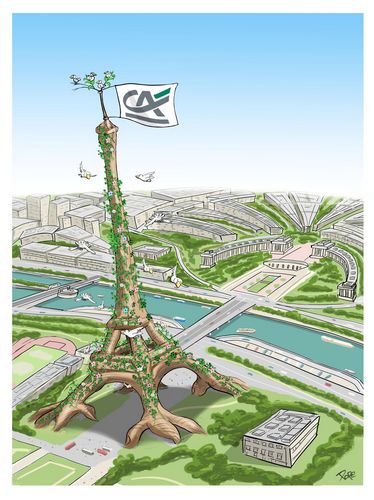

Top of the tree

Green bonds completed the journey from niche market to mainstream product last year as France planted the first liquid Green benchmark in a sovereign curve. For its central role in arranging 2017’s landmark deal while driving growth and innovation across Green and Social-impact bonds, Credit Agricole is IFR’s SRI Bond House of the Year.

France’s €7bn 1.75% June 2039 issue was the transaction that symbolised the coming of age of the Green bond market, and Credit Agricole was there every step of the way from conception to issuance.

Credit Agricole won the prestigious role of sole structuring adviser and sole European roadshow coordinator for the sovereign. The bank repaid that faith during an arduous four-month preparation process, playing the key role in defining the structure of the bond, the communication strategy, issuance terms, and timing.

“The level of effort required to react to all the political demands, involving several stakeholders including all ministries, was extremely intensive,” said Tanguy Claquin, head of sustainable banking at Credit Agricole. “This moved the needle.”

France’s trade extended the boundaries of the Green bond market, wedding state budget plans to the highest standards of environmentally responsible financing.

It was the largest Green bond trade, and at the time the longest, establishing a blueprint not just for Green bonds but sovereign issuance in general.

“We reached Dutch and Nordic accounts, who are the key ESG investors in Europe,” said Pierre Blandin, head of origination in sovereigns, supranationals and agencies. “This completely endorsed the Green OAT project.”

The tenor of France’s bond issue set a record that would go on to be broken during the year as issuers followed the sovereign out to the long part of the curve, pushing the boundaries of duration with 30-year notes.

Credit Agricole also helped seal the longest-dated Green bond deal of the year with SNCF Reseau’s €750m 2.25% December 2047s. The bank covered billing and delivery as the owner and manager of French railway infrastructure extended its Green bond profile.

Credit Agricole had worked on a previous SNCF Reseau Green bond offering during the year, and Claquin said that the bank’s ability to retain mandates for repeat transactions was a reflection of its dedication to servicing clients.

While other sovereigns were slow to add Green bond tranches to their debt profiles, corporate issuance blossomed as different sectors embraced sustainability bonds. Credit Agricole was at the vanguard of a succession of fresh names entering a growing market.

The bank was behind the first Green bond of the calendar year, as Enel raised €1.25bn through a long seven-year deal. Enel’s trade was the debut Green issuance from an Italian utility company, and set the tone for a year that saw sustainability bonds break into new sectors and cross different geographies.

Green meant global in 2017, and Credit Agricole was a player in markets across the world. Highlights for the bank included bringing the inaugural Green bond from the Middle East and Africa with National Bank of Abu Dhabi’s US$587m March 2022s. It was also on the books as Singapore opened up for the first time with DBS Group Holdings’ US$500m July 2022s.

A deal for QBE Insurance Group represented Credit Agricole extending its reach not just to Australia but also into innovation, as the market welcomed the first public offering of Green bonds in a major currency from the insurance sector.

The year witnessed the development of the Social bond market, with Credit Agricole at the forefront of innovation allied to good governance. The bank has a long-standing involvement in the development and safeguarding of the Green Bond Principles, with a role on the executive committee. It also coordinated the working group that led to the launch of the Social Bond Principles in June.

NWB Bank was a headline name to break into the Social-impact bond world, and Credit Agricole was there to help the Dutch agency with its €2bn debut dual-trancher. The sustainability element also showed that there could be potential for Social bonds to follow Green bonds in offering a pricing benefit to some issuers, as NWB Bank brought the bonds in line with its conventional curve.

Credit Agricole cannily steered clear of the year’s most controversial Green issuance when Repsol became the first oil and gas company to print a Green bond.

Second-party opinion provider Vigeo certified its €500m notes as aligned with the Green Bond Principles, but the Climate Bonds Initiative refused to include the offering in its Green bonds list, and the notes were excluded from many major Green bond indices.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.