![]()

The IPO of Verallia, the French glassmaker that makes bottles for much of the country's wine and champagne industries, did not exactly grab the headlines when it priced earlier this month. But within Deutsche Bank, one of three global coordinators on the €888m listing, the deal was big news.

The deal was Deutsche's first European IPO since a radical overhaul in July, which saw the bank pull out of equity trading and launch a new strategy for its remaining equity capital markets business, and for many in the bank it was proof that the new set-up could actually work.

Though rivals are sceptical, Deutsche's bold gambit is being watched closely by the market. If the bank can make ECM work without a full-scale equities trading operation, the model could become a blueprint for other banks struggling to make money out of trading.

"Three months in we are confident it was the right solution," said Henrik Johnsson, co-head of capital markets, who pointed to the technological arms race between banks. "Unless you're top three or top five in equity trading, you're just not able to sustain the level of investment."

While much has been made about the equities sales and trading business being shut down, around a third of the salesforce will stay on – they now sit in the debt trading business – but will now focus solely on selling ECM trades and research.

ECM-LED SALES

With a much smaller, more specialised salesforce, the ECM team is expected to do more of the heavy lifting when it comes to selling deals. This is in line with the trend in ECM where pilot-fishing and wall-crossing have become central to ECM execution.

Deutsche's analysis shows that almost two-thirds of block trades done this year have been wall-crossed – up from less than a third three years ago.

Deutsche, in line with all other banks, has sold an increasing proportion of IPOs to a core group of big investors. Almost three-quarters of shares sold in its IPOs since 2017 have gone to the top 20 lines, compared to less than half of shares sold a decade earlier.

"Ten years back, pilot-fishing was a new concept," said Ashish Jhajharia, head of equity syndicate in EMEA. "But now it's well established ... you have a very clear view of who you sell the deal to before it's publicly launched. All that discussion takes place on the syndicate desk and not the public side."

That in part reflects a change on the investor side.

"The buyside is rapidly consolidating," said Johnsson. "The amount of calls that you have to make to place an ECM trade has gone down dramatically. It's no longer necessary to have a huge salesforce selling equities when the important decisions are made by a small number of individuals."

The Verallia deal was a case in point: while BNP Paribas and Citigroup were also on the deal, it was Deutsche that secured a €275m cornerstone investment from Brazilian investment firm BWSA. For Josef Ritter, who runs the EMEA ECM business, the Verallia deal is clear proof the new model works.

"From a client standpoint, and we proactively explained this to them, the structure remains unchanged, the team servicing them for the past three to four months remains unchanged," he said. "The client didn't see any change in an execution from our end."

DECLINING REVENUES

But while the Verallia deal has been touted as the bank's first European IPO under the new model, the mandate for the deal was won before the strategy overhaul was announced. The real test, rivals say, will boil down to how many mandates it wins from now on.

Deutsche said it has won 26 ECM mandates since July – including a €600m follow-on for Aroundtown just a week after the strategy announcement, a tender for US$590m of DP World convertible bonds, and a €385m follow-on from Akelius Residential Property.

Deutsche said it has won 26 ECM mandates since July – including a €600m follow-on for Aroundtown just a week after the strategy announcement, a tender for US$590m of DP World convertible bonds, and a €385m follow-on from Akelius Residential Property.

It hopes that its relationship with companies on the debt and advisory side – especially with private equity clients such as Apollo, the main owner of Verallia – will help win it ECM mandates. It argues that continued research coverage of such companies will make it the ideal bank to sell equity.

"It's an ecosystem that works together: the research team covers a corporate, they get involved in IPOs, and then the advisory bankers try to identify opportunities," said Johnsson.

DOWN ROUND

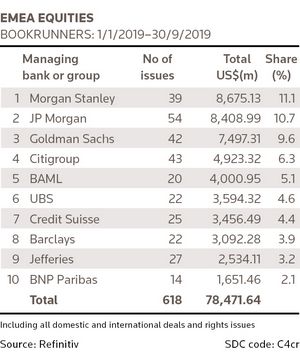

Still, uncertainty around Deutsche's wider strategy – even before launching its new ECM model – has undeniably dented its business. The bank was ranked second for EMEA equity-linked deals last year, according to Refinitiv data, and is 13th this year; in EMEA IPOs it has dropped from third to 16th.

Ritter's former co-head Ed Sankey quit just ahead of the ECM announcement to join HSBC, while the head of US ECM Jeremy Fox left for Credit Suisse after the new model was announced.

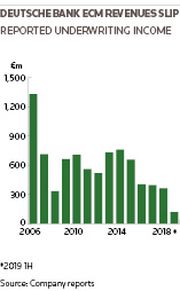

On a revenue basis, the ECM business is also on track for its worst year in a long time – possibly since the 1990s. The business brought in more than €1bn per year pre-crisis and has regularly brought in more than €500m per year since then. In the first half of this year, it reported just €118m of revenues.

The hope is that ECM will be more profitable – even with lower revenues.

EXTERNAL HELP

Of course, not having a trading operation will make some things much harder. Being out of equity flows will make it tough to gauge market sentiment; hedging might become more difficult and costly; and holding and disposing of a stick of unsold shares more painful.

Still, there are plenty more banks out there that will do some of that at a price much lower than carrying an expensive trading operation.

Another advantage is that, without trading, the ECM team will make the final call on trades.

"Our decision making will be slightly different because now there won't be situations where our trading platform has a slightly more aggressive view on situations," said Jhajharia. "The intention is to participate in all the blocks where we have good visibility."

The bank will now be keen to keep up the momentum of the last week or so, a period during which it priced the Verallia deal, the Akelius follow-on, and also a US$345m follow-on for Kazakhstan's Halyk Bank.

"Issuers will naturally have some questions given some external noise, but we are picking up new mandates," said Saadi Soudavar, another Deutsche ECM banker. "Our capabilities and ability to execute deals on the equity capital markets side is unchanged, which is what they care about and we're proving it by executing these transactions."