly, the bank was picking up good fees. The Volcan work was huge, sole and bespoke, but even smaller trades could be good paydays, such as CA Immobilien’s €200m CB, where JP Morgan was one of two banks but took home three-quarters of the fees.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.